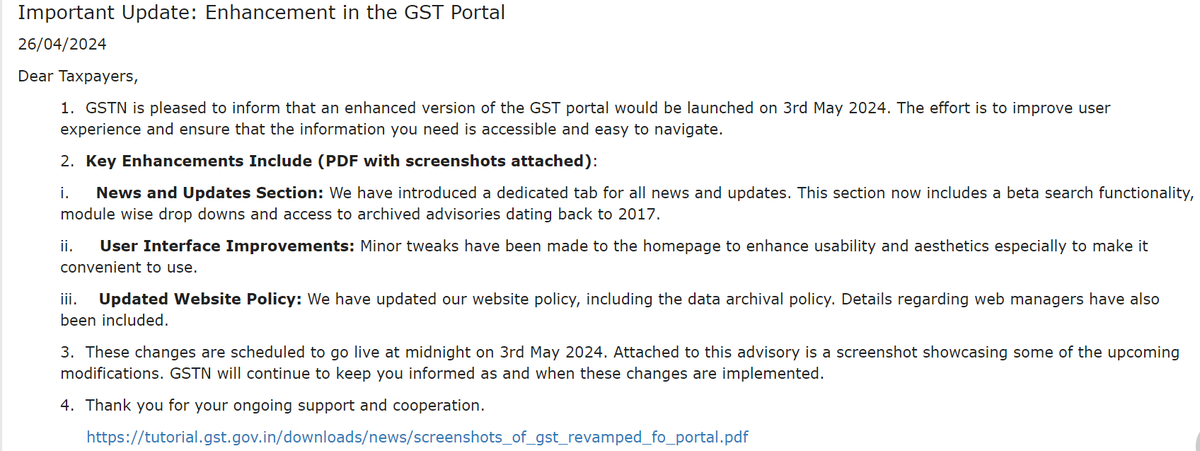

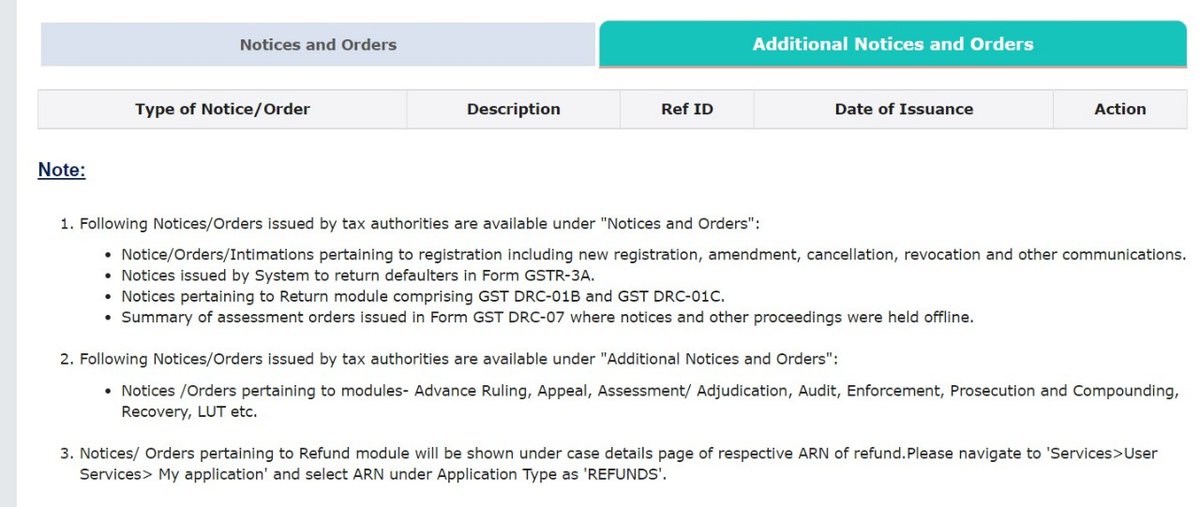

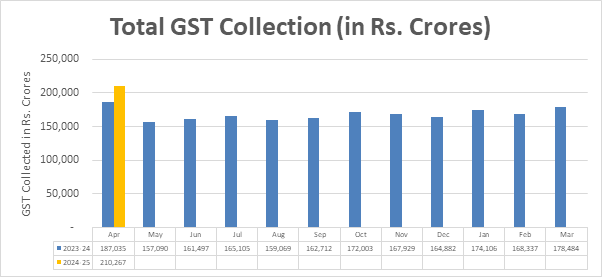

