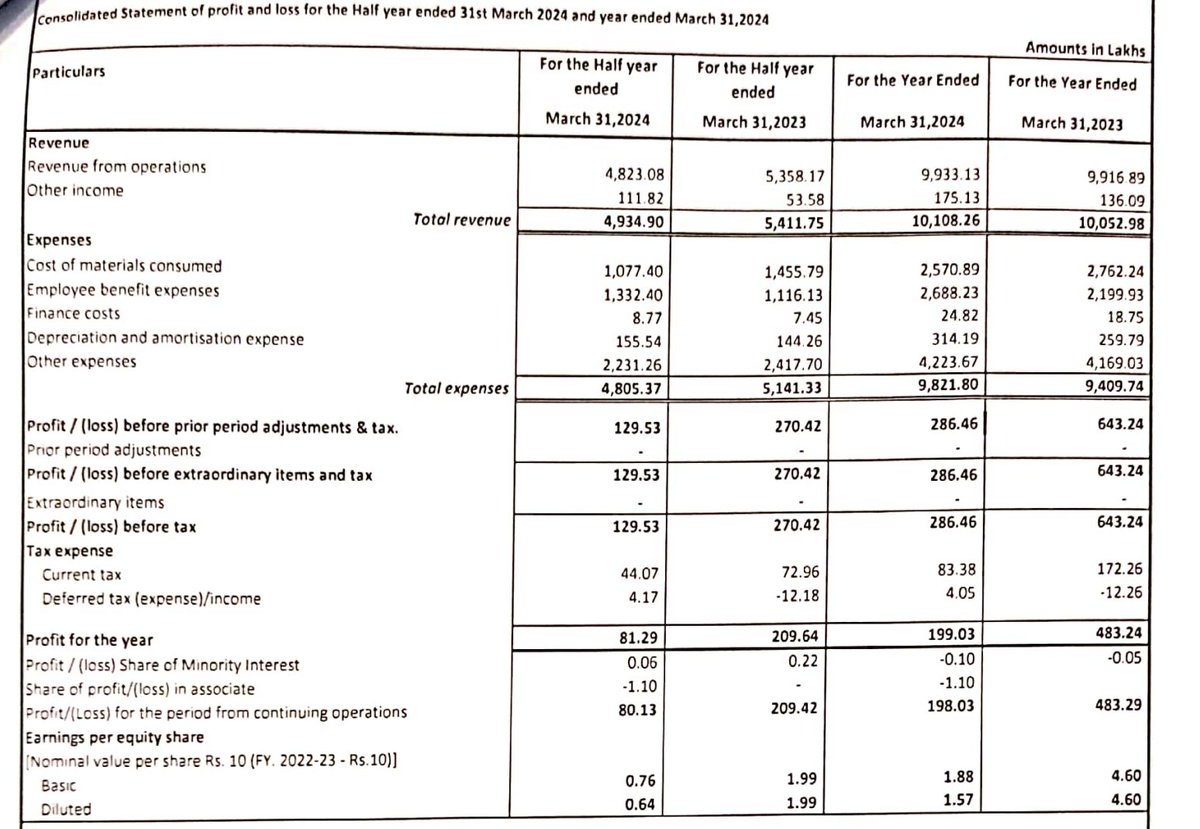

Vaidya Sane H2FY24

Poor nos 👎

Revenue at 48 Cr vs 53 Cr

PBT at 1.2 Cr vs 2.7 Cr

Net Profit at 0.8 Cr vs 2 Cr

FY24 OCF -4 Cr vs 0.06 Cr

#MADHAVBAUG #stockstowatch

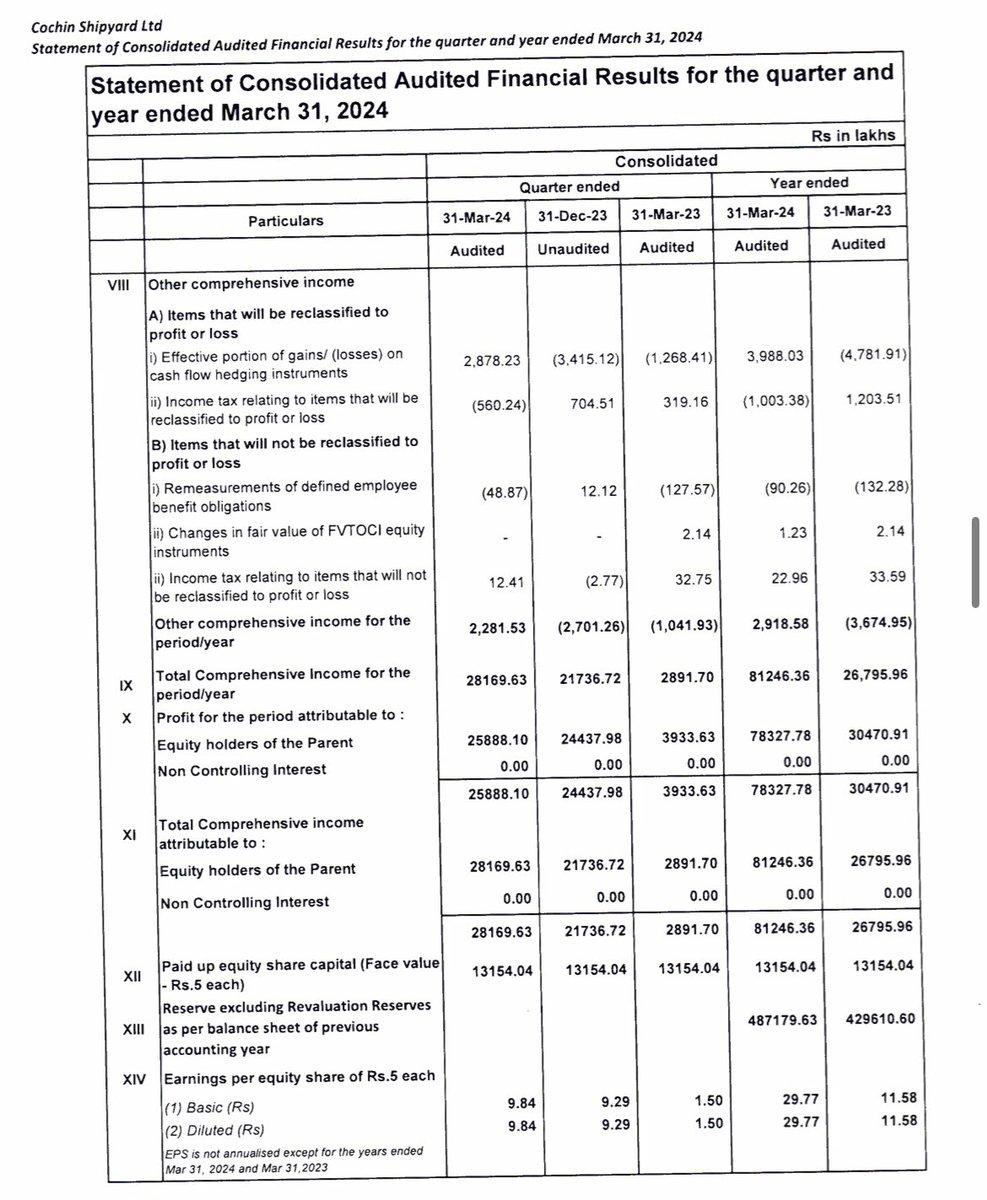

ABS Marine Services

#ABSMARINE - Complete business Analysis in a 🧵

CMP - 241

Market Cao: ₹ 594 Cr.

FY24: Revenues 138 Cr

FY24 PAT: 24 Cr

PE: 24.75

𝐄𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐅𝐘𝟐𝟓 𝐑𝐞𝐯𝐞𝐧𝐮𝐞𝐬 : 𝟐𝟏𝟎 𝐂𝐫

𝐄𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐅𝐘𝟐𝟓 𝐏𝐀𝐓 : 𝟒𝟎 𝐂𝐫

𝐅𝐨𝐫𝐰𝐚𝐫𝐝 𝐏𝐄: 𝟏𝟓

PSU bank stocks are soaring! 🚀

All 12 public sector banks hit a record ₹155,195 crore profit in FY24.

That's nearly 300% more than 3 years ago!

