Pierce O'Reilly

@PierceOReilly

Senior Economist & Head of Business & International Taxes Unit in the Tax Policy Division of @OECDtax. Formerly @Columbia. Usual disclaimers apply.

ID:630503722

08-07-2012 20:30:43

5,3K Tweets

1,0K Followers

1,1K Following

Join us for the next OMG Transatlantic Tax Talk on Tuesday 27 February @ 5pm GMT. Pierce O'Reilly Pierce O'Reilly and Ana Cinta Gonzalez Cabral Ana Cinta G. Cabral will present their paper 'The Global Minimum Tax and the taxation of MNE profit' Login details at oxfordtax.web.ox.ac.uk

'Profit shifting of multinational corporations worldwide' is published by World Development: authors.elsevier.com/a/1iQA1,6yxDOf… In one of the most ambitious papers by fantastic Javier Javier Garcia-Bernardo (@[email protected]) and me, we identify the distributional consequences of profit shifting of multinationals. 1/9

🗣Join us for webinar exploring the impact of digitalisation & AI on workplaces!

Our speakers - U.Holtgrewe,ZSI Research Policy; Anna Milanez,OECD Social; Trine Pernille Larsen & Anna Ilsøe 👩💻🤝 ( #INCODINGproject & FAOS) - will share insight from case studies!

bit.ly/3Sd8t4h

You can still register for tomorrow's webinar, where OECD experts will discuss the latest results regarding the impact of the Global Minimum Tax on the taxation of MNEs.

🗓️ 9 January 2024 🕒 15:00 CET

✍️📺➡️ oe.cd/eia-webinar

#GlobalMinimumTax

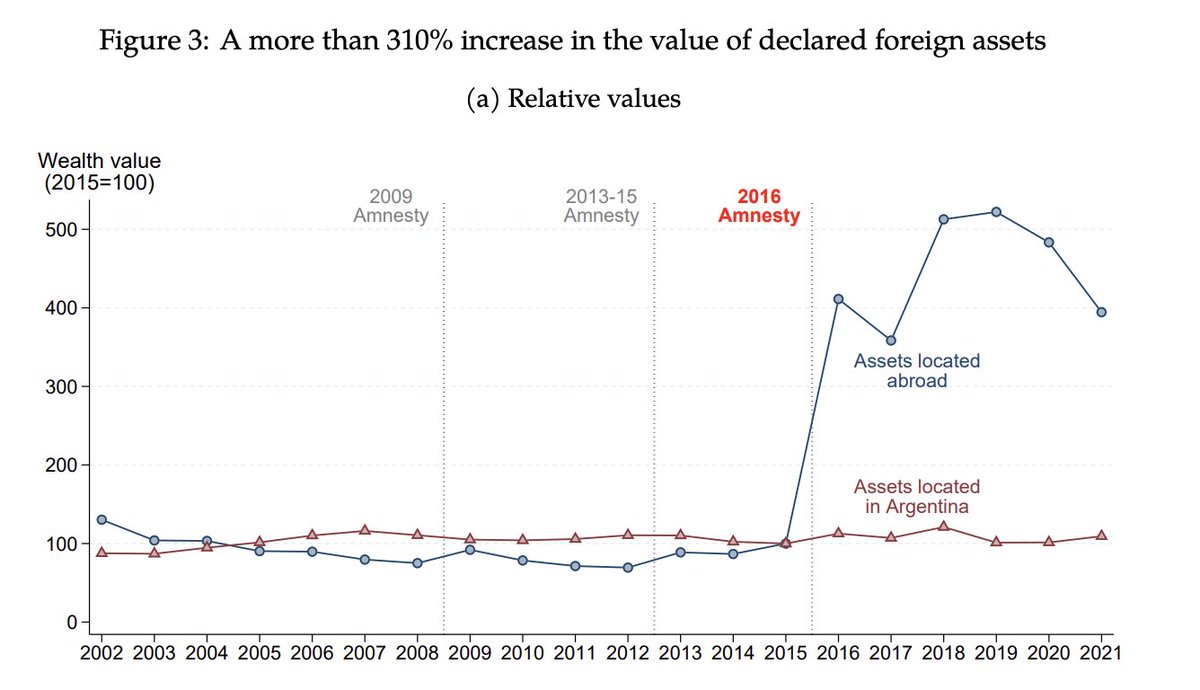

Awesome new working paper by Juliana Londoño-Vélez and my WB colleague Dario Tortarolo on how tax amnesty in Argentina revealed massive amounts of undeclared offshore assets!