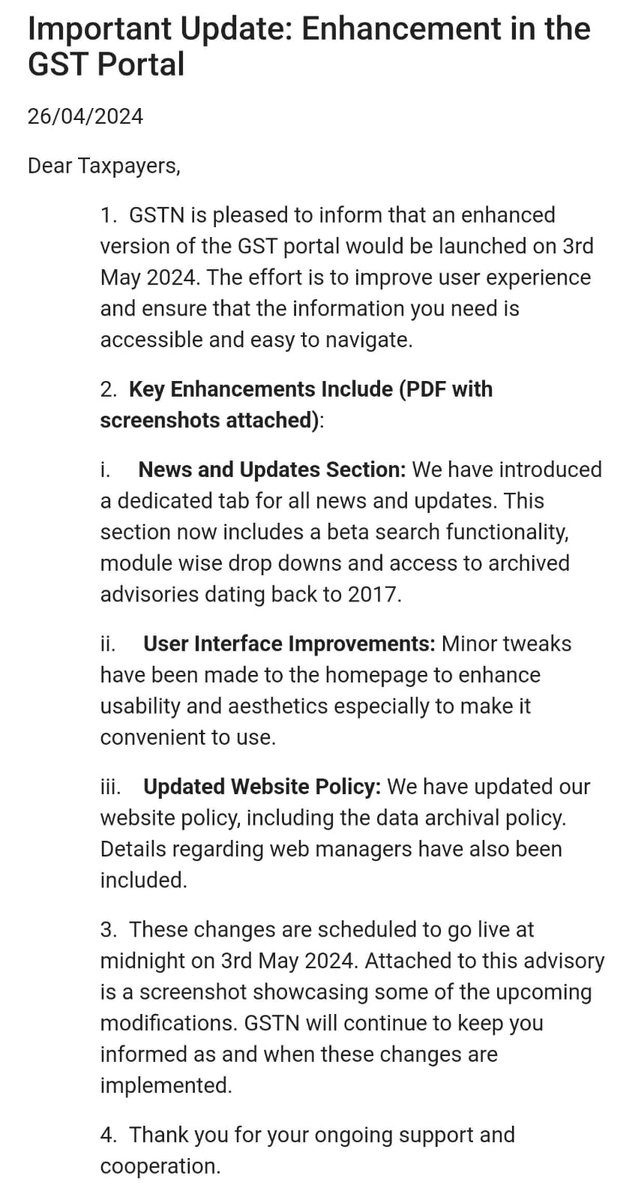

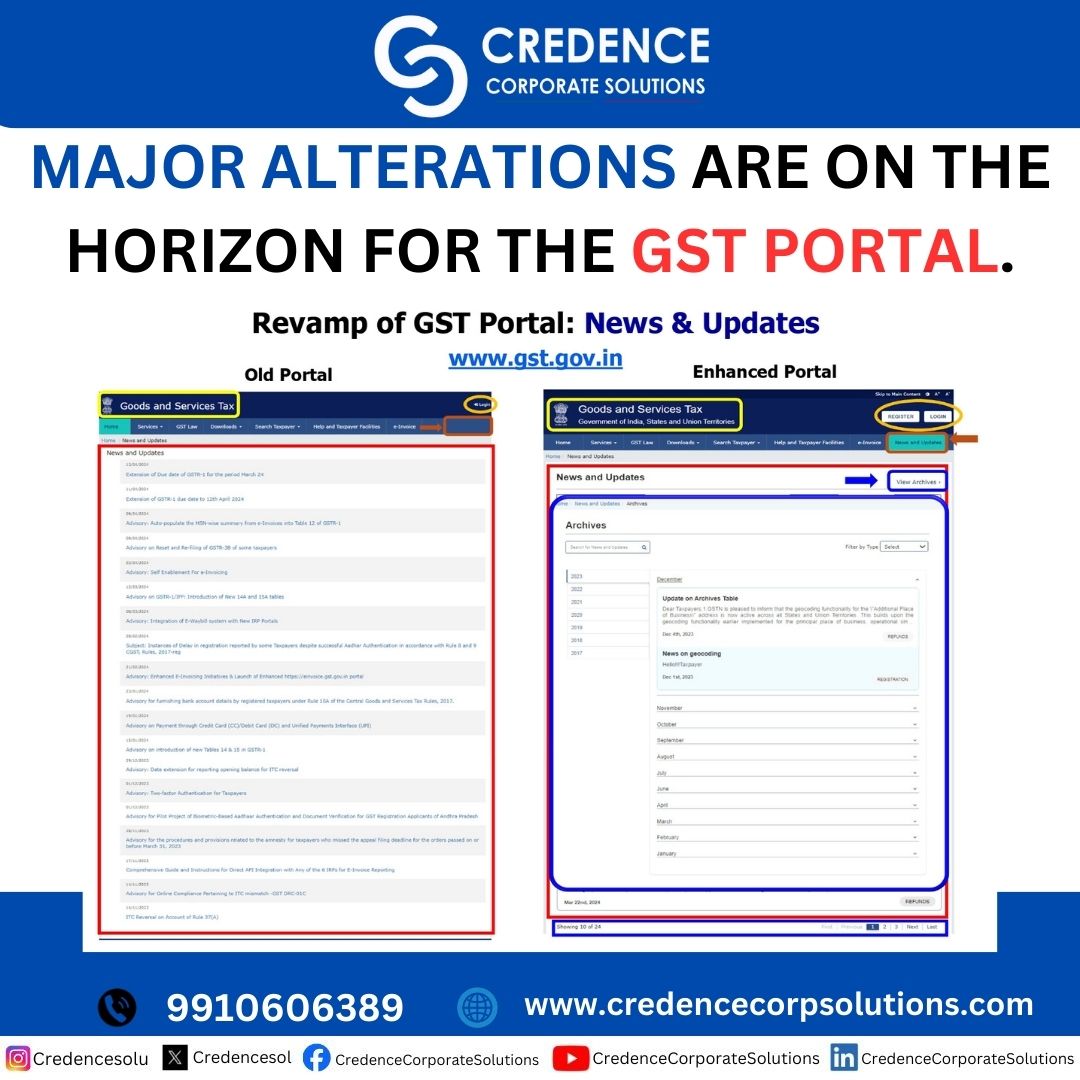

Exciting news from GSTN! 🚀 Get ready for an enhanced user experience with the upgraded GST portal launching on May 3rd, 2024. Check out the key highlights below. #GSTPortal #Upgrade #UserExperience