Which banks are leading? Let's find out in this visual thread. 🧵👇

#Stockstowatch #stocksinfocus #stockmarketindia

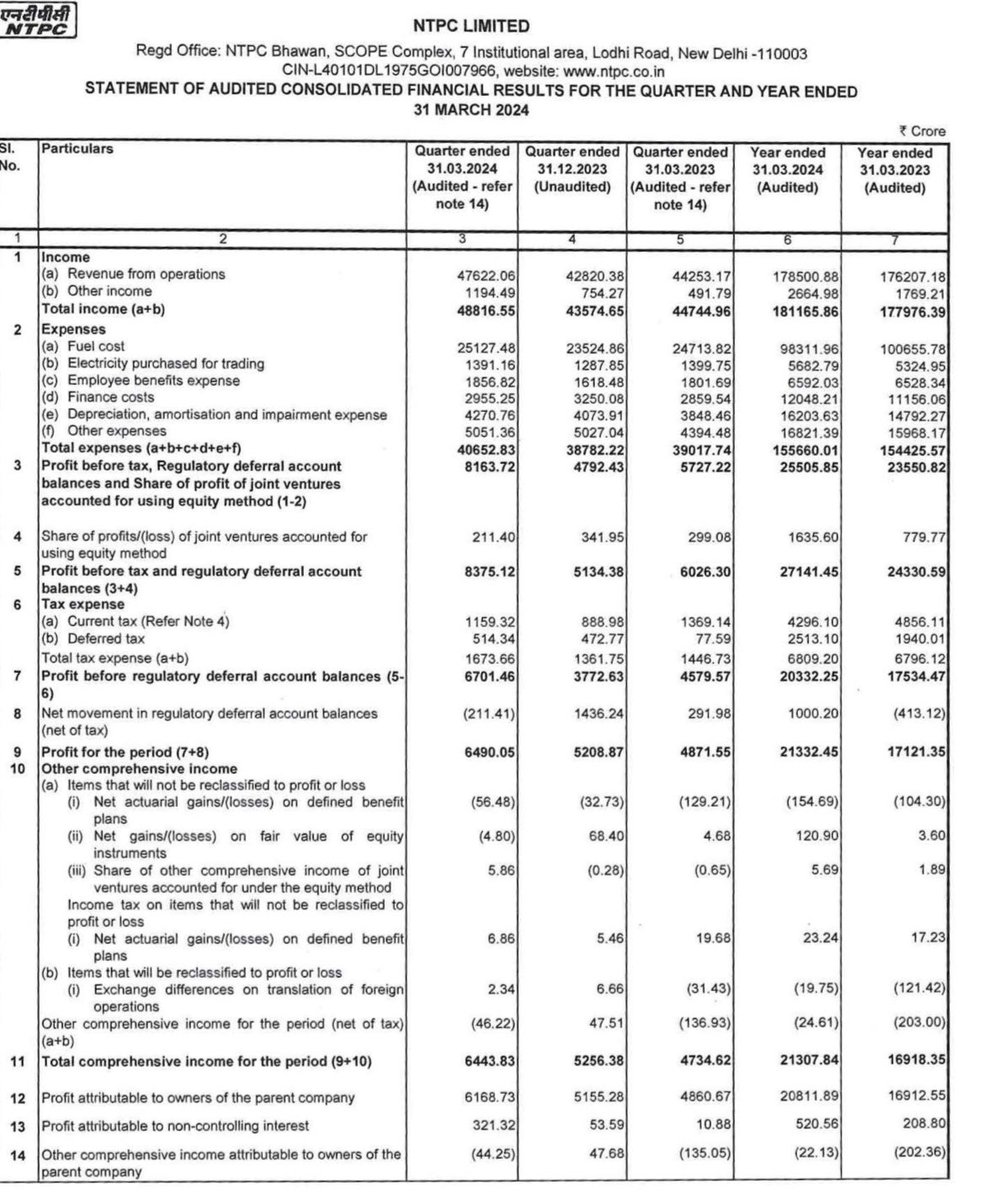

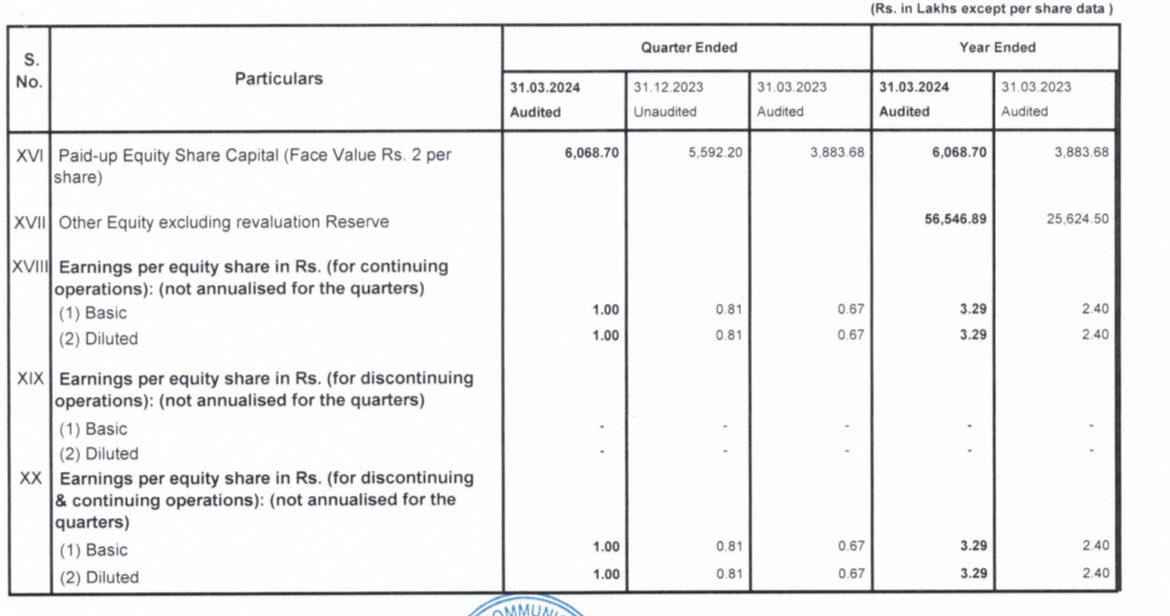

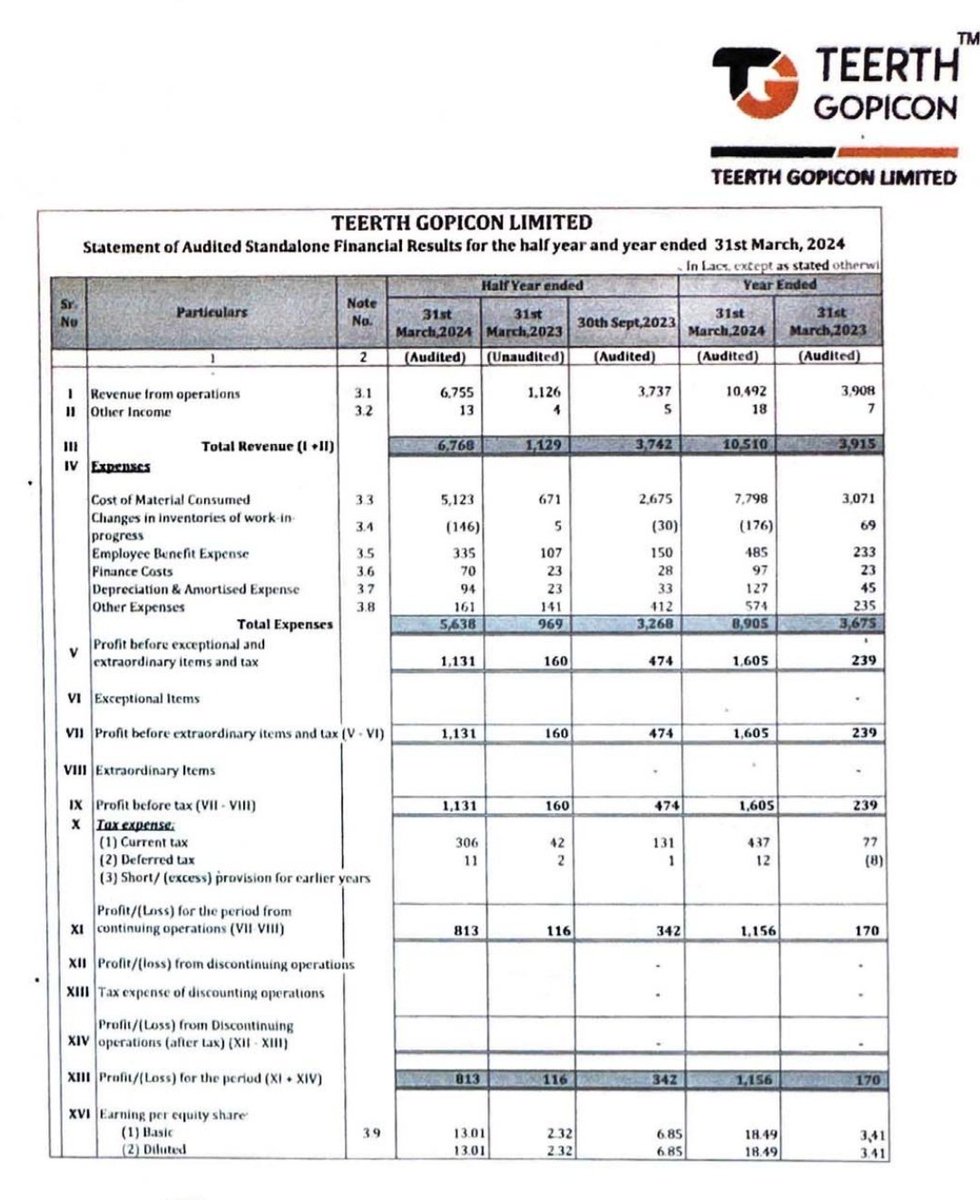

