Daniel Peris

@HistoryInvestor

Dividend investor in a stock market: The Ownership Dividend (2024). Recovering academic. Not investment advice; personal views. Most posts deleted.

ID:1028667090146942977

http://strategicdividendinvestor.com/ 12-08-2018 15:38:40

126 Tweets

2,3K Followers

459 Following

Not a pivot East as much as another iteration of the centuries-long, ambivalence-filled zig-zag course of R & the West. R brings little to the table other than energy/minerals, & the lands taken from C in 1860. R elites--not interested. H/t max seddon

on.ft.com/3V1OeYP

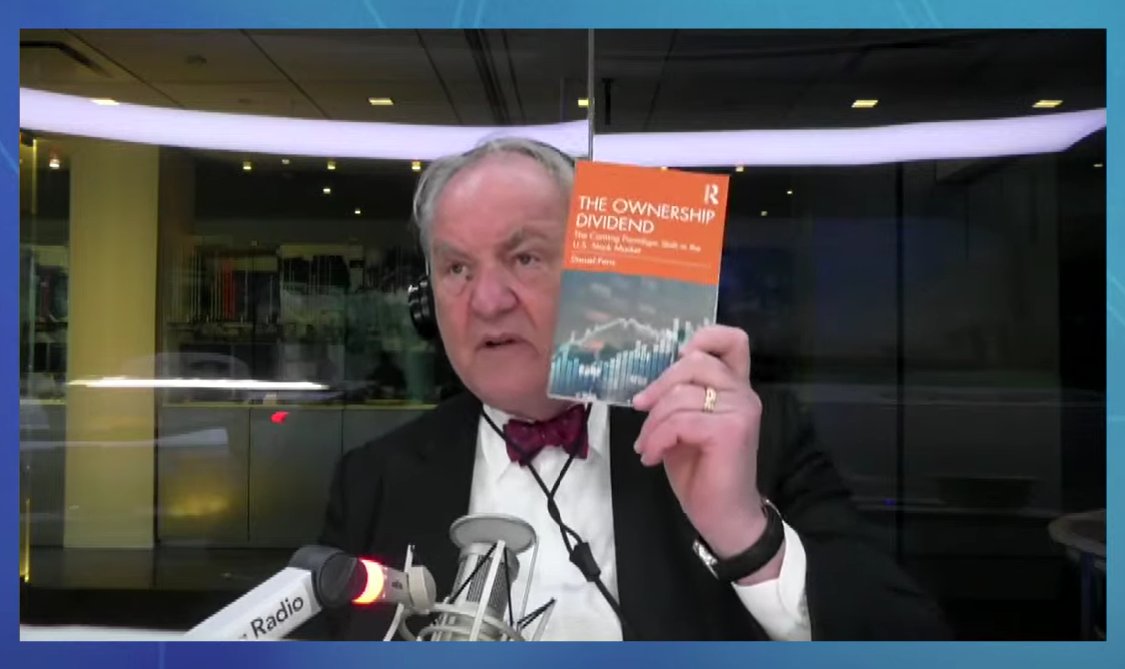

Flattered to be asked back by tom keene & Paul Sweeney on Bloomberg Podcasts/Bloomberg Radio to discuss tech companies turning to dividends. Even more flattered that Tom continues to waveThe Little Orange Book around.

Two brutal takedowns of America-last, Mearsheimer isolationism in Steve Kotkin's latest for Foreign Affairs