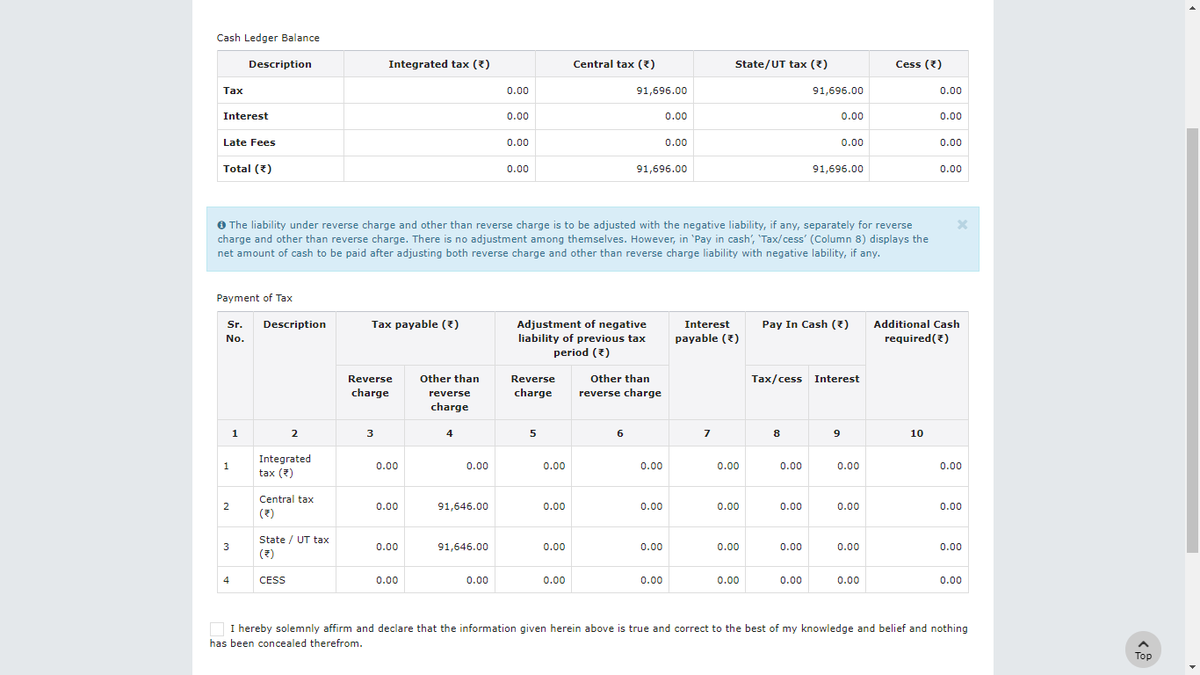

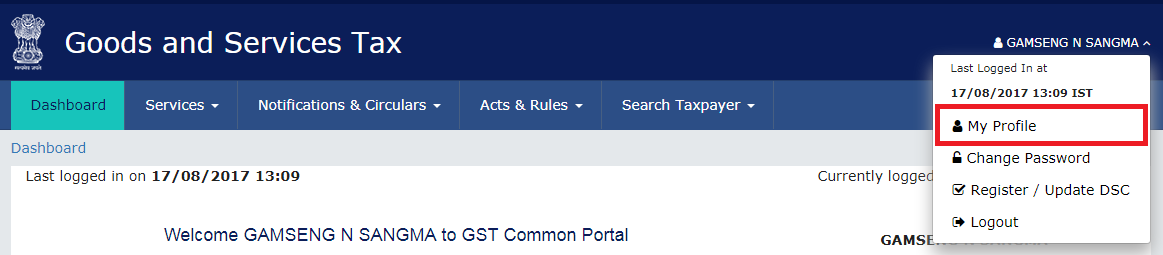

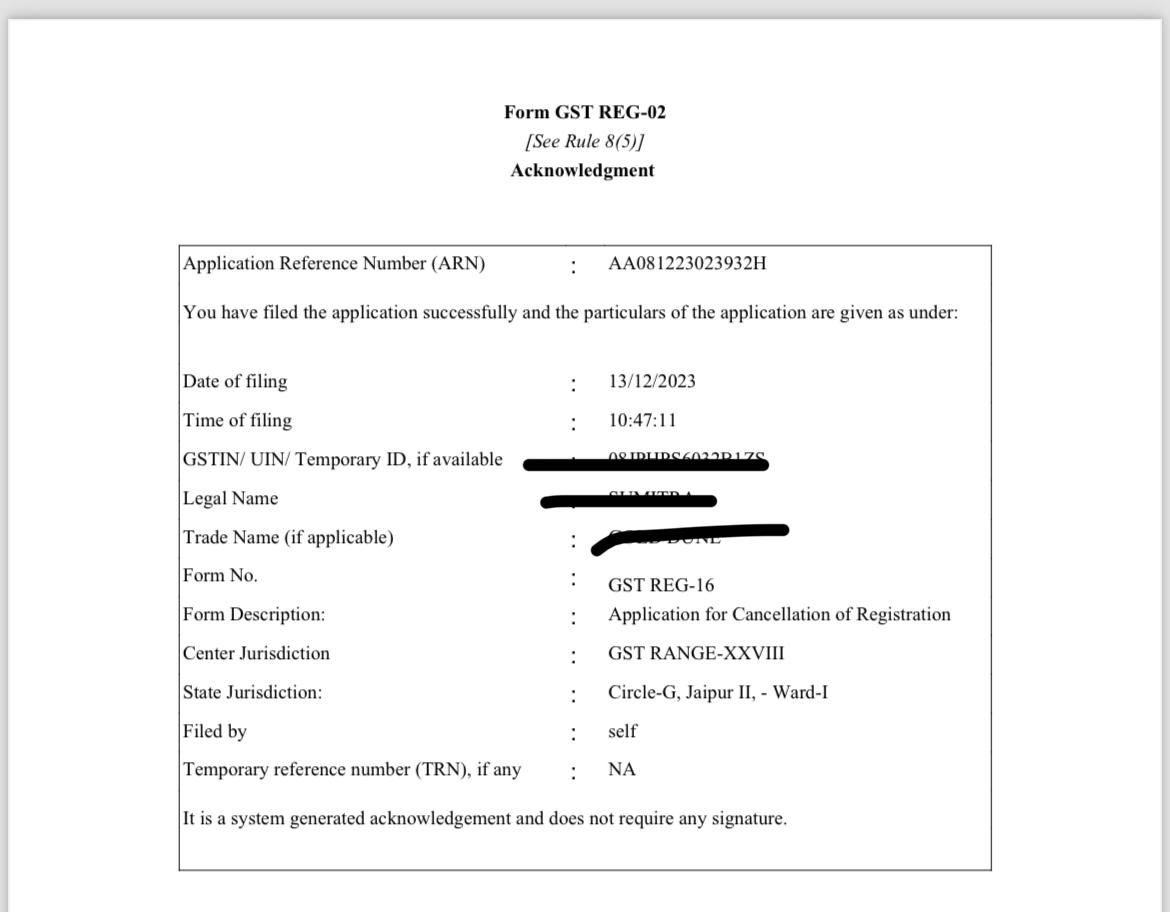

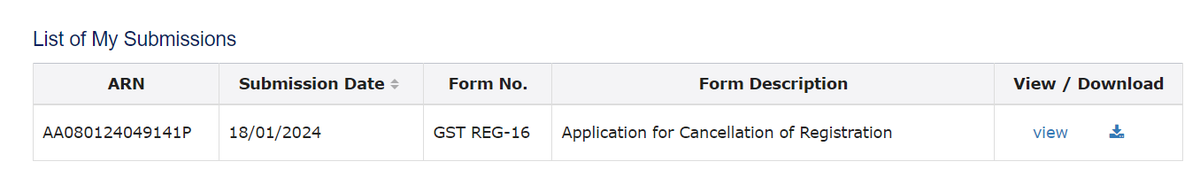

Gst Registration ......

#GST #gstportal #csc #RealEstate #accountant #Accounting #Accountability #financialyear #Finance #financialplaning

