SOS Branding

@SOSBranding

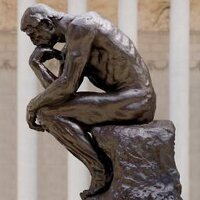

Branding with Attitude

#SOS

#SOSBranding

ID:715855478518112256

01-04-2016 10:57:00

7,9K Tweets

3,7K Followers

3,3K Following

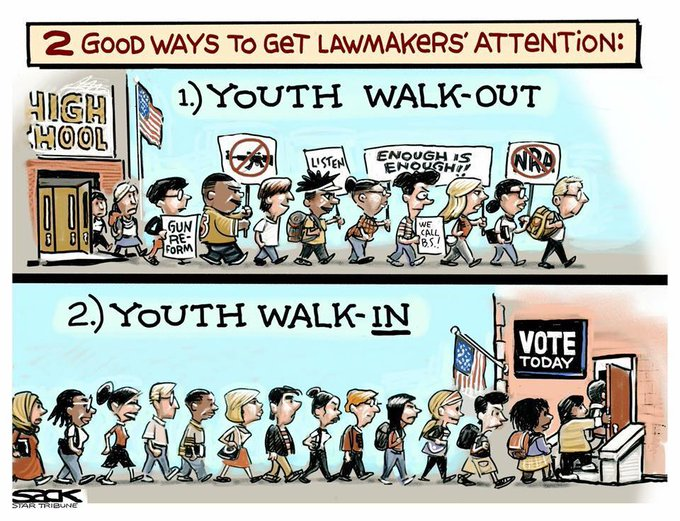

Vote for our Rights!

via Lino's Version

Pattie 💔

🌊🇺🇸Alan Smithee🌊🇺🇸⚖️☮️

Sweet Souli❤Democrat,single & feelin' groovy☮️

Isola Brown @isolabrown

THEE Montana DemGirl 🐝

Bohemian Prairie Girl

AMC 🇨🇦

Al 🅖🅓🅐🅓➊ Criswell

Bill Morris 🌊🌊🌊🌊🌊

Bab

Robert Kort/GEM21 💎 🌊

Liam Long

Rubicon

𝕲𝖆𝖊𝖙𝖆𝖓𝖔

Nana 💙💛💙🇺🇸🍀🌊🌈💔🟧 😷💉👣 #FBR👣

Grandpa Snarky 💙🌈🌊

𝐅𝐨𝐱𝐲 💔🇺🇸 🟦 SAVE DEMOCRACY

Author Stuart Miller (Indie)

