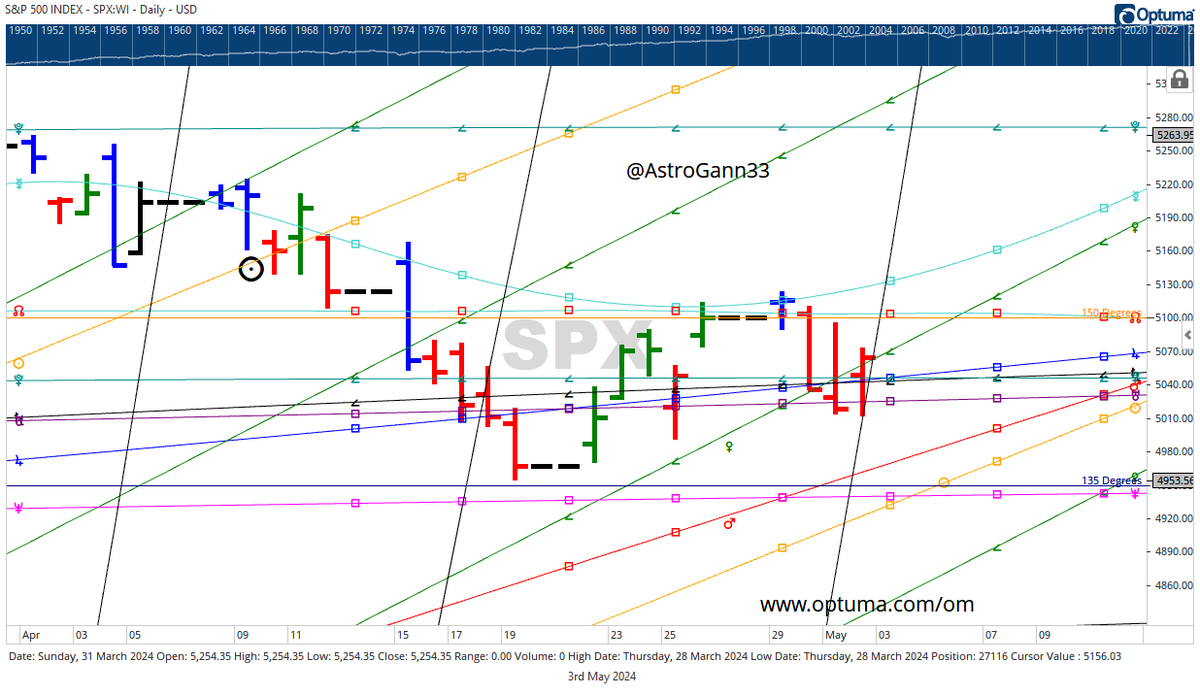

I'm often asked about the software I use.

This is GannTrader by @optuma

It has lots of #Gann and #astrology tools.

In this chart I have used Gann Planetary Lines, which allows you to plot planetary price lines, just like Gann. You can see why price often finds either

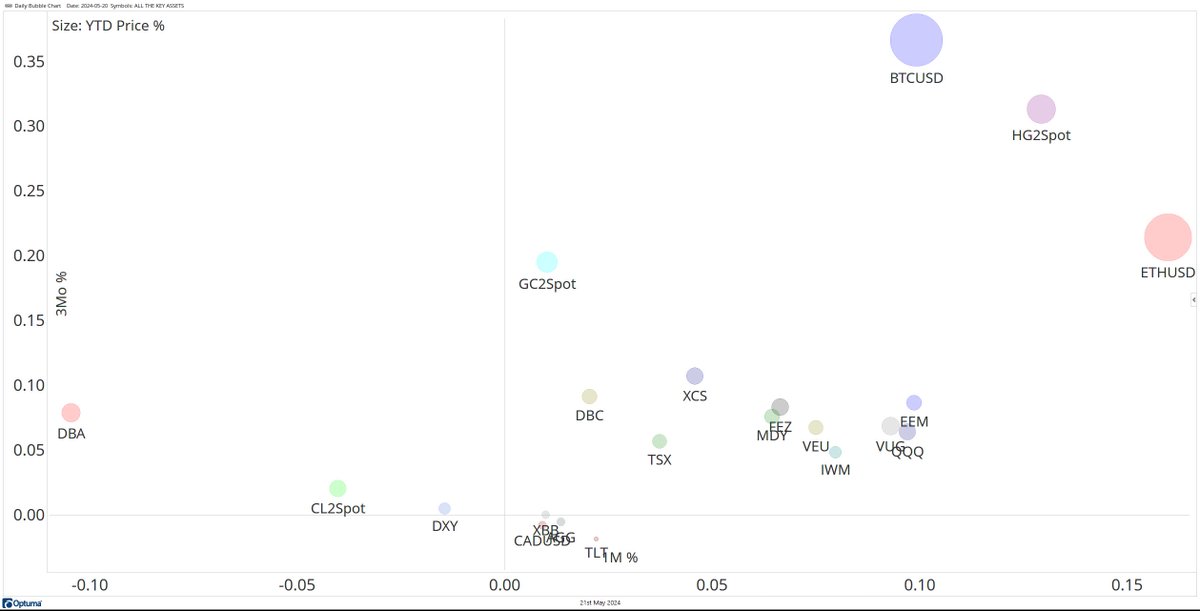

a look at an Optuma bubble chart showing our 'all asset' list...

x-axis: 1-month % change

y-axis: 3-month % change

Ethereum $ETHUSD, Bitcoin #BTC , copper standing out against the field... #AssetWatch

R / T : David Cox, CMT, CFA