Ocrolus

@ocrolus

Ocrolus is the leading AI-driven document automation platform in financial services, powering the digital lending ecosystem with trusted data

ID:1044584494945185792

http://ocrolus.com 25-09-2018 13:48:45

1,1K Tweets

1,1K Followers

104 Following

ICYMI: Ocrolus CEO Sam Bobley joined Lex Sokolin on the Fintech Blueprint podcast to talk about #OCR technology, #digitization at scale and turning challenges into opportunities. Listen to their full conversation: brnw.ch/21wEOac

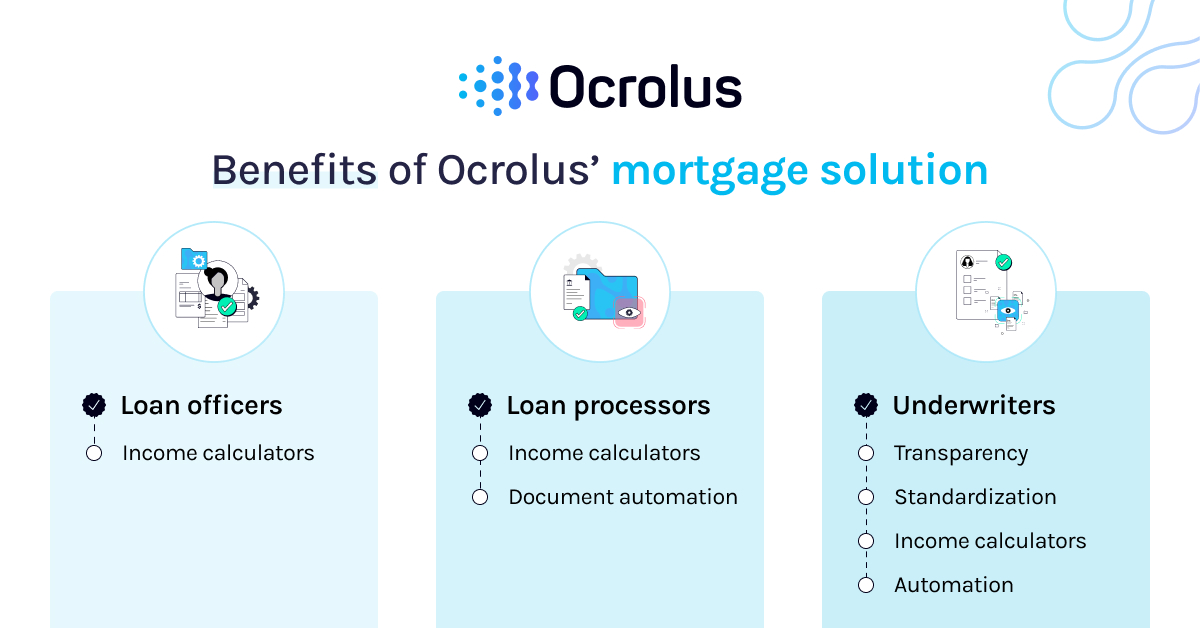

In a rapidly changing financial landscape, #mortgage #underwriters need to enhance their data analysis and risk assessment efficiency to meet the market’s demand for faster loan approvals. Learn how AI and #automation can help in our new blog post: brnw.ch/21wEBrX

By partnering with Ocrolus, Lendflow developed a full-scale solution that enables its customers to offer easier and faster #credit access to a variety of #smallbusiness owners leveraging #cashflowdata . 🤝 See how we did it: brnw.ch/21wEy0Y

A company’s growth – and its ability to handle more business as it grows – relies on its flexible #technology . Learn why uptime is key to efficiency and flexibility in #financial services: brnw.ch/21wEqYu

In his latest edition of Fintech AI Review, Ocrolus SVP of Growth David Snitkof 🇮🇱🇺🇸 asks the burning question – can #AI be your analytics intern? Follow along for a digestible yet technical exploration of the capabilities of LLM-based #dataanalysis tools: brnw.ch/21wEpn6

Another month, another full slate of fantastic industry events for the Ocrolus team! ✈️ 🧳

From Money20/20 to Mortgage Bankers Association Annual and beyond, read all about the events we visited, insights we gained and connections we made in our recap: brnw.ch/21wEeoq

In a new episode of the Fintech Blueprint podcast, Ocrolus CEO Sam Bobley joined Lex Sokolin to discuss the evolution of machine vision, Sam’s entrepreneurial path and Ocrolus’ latest projects. 👂 Listen here: brnw.ch/21wEcir

Fintech Blueprint @lexsokolin

We’re signing off from Auto Finance Summit 2023 in Las Vegas – thank you Auto Finance News for hosting! From #dealerships to credit unions and banks, we are grateful for this opportunity to learn from the leading innovators in auto #finance . Until next year!

We had an absolute blast at #Money2020USA , gaining world-class insights from some of the sharpest minds in #fintech . Money20/20

Missed us? Check out where the Ocrolus team will be next! brnw.ch/21wDSWq