Ian Harnett

@IanRHarnett

Veteran macro strategist - Co-founder Absolute Strategy Research - All views are my own and not those of ASR. RT does not mean endorsement

ID:1482295330485981184

15-01-2022 10:15:48

1,4K Tweets

19,3K Followers

408 Following

Follow People

The always insightful John Authers highlights the role that monopoly profits play in the current market rally - a point we also made to Absolute Strategy Research clients in a recent note...we also showed how large cap profits come at the cost of margins in the small and mid caps...

An excellent article from Simon Nixon on some of the causes of and potential solutions to the Eurozone growth malaise. And it has more to do with Banks than AI... For full transparency, Absolute Strategy Research is delighted to have Simon Nixon as a consultant ahead of the UK election.

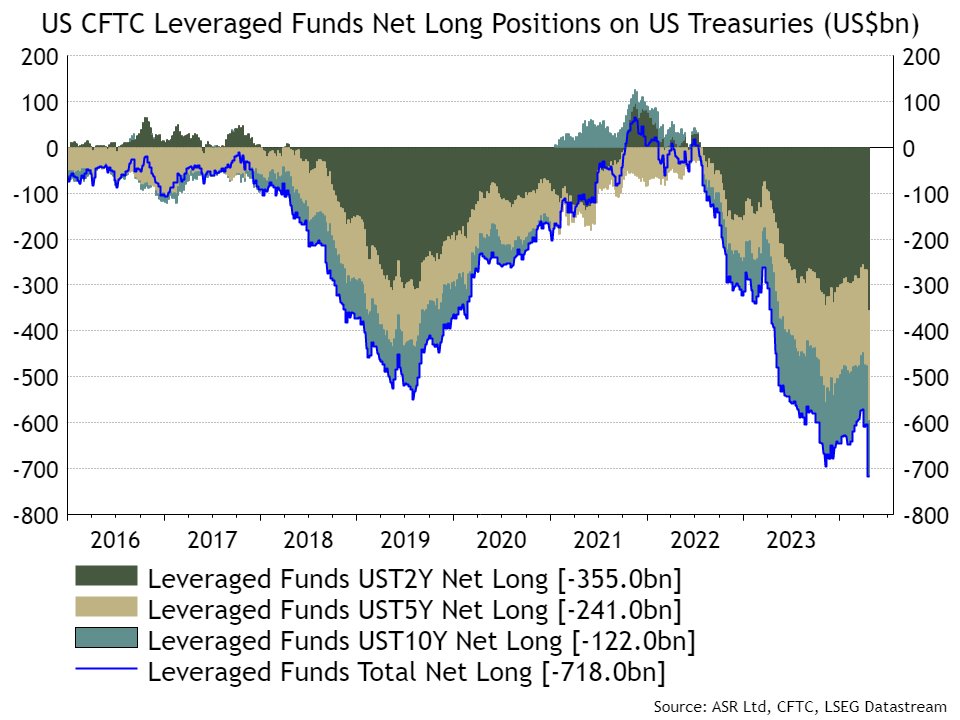

As US yields have risen back toward 5%, the US Hedge Fund 'big short' in the Treasury Basis Trade' has exploded back into life. Six months ago, the scale of this trade attracted a great deal of Federal Reserve, Bank of England and @IMF concern...it is likely to do so once again

Many thanks to Callum Thomas for including this Absolute Strategy Research chart of US yields in his ever excellent weekly chart storm alongside so many amazing #fintwit content creators. It’s always an honour to have our charts included in Callum’s curated content. Thank you…

Thank you to Steve Hou (“LEASE MORE”) for sharing his time and thoughts at Absolute Strategy Research this afternoon. So much to discuss and so little time! Fascinating discussion on his pricing power models and his work on fiscal issuance in different inflation regimes. It was great to meet Steve in person.

The TINY ( #thereisnoyeild ) market means that you can now get almost 4x the yield in Treasury Bills rather than US Large Cap stocks...in the last 100 years has only ever been the case in the Tech Bubble years

From TINA (There is No Alternative) to TINY (There is No Yield) - We recently highlighted to Absolute Strategy Research clients that US S&P Yields at 1.4% had only been lower 3% of the time in the last 100 years...

From the world of TINA 'There Is No Alternative' to the TINY (There is No Yield) world... Many thanks to John Authers for highlighting our recent comments in his excellent Bloomberg Opinion piece today. bloomberg.com/opinion/articl… via Bloomberg Opinion

ASR Asset Allocation Survey Results | 5 Top Charts

#economics #macroeconomics #research #assetallocation #investmentstrategy #assetallocation survey