#TeerthGopicon H2 results

Now the PE has crashed from 134 to 20 🔥💥🚀

FY24 vs FY23 comparison -

Revenue jump 167% Yoy

PAT jump 580% Yoy 🔥

H2 FY24 vs H2 FY23 comparison -

Revenue jump 500% Yoy

PAT jump 600% Yoy 🔥

H2 FY24 vs H1FY24 comparison -

Revenue jump 80%

PAT jump 137%

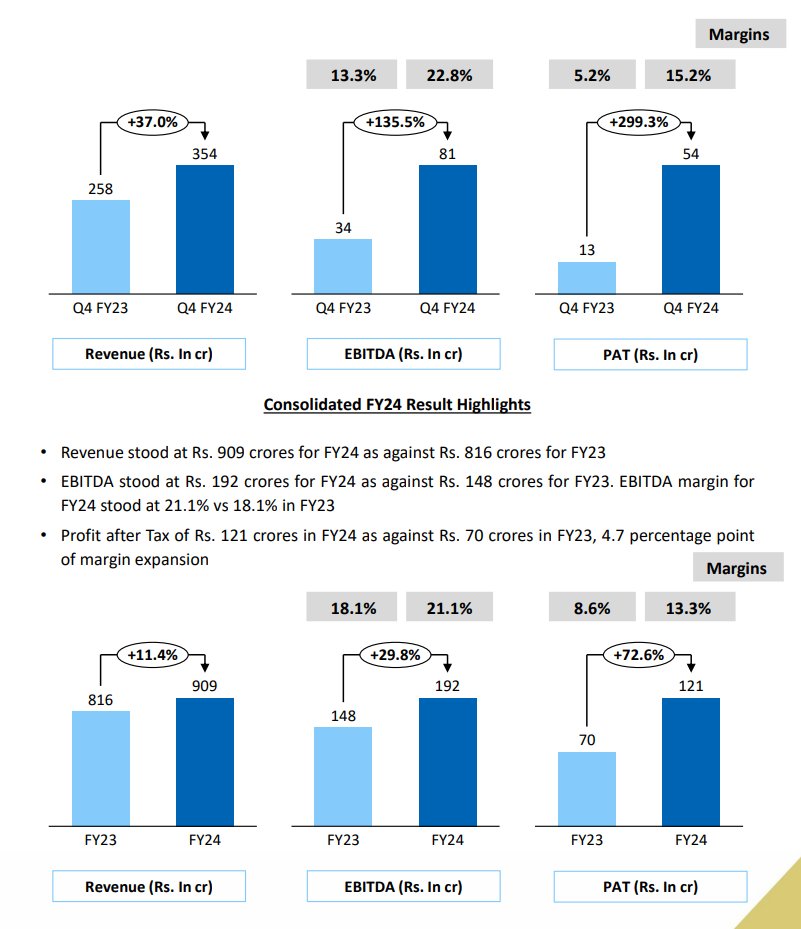

Astra Microwave #Q4FY24Results

Strong nos 👏

Revenue stood at 354 crores vs 258 crores YoY

EBITDA grew by 135% to 81 Crore

