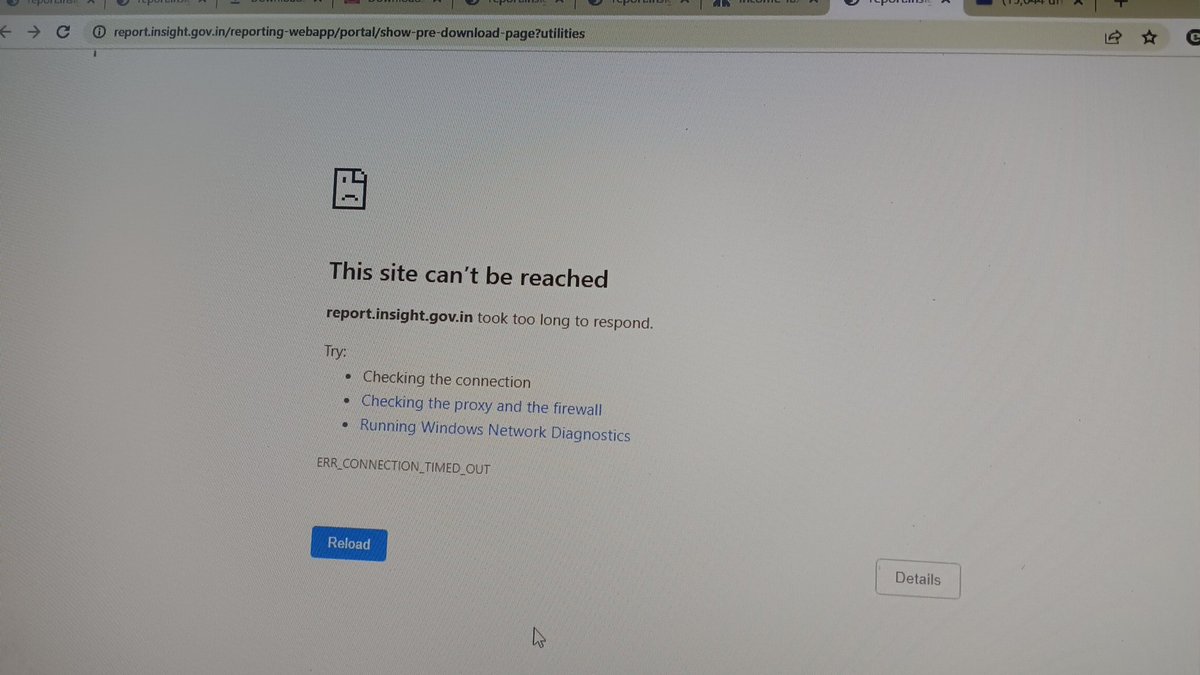

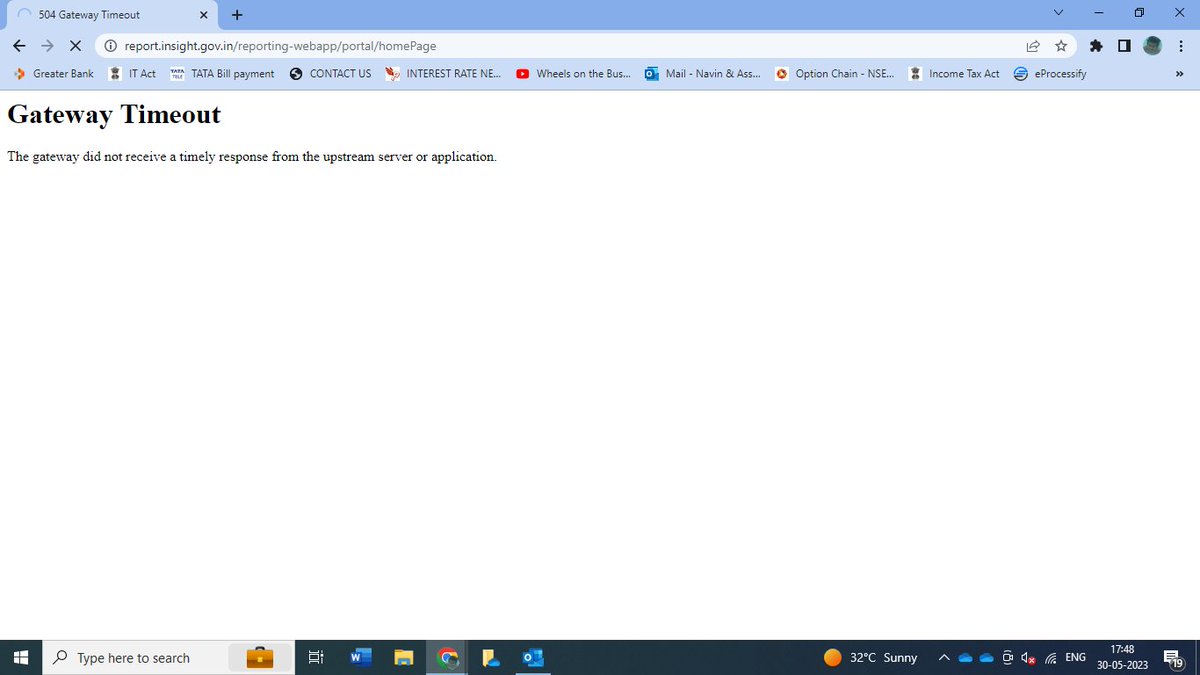

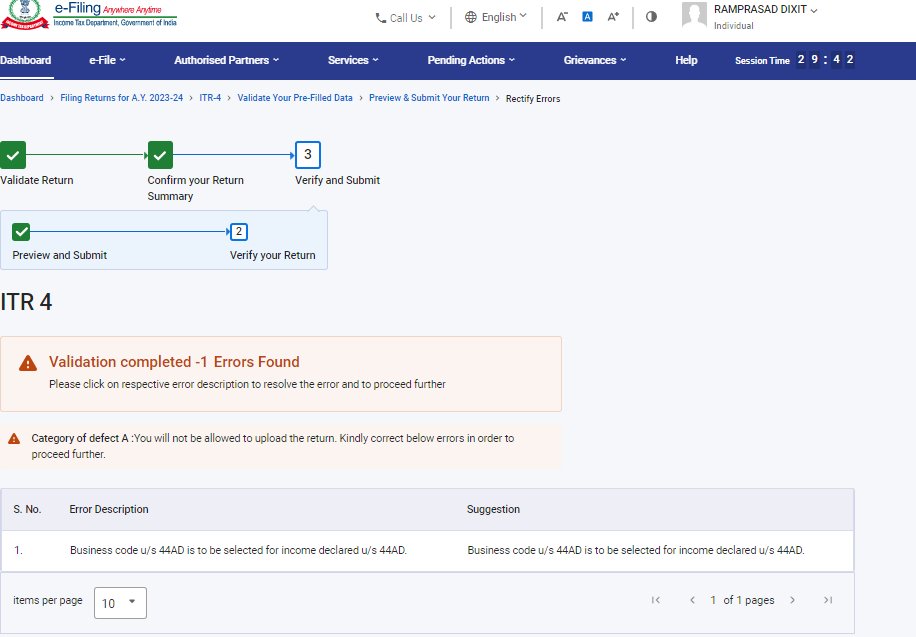

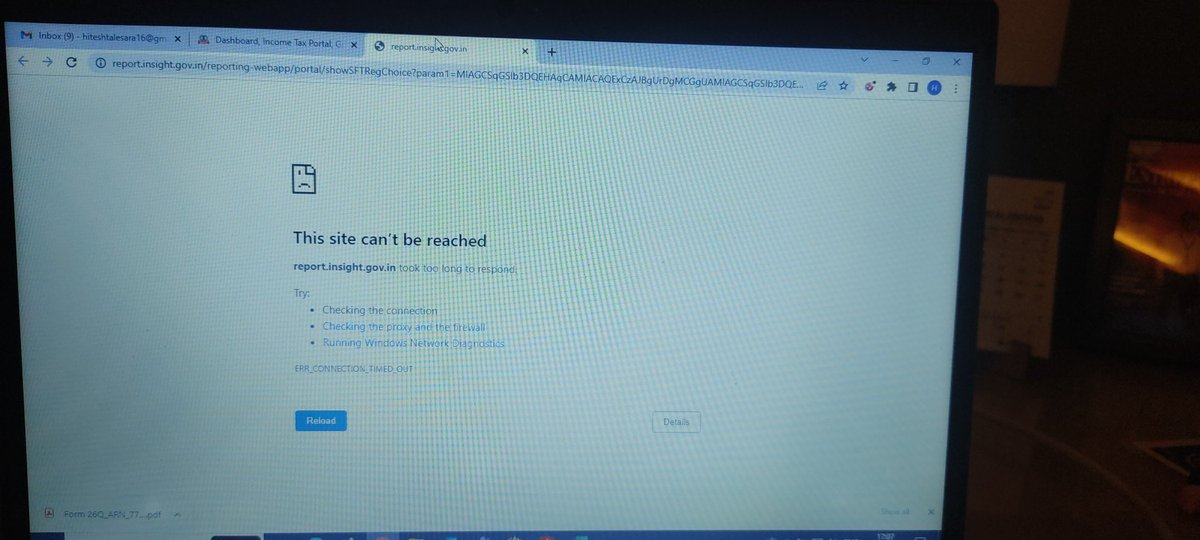

The Reporting Portal is not working. Today is the