Mark Rendell

@mark_rendell

Covering the Bank of Canada, finance and economics for The Globe and Mail’s @globebusiness. [email protected]

ID:837042307

21-09-2012 05:07:10

1,4K Tweets

3,8K Followers

4,2K Following

New (w/ Jason Kirby & Mark Rendell):

Why you can’t afford a home, explained in 10 charts theglobeandmail.com/business/artic…

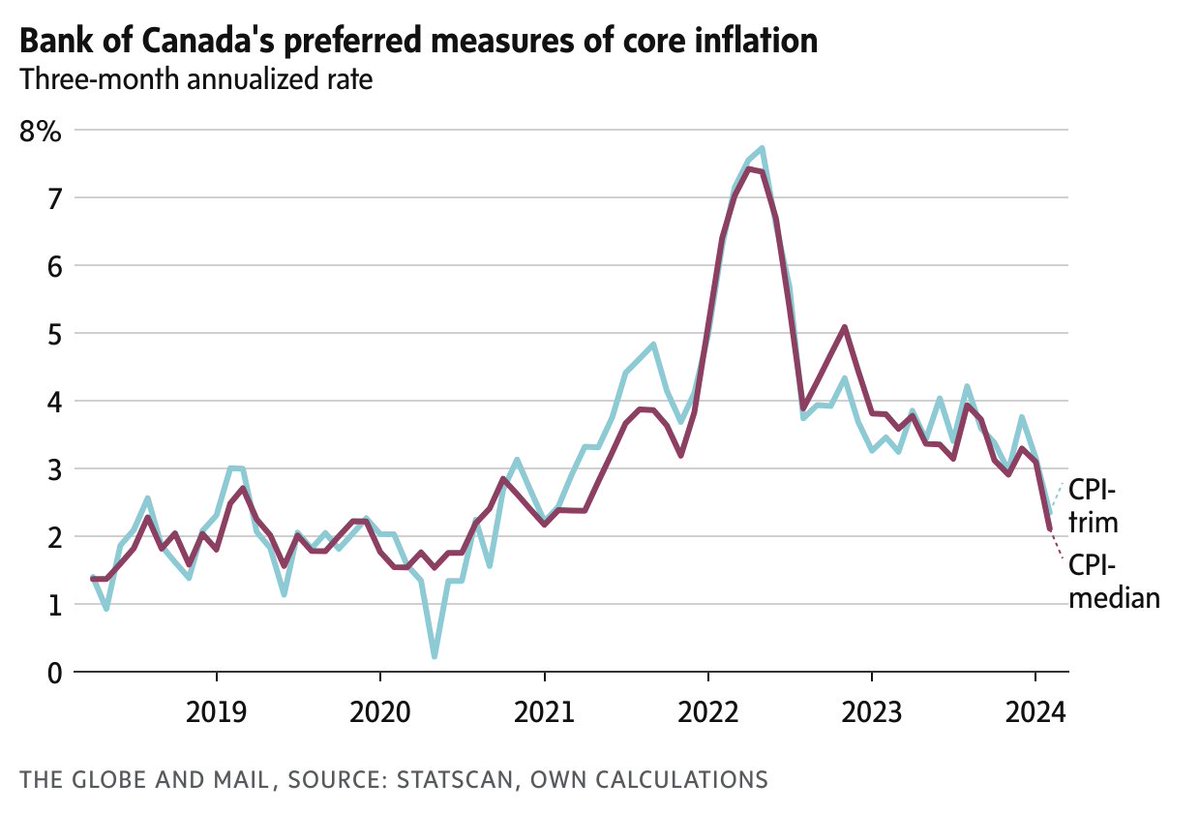

Some economists think the last mile of inflation will be the hardest. Others think it's closer to target than hawkish central bankers at the BoC and elsewhere are willing to admit. Matt Lundy, Jason Kirby and I take a look at the debate.

theglobeandmail.com/business/artic…

“At some moments in history, central bankers were all heroes; and other times, they’re all villains,” Bank of Canada's Tiff Macklem tells The Globe and Mail in a year-end interview looking back at 2023 and forward to a pivotal next year. With David Parkinson theglobeandmail.com/business/artic…

Interesting split in the BoC's gov council: “Some members felt that it was more likely than not that the policy rate would need to increase...Others viewed the most likely scenario as one where a 5% policy rate would be sufficient'if held high long enough theglobeandmail.com/business/artic…

The BoC and the Fed both began raising rates in March, 2022 and tightened aggressively. In Canada, that’s pushed the economy to the edge of a recession. South of the border, the U.S. economy is defying gravity. What gives? with Jason Kirby

theglobeandmail.com/business/artic…