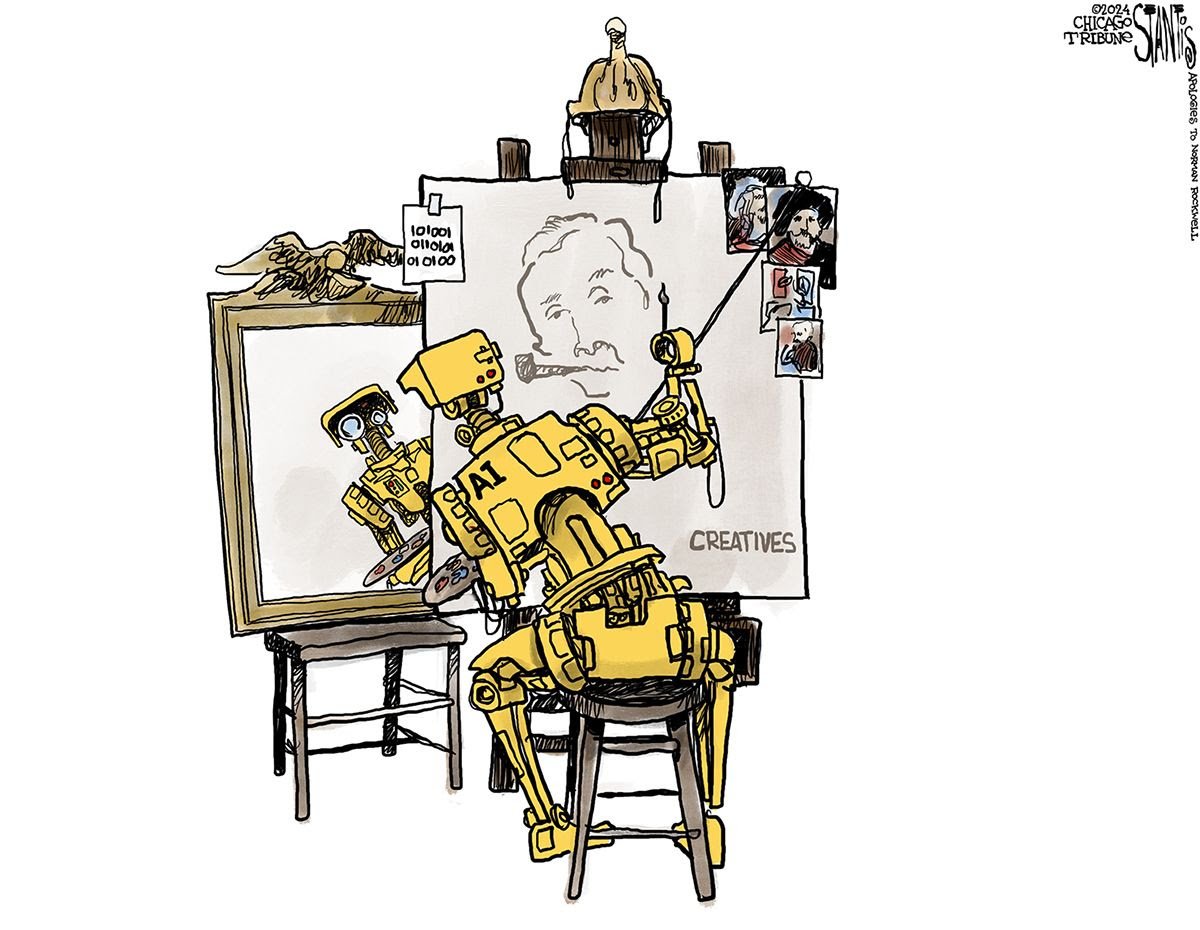

The Art of Social Media: Thoughts linomatteo.wordpress.com/2024/04/27/the…

SOS Branding

Lino's Version

Community VIA

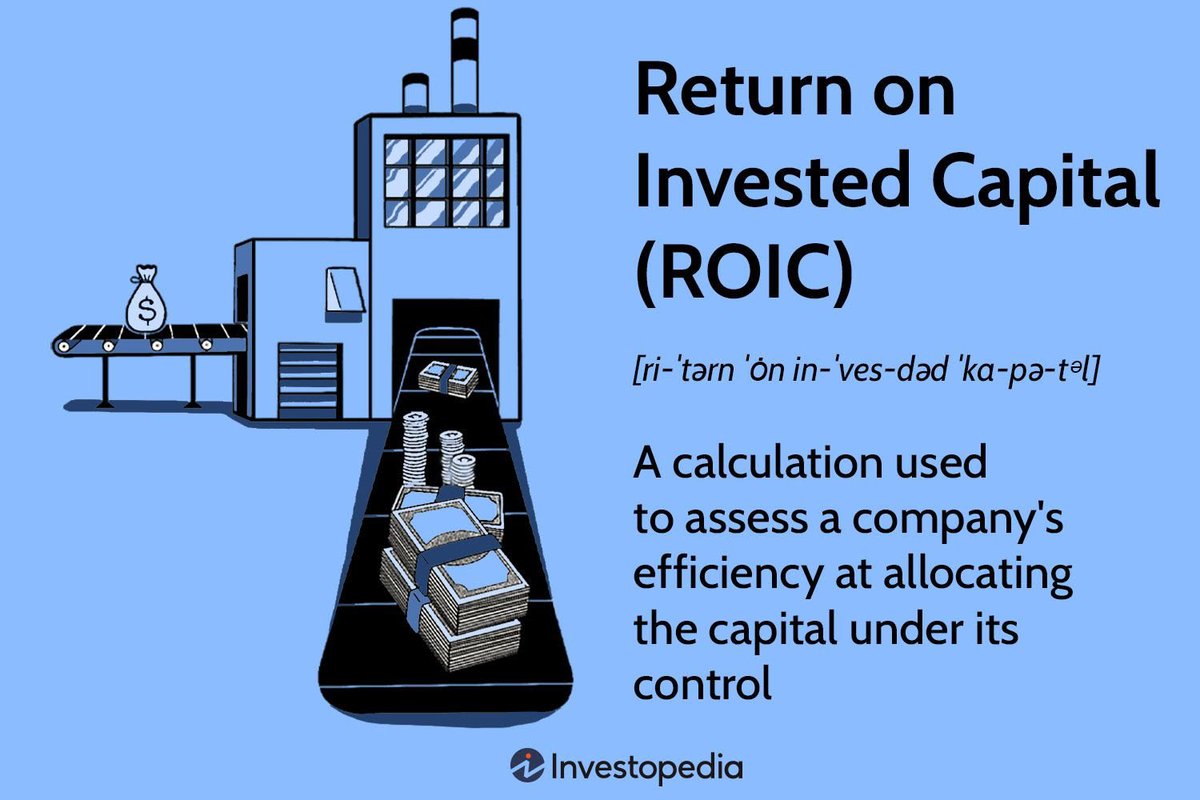

Return on invested capital (ROIC) assesses a company's efficiency in allocating capital to profitable investments. It is calculated by dividing net operating profit after tax (NOPAT) by invested capital.