last date to file SFT form 61A. Again IT issues. Nirmala Sitharaman Income Tax India

Anyone able to view/ download AIS today??

I just seem to be getting this error message

Income Tax India

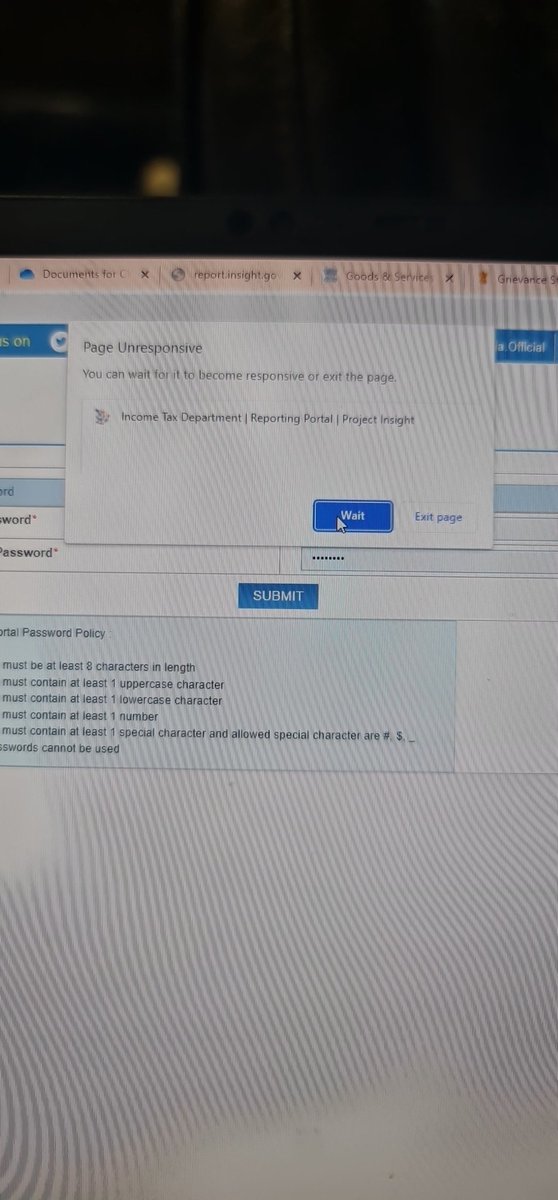

Nirmala Sitharaman Income Tax India Due date for Filing AIR ( SFT Transactions 31st May) but not able to generate ITDREIN No for reporting the transaction trying for last few days. Video attached.