Margins was 22.8% vs 12.2%

Net Profit grew by 300% to 54 crores YoY

Order book of Rs. 2,299 Crores

FY24 OCF -187 Cr vs -22 Cr

Receivables: 503 Cr vs

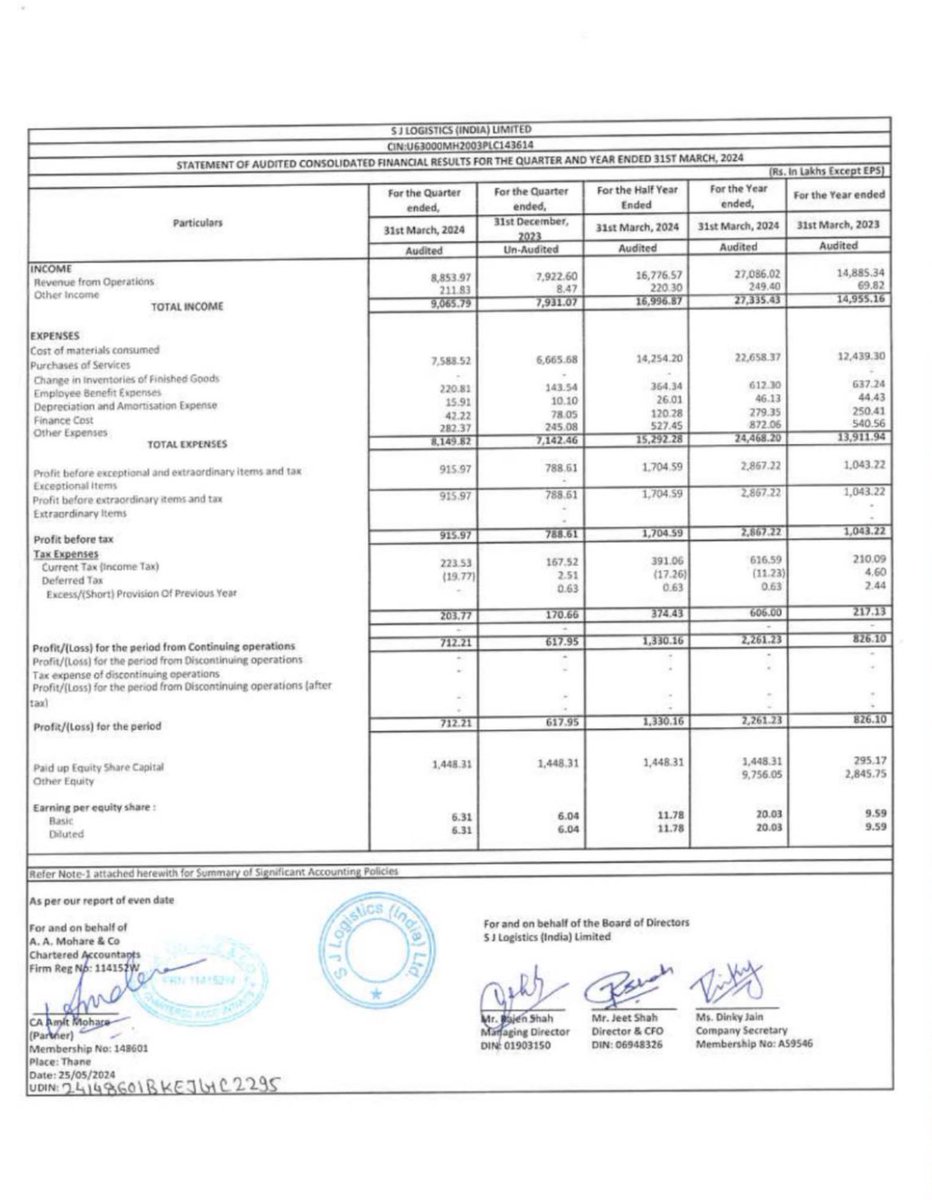

SJ Logistics posted fantastic set of numbers.