investopedia.com/terms/r/return…

#BusinessEnglish #Montreal #505050Rule

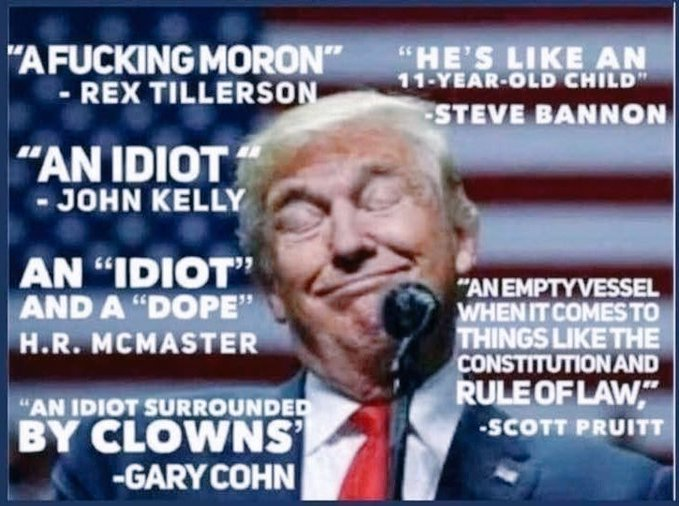

The 'finest' people know!

Tournesol Research

Montreal Business

Pascali Reads (& Writes)

Lino's Version

Eileen - Amazingly Enough I Don't Give a Shit

Connie

Coko #ResisterSister #BlueStormFriends #UniteBlue

𝐅𝐨𝐱𝐲 💔🇺🇸 🟦 SAVE DEMOCRACY

Rubicon

Bab

Robert Kort/GEM21 💎 🌊

Meta Resistance #StrongerTogether

Leslie #FBR #FF ☮️ 🌊💙🟧💉🌺💃🏻

Artie Miss (👀) Cory Marie Chisholm

SLife

Julie

Abbie Says

SOS Branding

Community VIA

Boost Blue Accts <10K🚀

Vet🌊FB🌊RT

Lisa Aiken 🌊🟧 🏳️🌈 🇺🇦💙

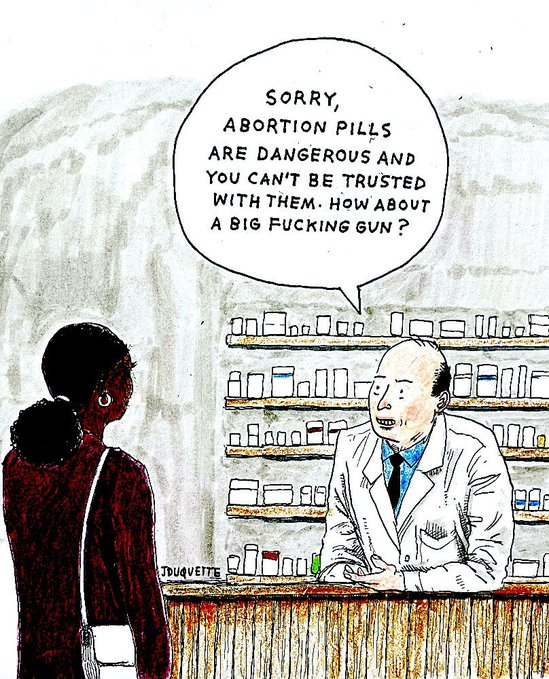

My Body My Choice 🇺🇦🌻💉🌊🌎🦄🐾😷 🏴☠ 🌈🗳

Deb K

Mooms Da Word 💙🌊

John Messina

Kristi Kehrer

GiGi 🗳️💙🛟🇺🇸

TracyMTindle

AuntieBetty’sCafe

Darkwing

Chronic Pain Princess

Meritt Hutton 🌊♋🧙♂️

Ossi_Justav

elmer e bushong

Progress NOW

carrie. 🟧🏴

Angry Panda 🐼 #DemVoice1 🌊

ChrisHealth…