Bennett Thrasher

@btcpa

Providing businesses and high net worth individuals with professional tax, audit, advisory and business process outsourcing services

ID:30296124

http://www.btcpa.net 10-04-2009 19:48:35

415 Tweets

517 Followers

355 Following

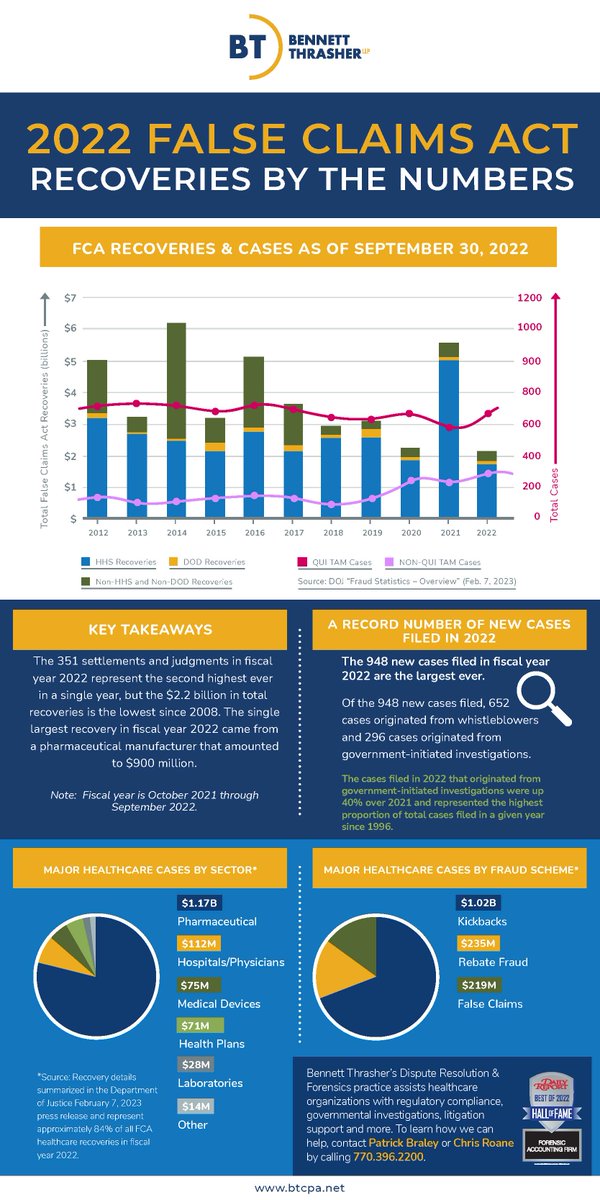

The Department of Justice recently reported its annual False Claims Act recovery statistics for fiscal year 2022. Check out our infographic recapping the new figures below, and read more insights here: hubs.la/Q01C_ZfK0

#Accounting #PaceOfChange

BT is pleased to announce the largest patner class in the firm’s forty two-year history, and ushers in a diverse class of outstanding talent to the firm. Read the full announcement here: hubs.la/Q01xrpvN0. #BetterTogether

On November 30, the IRS issued Notice 2022-61, providing guidance on the prevailing wage and apprenticeship requirements that apply to Section 179D and Section 45L, as amended by the Inflation Reduction Act of 2022. Learn more: hubs.la/Q01vpMK80

#Accounting #PaceOfChange

Our tax experts recently authored an article published to CPA Practice Advisor about the 100 percent bonus depreciation tax advantage for purchasing aircraft coming to an end. Learn more: hubs.la/Q01tvCLv0

#Accounting #PaceOfChange

Jeff Call, our firm's Managing Partner and member of the Forbes Finance Council, recently provided tax credit tips for entrepreneurs in a Forbes piece. Read the full article here: hubs.la/Q01n_SC90

#Accounting #PaceOfChange

In August, President Biden signed the Inflation Reduction Act into law, which expanded the R&D Tax Credit. Learn more: hubs.la/Q01nBVyv0

#Accounting #PaceOfChange #RDTaxCredits

The Georgia Conservation Tax Credit has been extended, but restrictions apply. Brian Sengson, Senior Manager in our SALT practice, discusses how approval of the credit works: hubs.la/Q01mrPtF0

#Accounting #PaceOfChange

Bennett Thrasher is proud to announce the promotion of Courtney Edwards to Chief Information Officer. Read the full announcement here: hubs.la/Q01mbnKb0

#BetterTogether

While #inflation can negatively impact the value of your company, there are strategies that can be taken to combat its effects. Learn more: hubs.la/Q01lTNrz0

#Accounting #PaceOfChange

Bennett Thrasher is proud to announce it has been named a 2022 Best Firm to Work For by Accounting Today, ranking #4 in the large-firm category. Read the full announcement here: hubs.la/Q01lT6Cn0

#Accounting #PaceOfChange

Sales tax compliance has only increased in complexity and cost since the Supreme Court’s 2018 Wayfair decision, and many businesses are hoping for solutions that simplify and streamline compliance. Learn more: hubs.la/Q01lpFlY0

#Accounting #PaceOfChange