Good revenue and PAT growth for whole year.

Net profit is almost 2.7X than last year.

Available at 21 PE FY24.

#sjlogistics

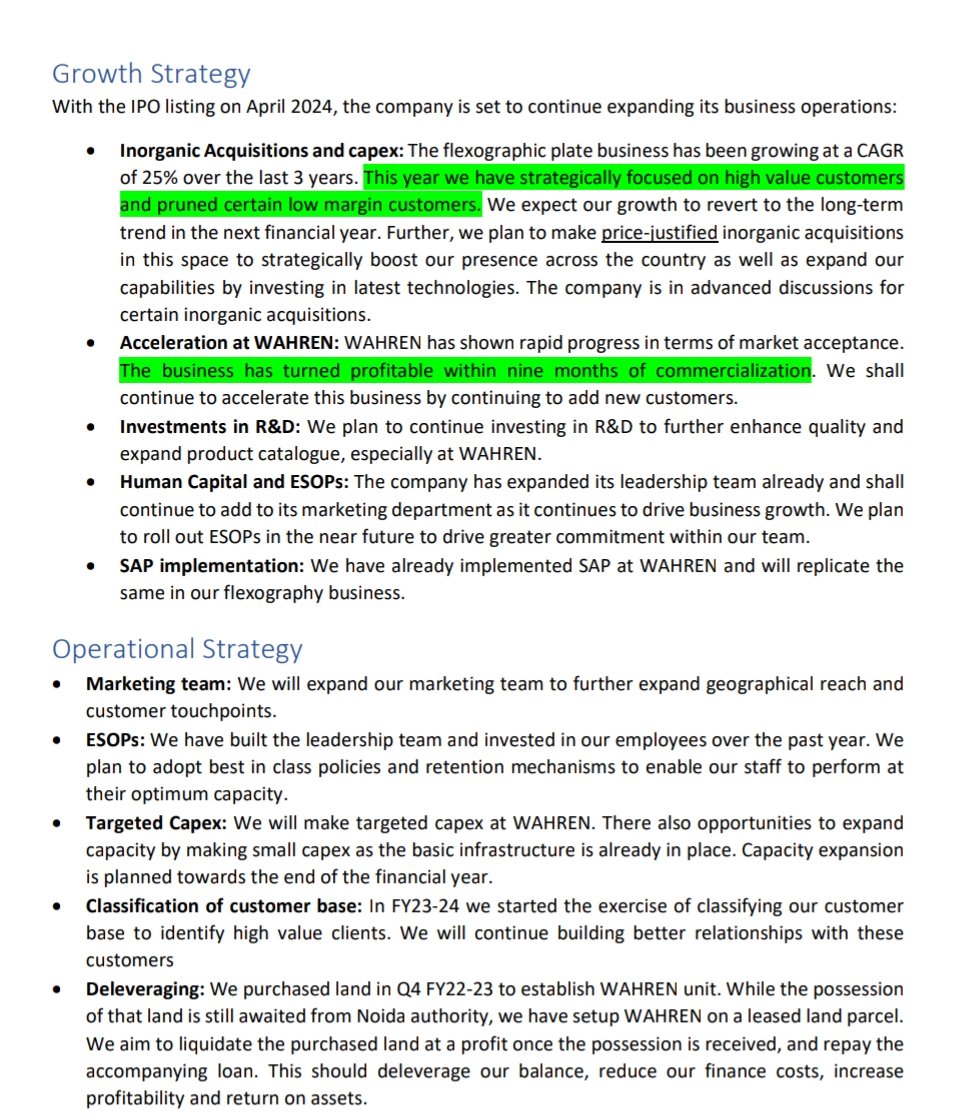

Creative Graphics

#CGRAPHICS

Good FY24 overall

However H2 is poor with margin erosion

