Danielle DiMartino Booth

@DiMartinoBooth

CEO & Chief Strategist, QI Research LLC, Fmr Federal Reserve insider, Economist #FedUp https://t.co/HD8LtvuXJ8, https://t.co/QpwfxheMSJ

ID:3280573716

http://www.qiresearch.com 15-07-2015 12:56:04

145,4K Tweets

291,9K Followers

500 Following

Follow People

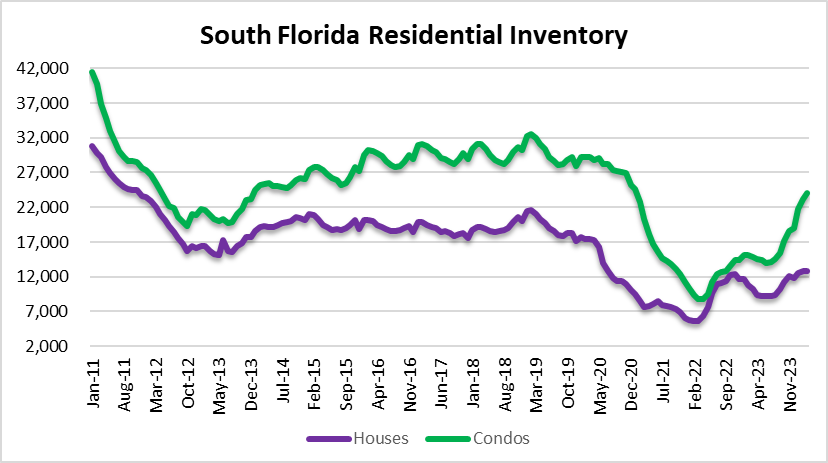

Danielle DiMartino Booth Melody Wright Daniel McNamara At what point can we call this a parabolic move in South Florida condo inventory?

“It’s not the buyers that aren’t qualifying. It’s the buildings that aren’t qualifying.”

wsj.com/real-estate/lu…

cc Melody Wright Daniel McNamara

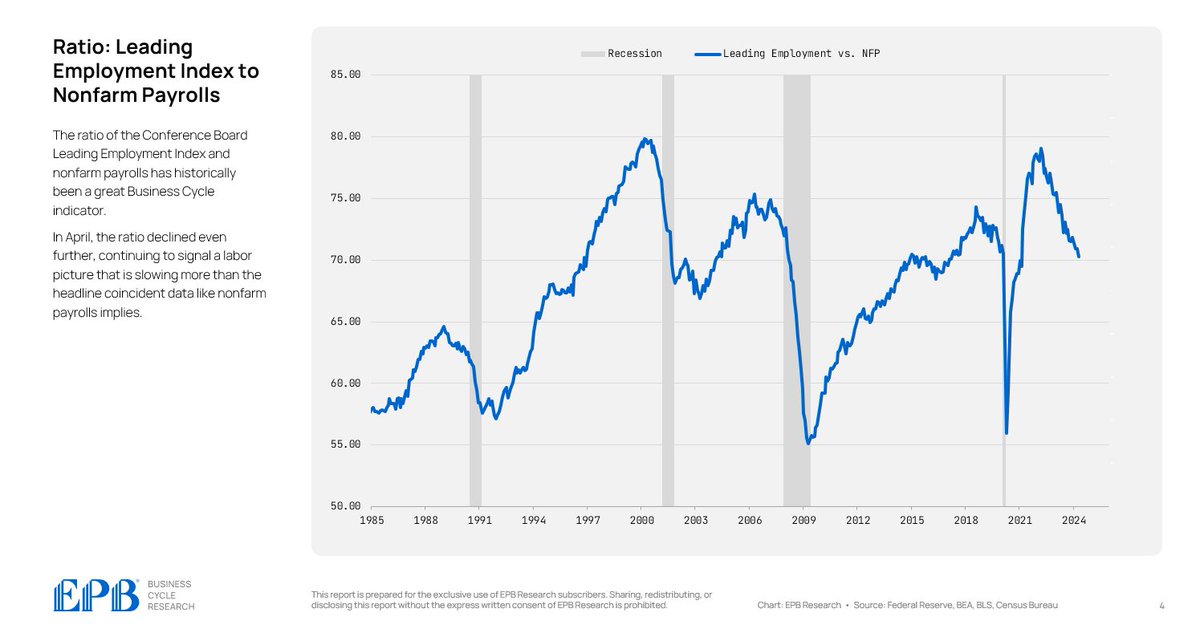

Job losses began in 2023’s third quarter. Layoff announcements have departed from seasonal patterns and accelerated into spring. Households awareness of weakening job market evident in University of Michigan surge in expectations for unemployment to rise, double the norm for the any given month.

Melody Wright Annie Danielle DiMartino Booth There are several startups looking at mortgage defeasement models that would allow the current market value of a 3% mortgage to be split with the borrower. The bank: 'refi from a 400K 3% to a 400K 7% and we will give you 40K. Split the proceeds with your buyer.

Melody Wright Annie Danielle DiMartino Booth The biggest issue with non-banks is that they will stop lending when the model goes upside down. It's like the so called 'Basis trade' that the big hedge funds do. They stop when they feel like it. Banks will be sitting on the sidelines like' what do you want us to do?'

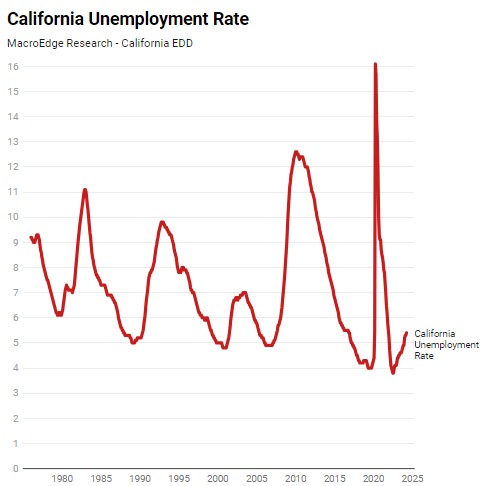

California has the highest unemployment rate in the nation and we expect that it advanced higher in April

Our Unemployment Radar updates when the state-level data is released later this month

#MacroEdge

Danielle DiMartino Booth University of Michigan I would imagine what could behind this are two forces: 1) hiring budgets are frozen and that’s leading folks to worry about what’s around the corner; and 2) education industry hands out contracts in May typically in our area. The post-pandemic stimulus aiding education ran dry…