Q4 FY24 result - Mixed set

1. Kalyan jewellers - Good YoY and subdued QoQ

2. APL Apollo Tubes - Good top line and subdued bottom line

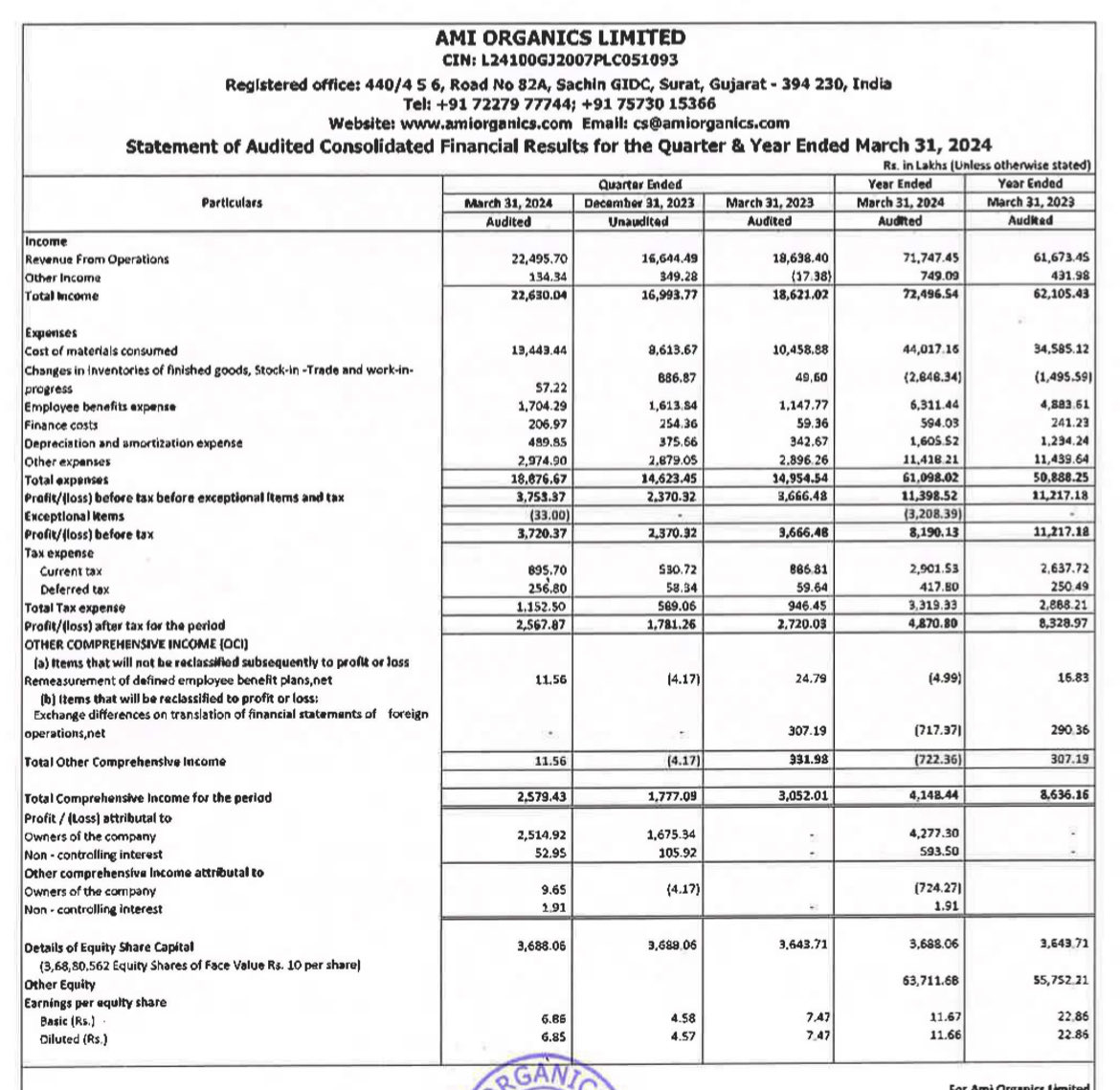

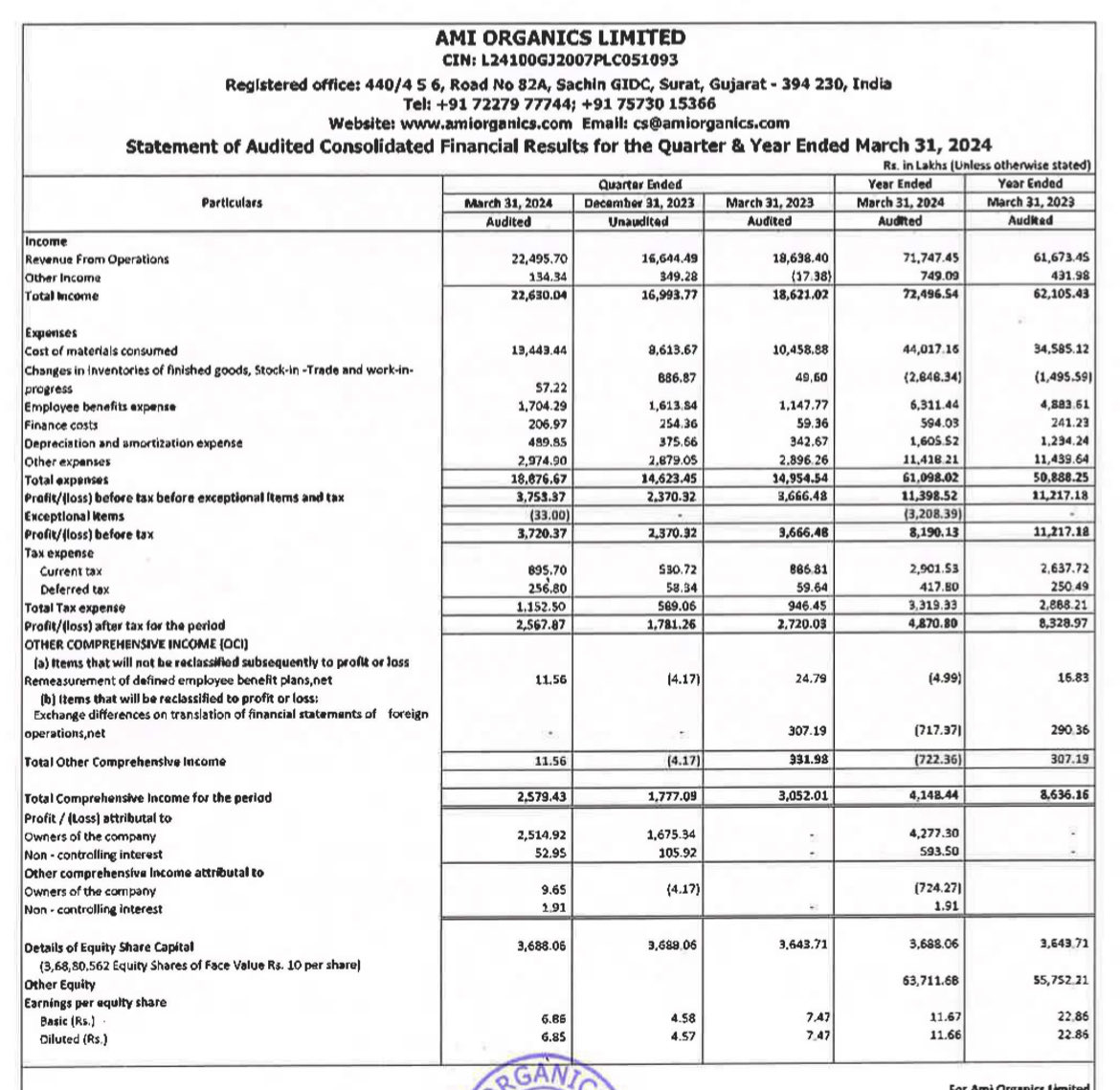

3. Ami Organics - Good top line and subdued bottom line

#Q4FY24 #kalyan #aplapollo #amiorganics

Q4 FY24 result - Mixed set

1. Kalyan jewellers - Good YoY and subdued QoQ

2. APL Apollo Tubes - Good top line and subdued bottom line

3. Ami Organics - Good top line and subdued bottom line

#Q4FY24 #kalyan #aplapollo #amiorganics