facebook.com/aasiangroup2012

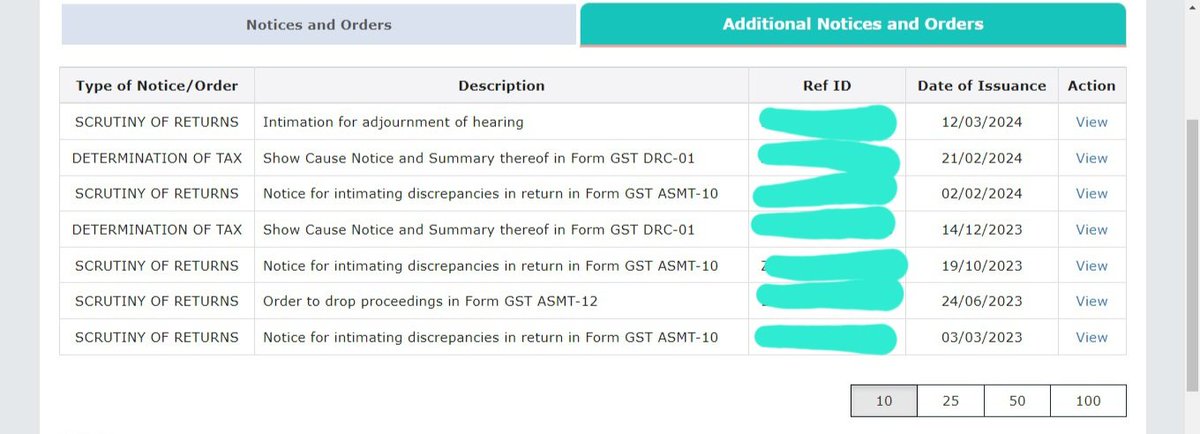

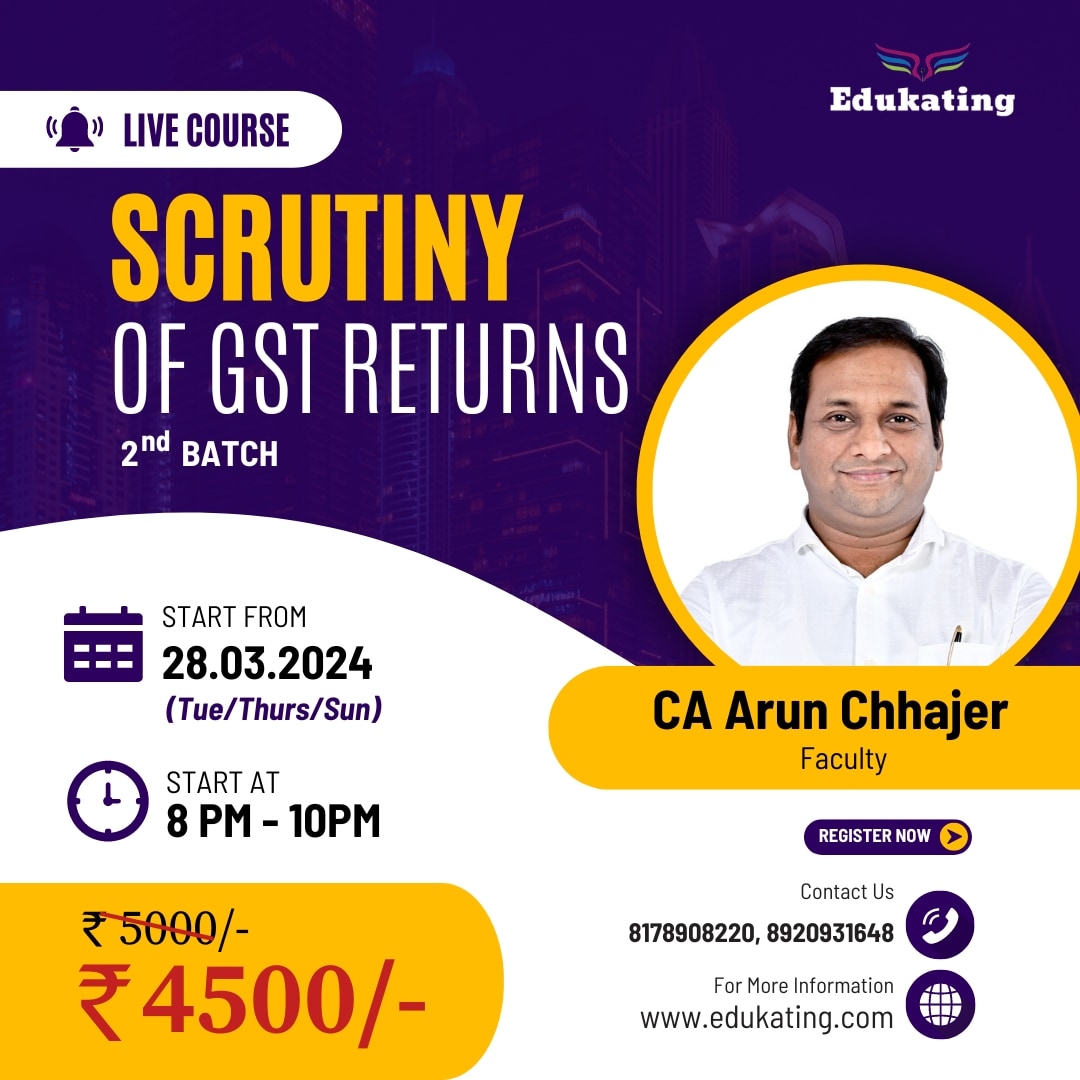

*Scrutiny of Returns *2nd Batch with CA Arun Chhajer.

Register Now!*

For more details visit edukating.com

#gst #gst updates #newcourse2024 #scrutiny #scrutiny ofgstreturns #elearning #gst queries #trending #business #gst portal #edukating