documents1.worldbank.org/curated/en/099…

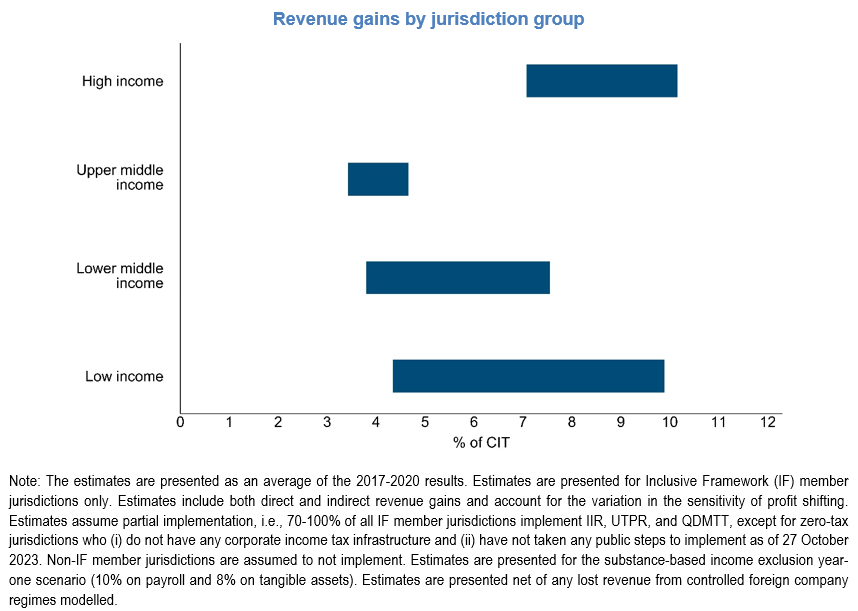

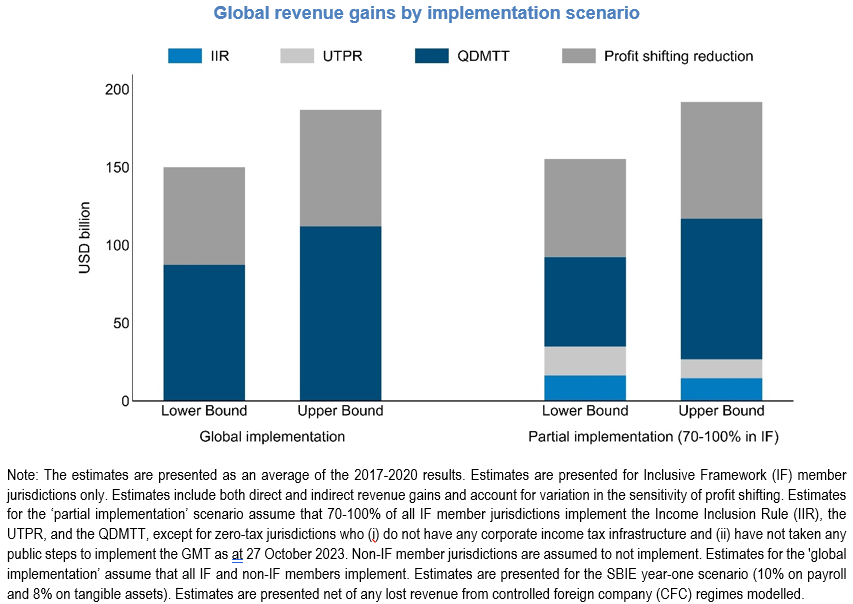

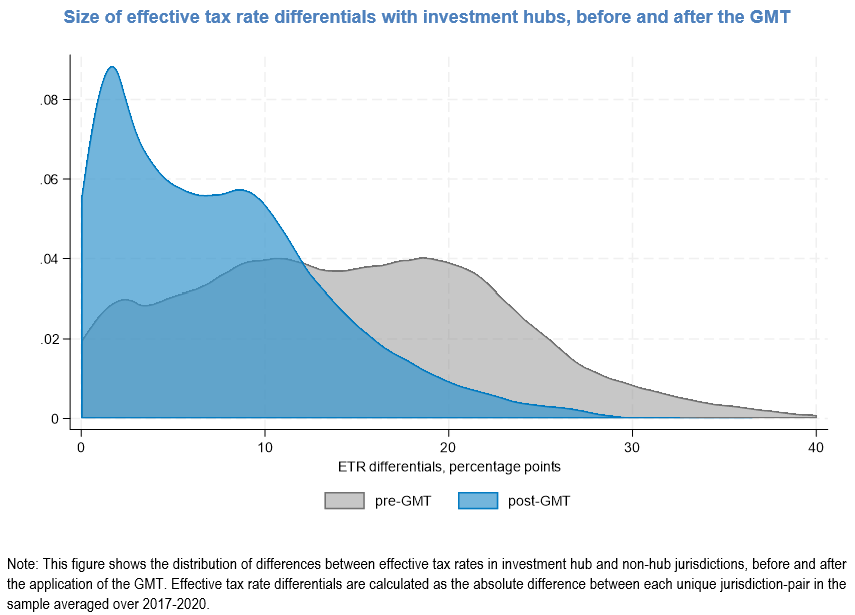

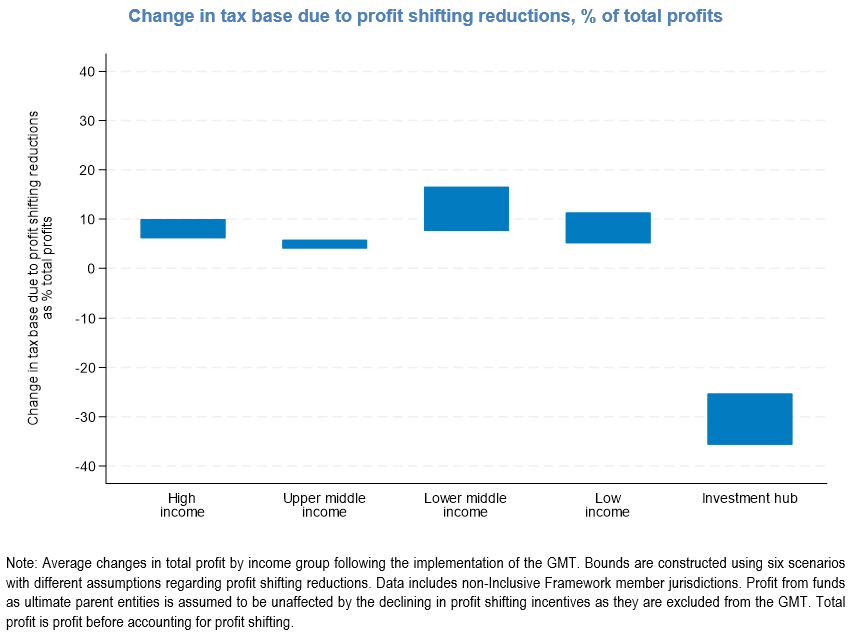

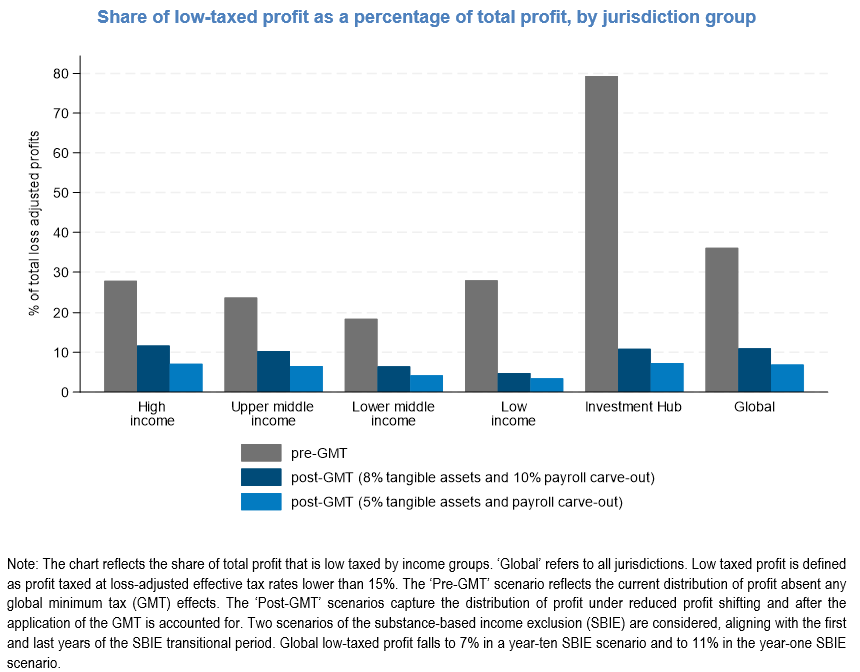

![OECD Tax (@OECDtax) on Twitter photo 2024-01-09 15:31:46 [OUT NOW] New analysis assesses the impact of the Global Minimum Tax on large MNEs low-taxed profit, profit shifting incentives, tax rate differentials & corporate tax revenues of large MNEs operating worldwide ➡️ oe.cd/5nF Key highlights🧵⤵️ [OUT NOW] New analysis assesses the impact of the Global Minimum Tax on large MNEs low-taxed profit, profit shifting incentives, tax rate differentials & corporate tax revenues of large MNEs operating worldwide ➡️ oe.cd/5nF Key highlights🧵⤵️](https://pbs.twimg.com/media/GDaMnQHawAA9vr3.jpg)