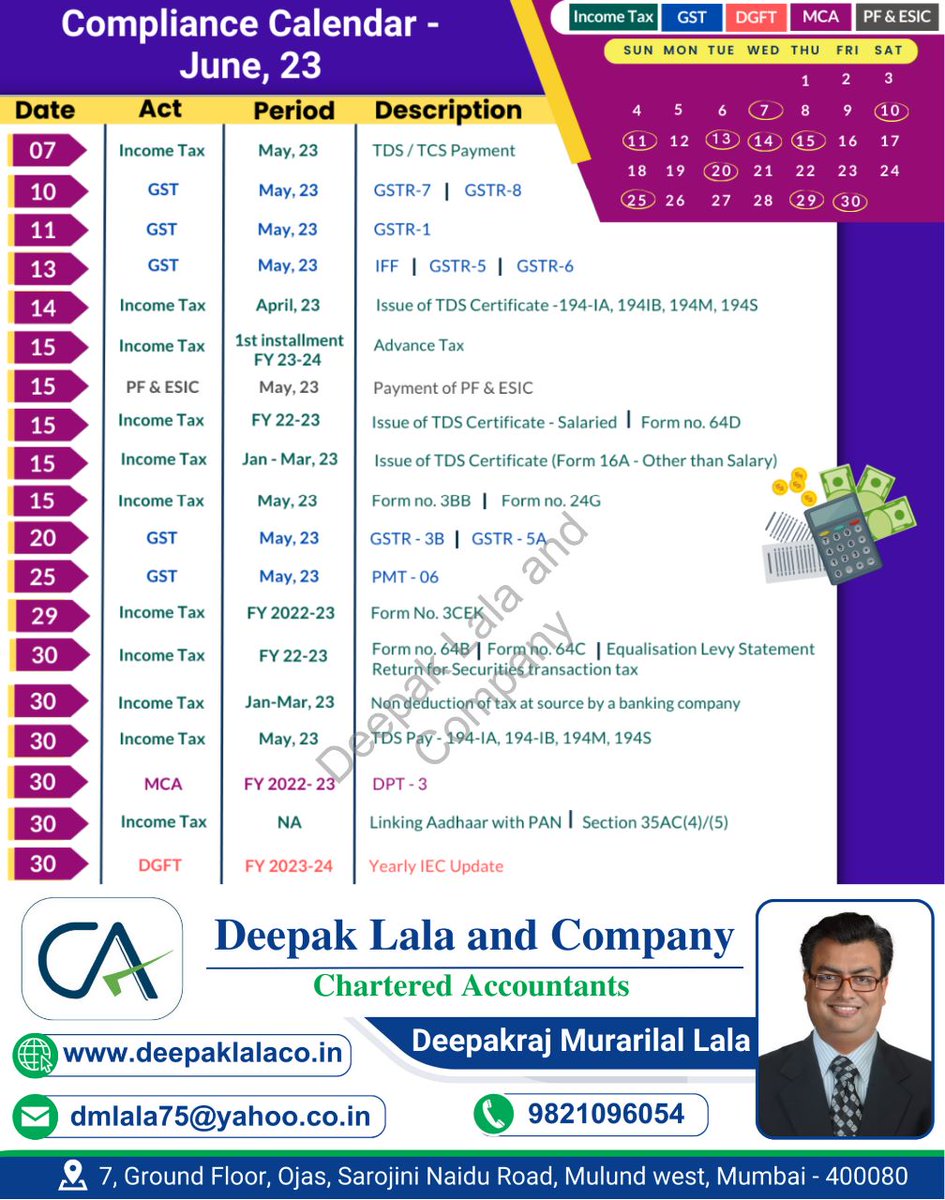

CA Chirag Chauhan CAclubindia

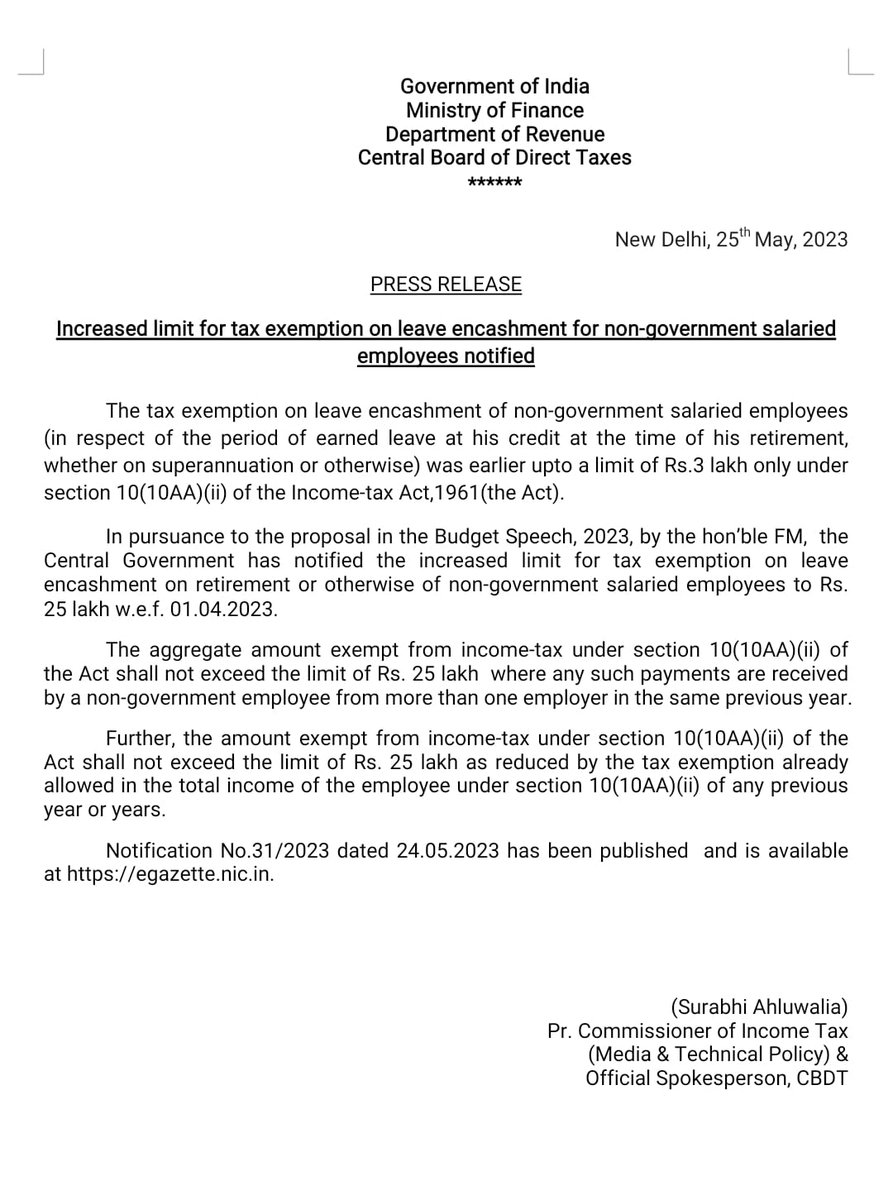

June 2023 Monthly Compliance #incometaxindia #gstindia #DueDates #compliance #charteredaccountant #deepaklala

Income Tax India NSitharamanOffice Office of Pankaj Chaudhary Ministry of Finance PIB India As per the provision of rule 114E of income tax rules read with action 285BA of income tax act, a reporting entity is required to upload SFT 61A up to 31st May 2023, but the reporting site is not working. How can a reporting entity file sft unless portal facilitate the same.