Ira Joseph

@ira_joseph

Global Fellow, Center on Global Energy Policy, Columbia University. Former Head of Pricing & Analyics for Generating Fuels & Electric Power at S&P Global

ID:956583506

19-11-2012 02:08:12

14,1K Tweets

12,0K Followers

135 Following

Ira Joseph Center on Global Energy Policy The report in which the charts appear. Contains summaries of earlier reports examining some of the reasons why host counties fail to prosper. It's basically 'the resource curse' quantified. ohiorivervalleyinstitute.org/wp-content/upl…

Ira Joseph Precisely what puzzles me in recent EU gas buying spree. We are once again looking at supply worries, whereas bull markets are driven by demand. Supply premium fade in due time, a decent chunk of money is committed already on gas upside.

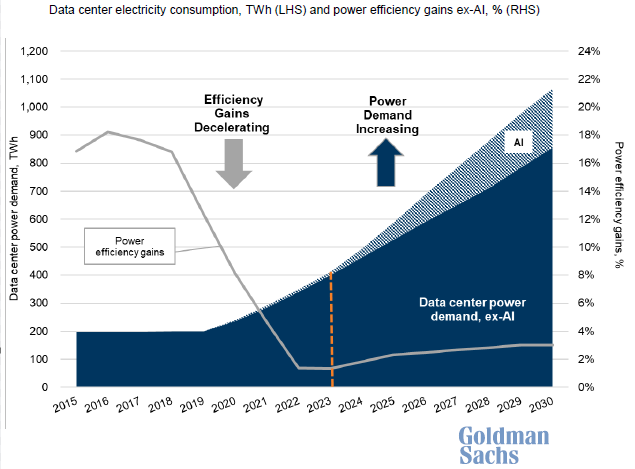

One important distinction. Data centers need power 24/7, but data centers do not run at peak capacity 24/7. The amount of daylight (or nightlight!) between these two operating numbers can be quite significant. Center on Global Energy Policy

On Monday, CGEP Founding Director Jason Bordoff joined the Milken Institute's expert discussion on harnessing the power of renewables to enhance energy efficiency and foster resilient infrastructure.

Missed the #MIGlobal panel?

Watch here 👇

milkeninstitute.org/panel/15484/br…

LNG Investor 💥Energy Flux💥 Ira Joseph He Yiyong All Things LNG Laura Page Ruth Liao TheLNGAnalyst Tom Haddon Sergio Chapa Javier Blas Jake Horslen LNG Tomasz Włodek Susan Sakmar Stephen Stapczynski LNG Enthusiast Sorry, let's try that again. By 2030:

- Powergen adds +10-18 bcf/d

- LNG adds + 15 bcf/d

Total additional gas demand in 2030 will be in the 25-33 bcf/d range

Price impact depends on supply response and transmission constraints

My adjacent take is power demand is going to become much more fluid globally, so it’s going to be difficult to peg where the AI-related power boom will occur & how quickly it will move around to chase price. And as John Arnold mentioned, do not sleep on efficiency gains.

So, does a gas-fired AI boom mean US LNG goes bust?

More 👉 energyflux.news/p/data-centres…

CC Ira Joseph He Yiyong All Things LNG Laura Page Ruth Liao TheLNGAnalyst Tom Haddon Sergio Chapa Javier Blas Jake Horslen LNG Tomasz Włodek Susan Sakmar Stephen Stapczynski LNG Enthusiast…

Whatever you like, don’t like, or wish was further commercialized, the world is going to be floating in cheap solar, batteries and gas by the late 2020s through early 2040s. H/t mike andrade “🎶And if you can't be with the one you love, honey, love the one you're with 🎶”