Michele Linn

@michelelinn

Marketer. Speaker. Blogger. Podcaster at @BreakoutPod Former head of editorial @cmicontent. Believer in data + story at @MantisResearch

ID:19706922

https://www.linkedin.com/in/michelelinn/ 29-01-2009 11:36:43

8,1K Tweets

13,1K Followers

1,6K Following

So easy to make survey mistakes!

A8. Some common ones include:

👎 Requiring an email address

👎 Using words your company uses instead of the words your survey taker uses

👎 Using the wrong type of question

#contentchat

More survey mistakes:

👎 Not including a valid answer option for the survey taker

👎 Missing an opportunity to answer a follow up question

👎 Asking survey takers questions they don’t have the knowledge to answer

👎 Using words like 'biggest'

#contentchat

A7. Think about how you can ask questions that will:

🔥 Expose a disconnect

🔥 Reveal a gap

🔥 Uncover a pain point

🔥 Pinpoint a missed opportunity

🔥 Ask an “Oxford comma” question

🔥 Show differences between segments

#contentchat

A7. Great survey questions for #contentmarketing and #thoughtleadership

* Are jumping off places for editorial

* Are rooted in credible data

#contentchat

A6. My fav way to get responses: partnerships.

Ideal partners:

👍 Have a large, engaged audience (think: communities, SaaS tools, event organizers, publications)

👍 Want answers to the questions you’ll be asking

👍 Already have a relationship with your brand

#contentchat

A6. For instance, when my company was new, we partnered with @Buzzsumo to survey marketers on if/how they are using survey-based research. It’s a win-win because we used their list and had a co-branded report. #contentchat

A6. You have two options to get survey responses if you don’t have an engaged list:

👉 Partner with others (this is free)

👉 Use a panel (this costs money)

#contentchat

A5. If you’re conducting survey-based research, the only tool you really need is a survey tool like kovalchuk igor or SurveyMonkey . (Not all survey tools are created equal, so you’ll need to find one that works for you.) #contentchat

A5. Also consider finding others who are also working on research so you can share ideas and learn from one another. #contentchat

A5. If you have a limited budget, my suggestion is to get help writing your survey questions. You need questions that will help you uncover stories. And you also also need a keen eye to ensure the questions are clear and can be easily answered. #contentchat

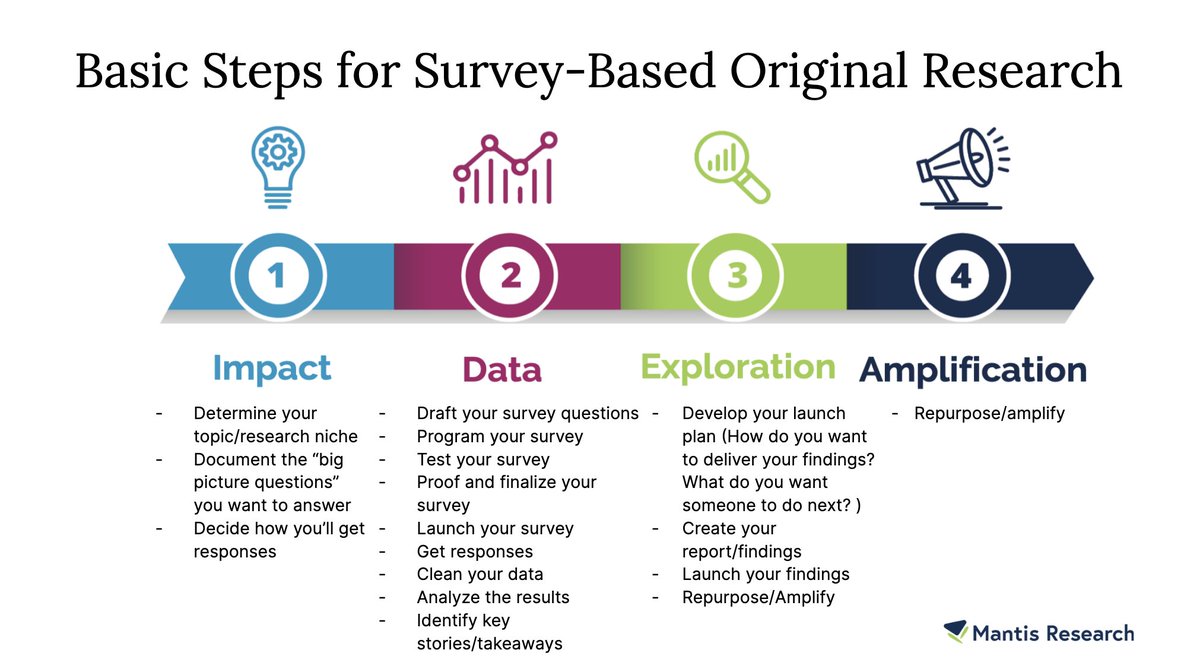

A4. The process I use is called IDEA.

I = Impact (This is the strategy/planning phase)

D= Data (Collect data)

E = Exploration (Find the story and launch your findings)

A = Amplification (Repurpose)

For a survey-based research projects, the steps look like this. #contentchat

A4a. Of course there are a lot of “it depends” factors, but I would plan at least 3 months.

1st month: Research strategy

2nd month: Field survey

3rd month: Analyze results, create findings

#contentchat

A3b. Misconception #2: You shouldn’t survey your own list because it’s biased.

Truth: Oftentimes, surveying your own list works well because your audience wants the answers to the questions you’re asking. So they’ll be thoughtful in their response. #contentchat

A3c. Misconception #3: “Just” publishing original research will get you results

Truth. You need to find a topic/niche that hasn’t been covered so you are offering something new. (The world does not need another “State of Content Marketing” report.) #contentchat

A3a. Misconception #1: Original research works best if you’re an established brand and/or have a big budget.

Truth: Companies of any size can (and should) publish original research. It works especially well for small and emerging brands

#contentchat

A2a. Original research works well for #contentmarketing and #thoughtleadership because you are answering your audience’s unanswered questions. By its very nature, you are adding something new and meaningful to your industry’s conversation. #contentchat

A2b. Original research positively impacts so many parts of the business – and it’s a great competitive advantage if you want to publish something that AI can’t replicate #contentchat

A1d. Observational research explores a topic by choosing something you want to understand and collecting data to learn how others do this.

Love this example from Andy Crestodina: orbitmedia.com/blog/web-desig… #contentchat

A1a. There are many types of original research you can publish, but here are five common ideas:

⭐ Survey-based research

⭐ Qualitative interviews

⭐ Observational research

⭐ Analysis of user data

⭐ Analysis of public data

#contentchat

A1c. Qualitative interviews are ideal if you want to ask nuanced, “inside baseball” questions. Conduct interviews and share the high-level insights.

This works great if you don’t have a large audience to survey.

Here’s an example: 20for20.com/white-paper/ #contentchat