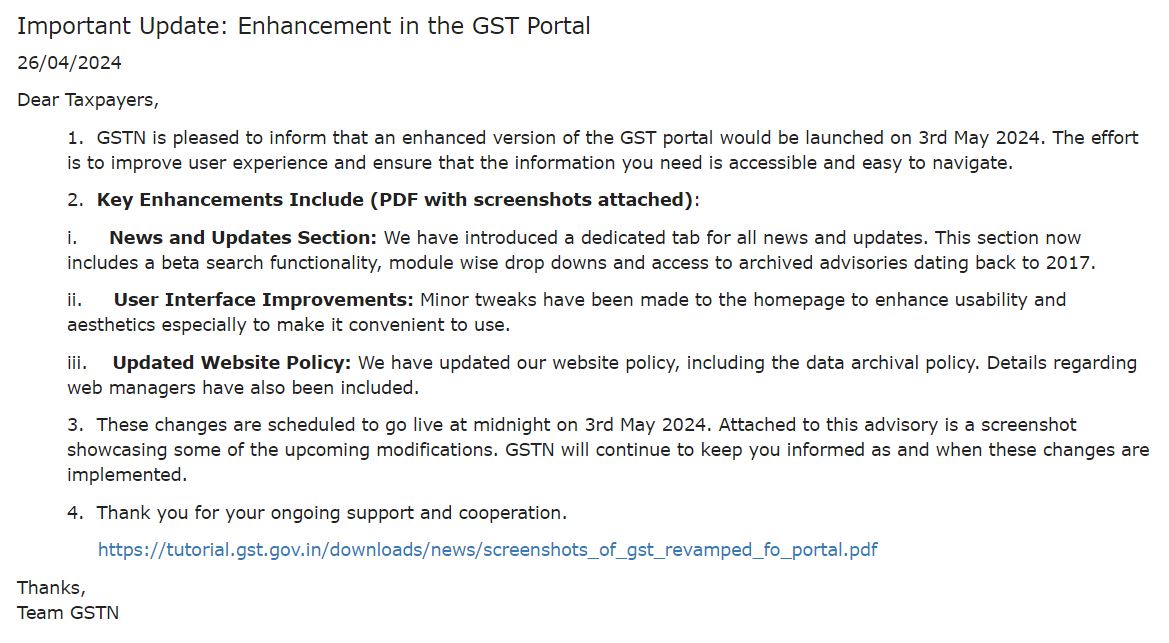

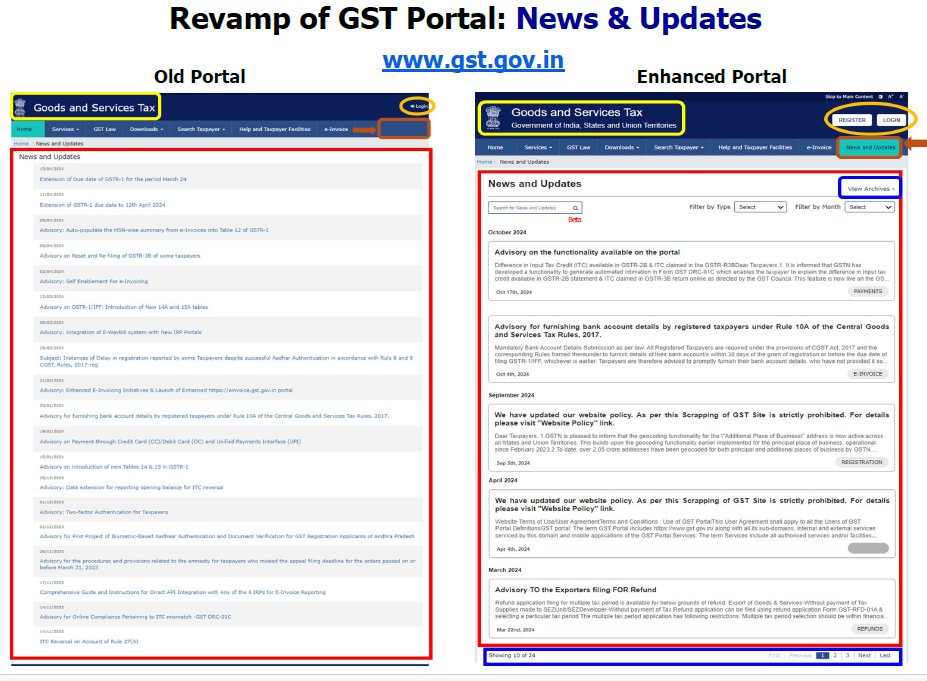

📢Enhancement in the GST Portal📢

☎️CONTACT US FOR GST SERVICES☎️

#gstportal #NEWS #UPDATE #updates #icaiexam #GST #ICAI #TrendingNow #updatenews360

GST Council GST Tech Finance and Taxation Goods & Services Tax Income Tax India Tax Management India Ministry of Finance Taxmann Institute of Chartered Accountants of India - ICAI