Max Twang highfrequencyhertz someonee Booster 10 Kali 🏴🏴🏴 These are the only dates in the entire filing, not one mention of IFT-3.

Will DeCotiis One year after $SIVB and $SBNY and they're already priming the pump to bailout the bad actors again.

This sequel is lame!

Parrot Capital 🦜 How are they finished? What’s the forcing function off a life insurance company to middle income Americans to be finished due to a “crisis of confidence” or are you confusing a run on a bank because SIVB was a year ago? And deposit outflows

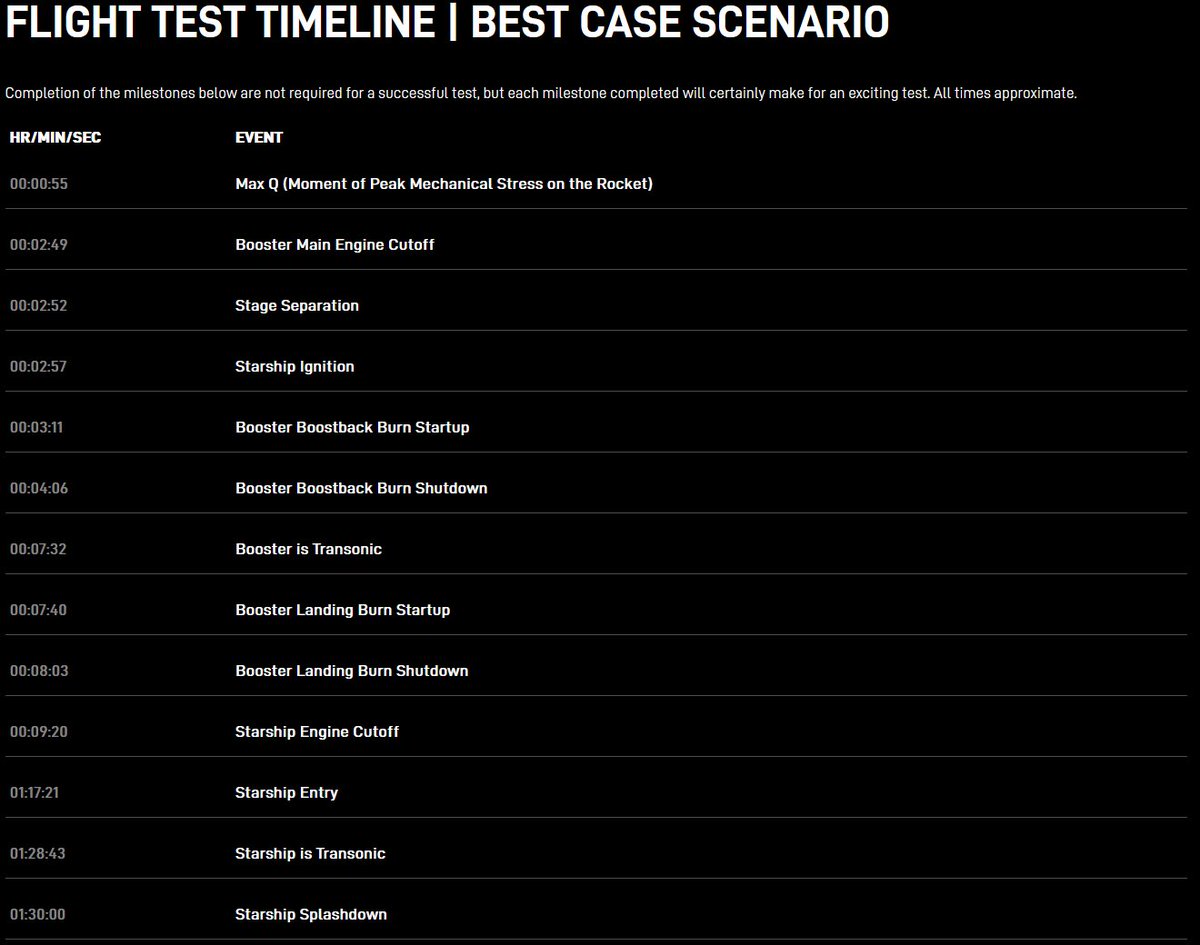

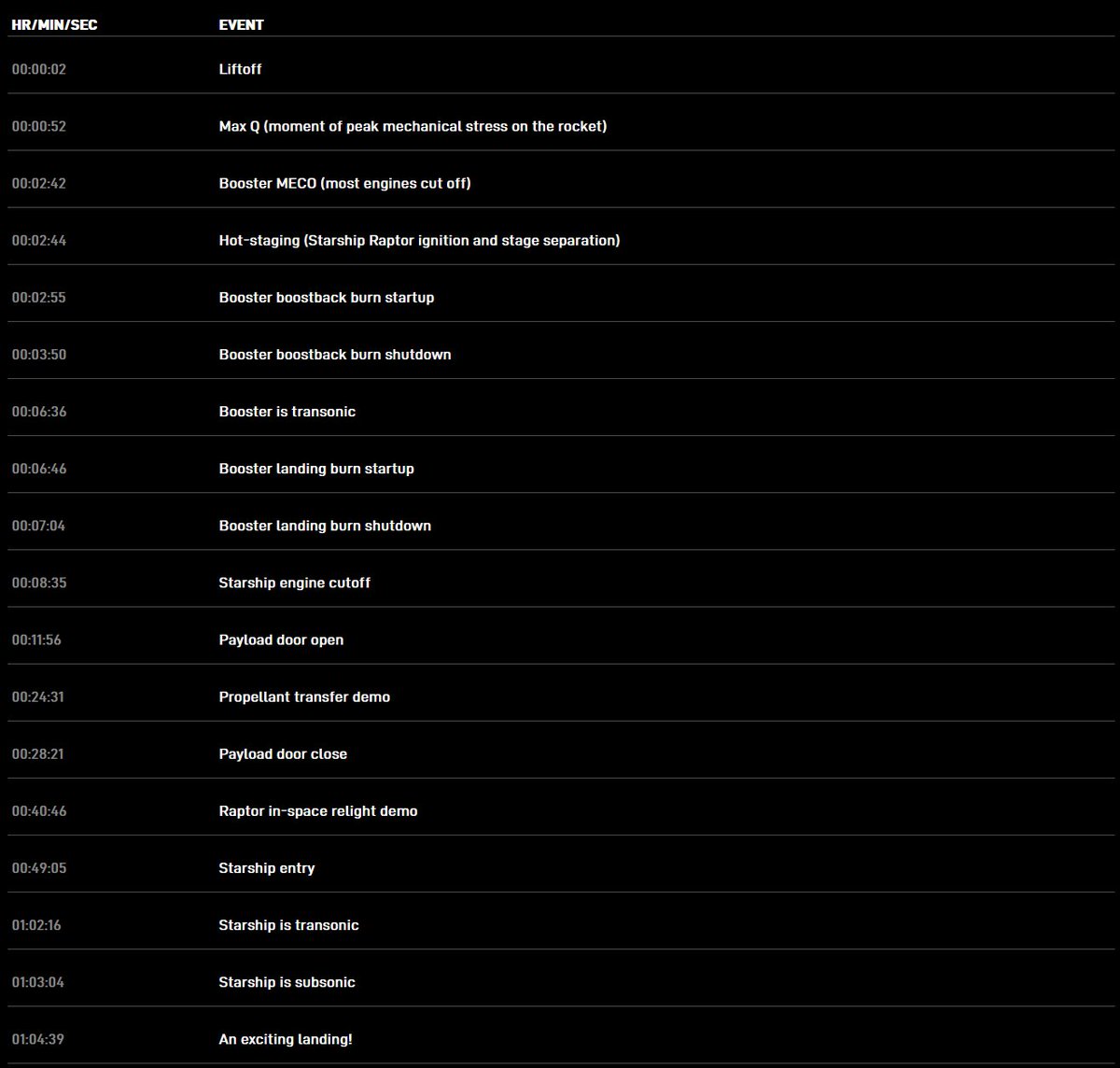

Max Twang highfrequencyhertz someonee Booster 10 Kali 🏴🏴🏴 IFT-1 and IFT-2 were essentially the same flight plans, with 250 x 50 km trans-atmospheric trajectories with splashdowns in Hawaii.