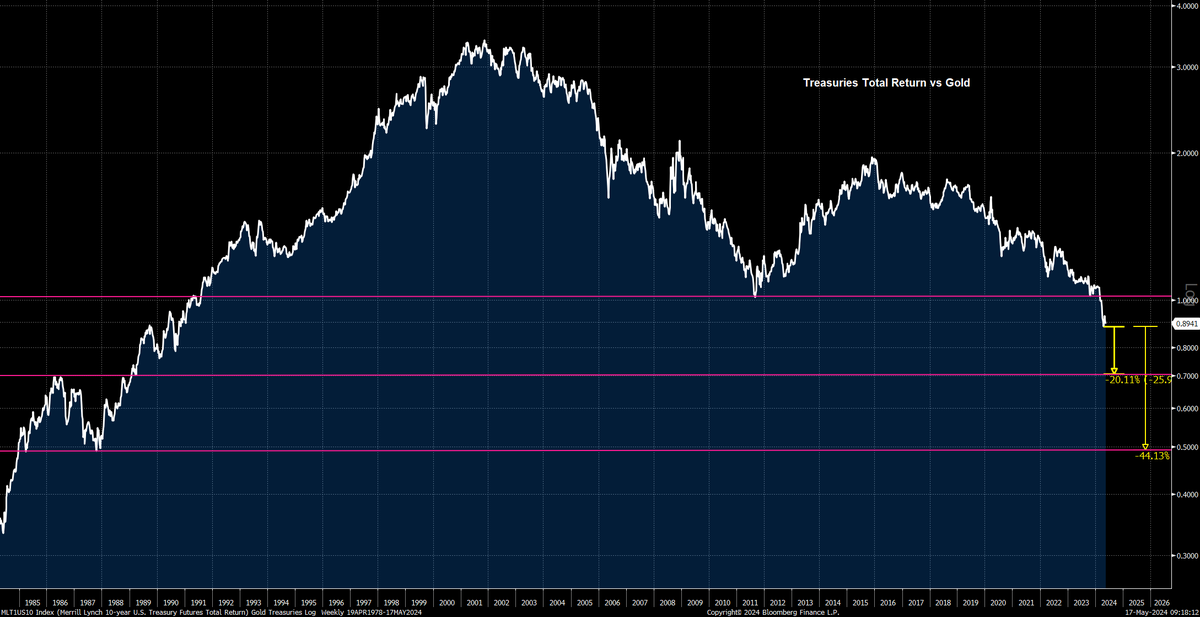

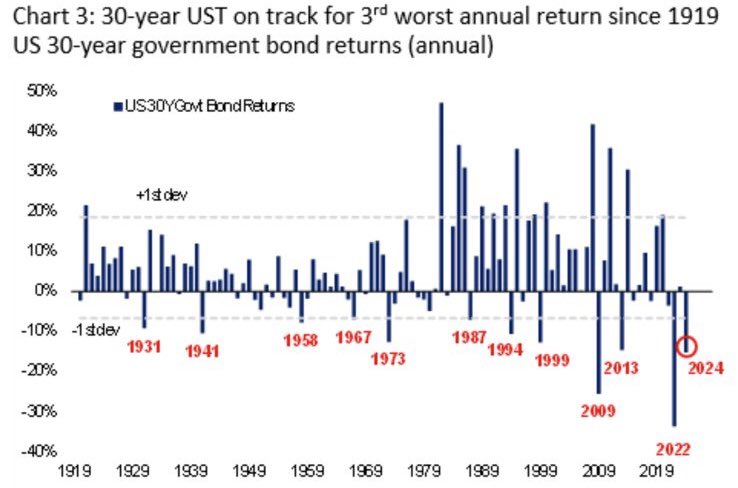

Treasuries de 30 anos apresentando até agora o terceiro pior retorno anual desde 1919

Jonathan Camargo Sergio Machado (CONTA NOVA) Júlia Wazlawick Roberto Motta Stephan F. Kautz Rafaela Vitoria Ricardo Casagrande Luís Fernando Moran de Oliveira EQI / Research @eqiasset

Michael Saylor and MicroStrategy have total holdings of 214,400 Bitcoin, surpassing 1 Percent of All Bitcoins in Circulation...

Exceeding those of the United States Government, which holds 207,189 Bitcoin as reported by Bitcoin Treasuries. Michael Saylor⚡️