H2 had solid revenue uptick with good contribution from WAHREN

However, margins are poor with low utilization

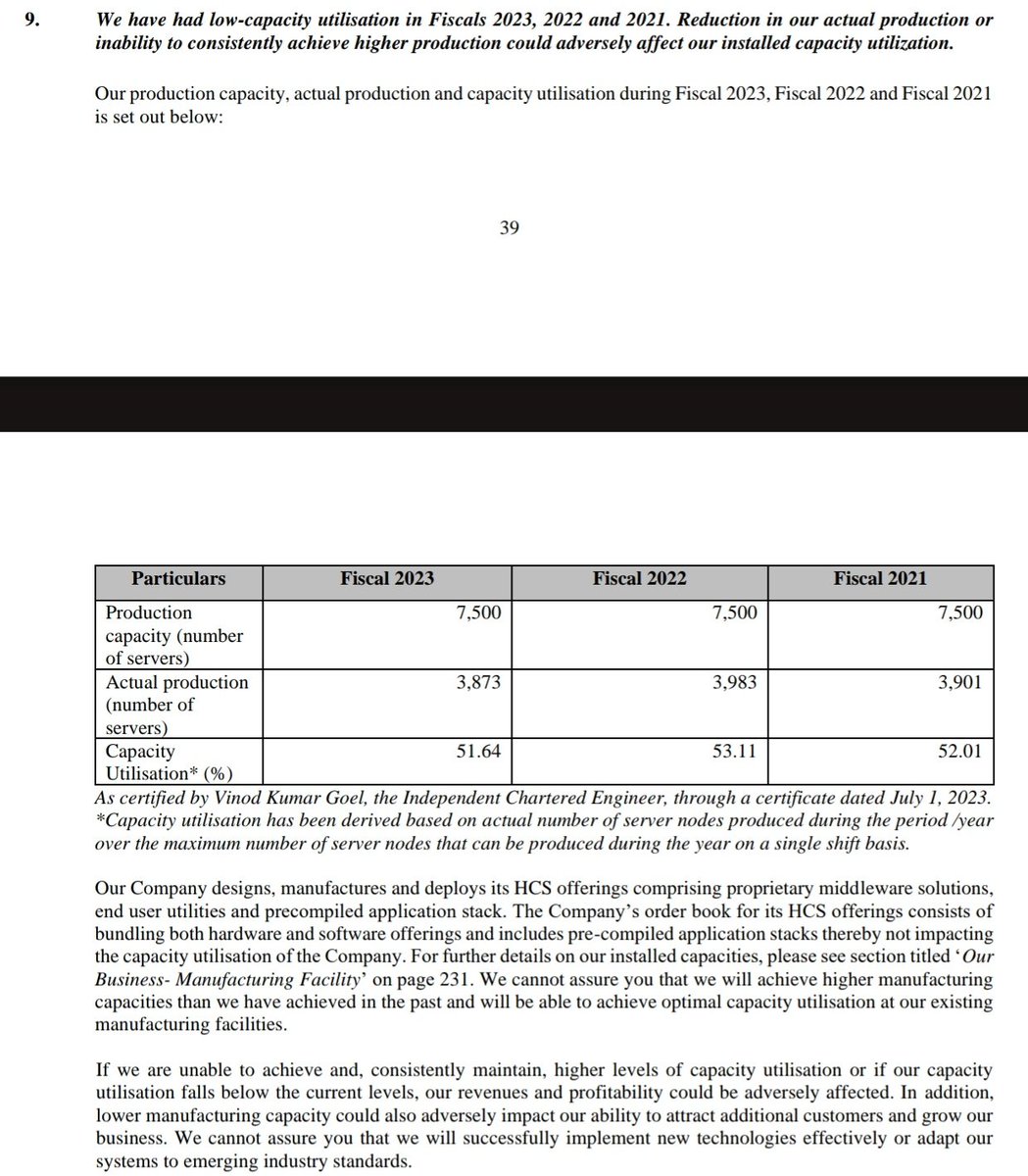

Press release states the reason for the same:

WAHREN:

Business started in Q2