Are you worried about 2000 Rs bank notes?

#banknotes #announcement #FAQs #2000rs #finance #MONEY #FiancéFinance

#TaxPro

#AccountantLife

#FinanceWhiz

#TaxExpert

#CharteredAccountant

#MoneyMatters

#FinancialGuru

#TaxSeason

#NumbersNinja

#FinancialWizard

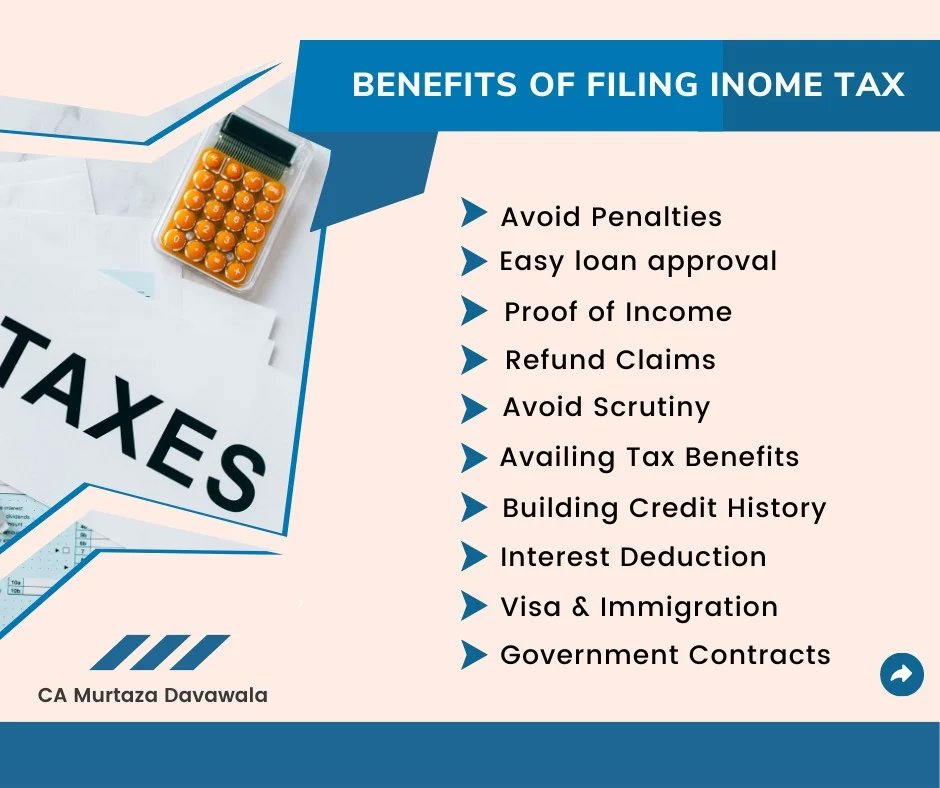

💰Income Tax Return (ITR) Eligibility For Kids In India💸

#incometax #incometax return #IncomeTax2023 #fiancéfinance #taxpro #accountantlife #financewhiz #taxexperts #charteredaccountant #moneymatters #FinancialGuru #taxseason #numbersninja #financialwizard #camurtazadavawala

Unlock the 3-2-1 Review for CA Accounting.

#CharteredAccountant

#CAExam

#AccountingPro

#FinancialAdvisor

#AuditExpert

#TaxConsultant

#CPA

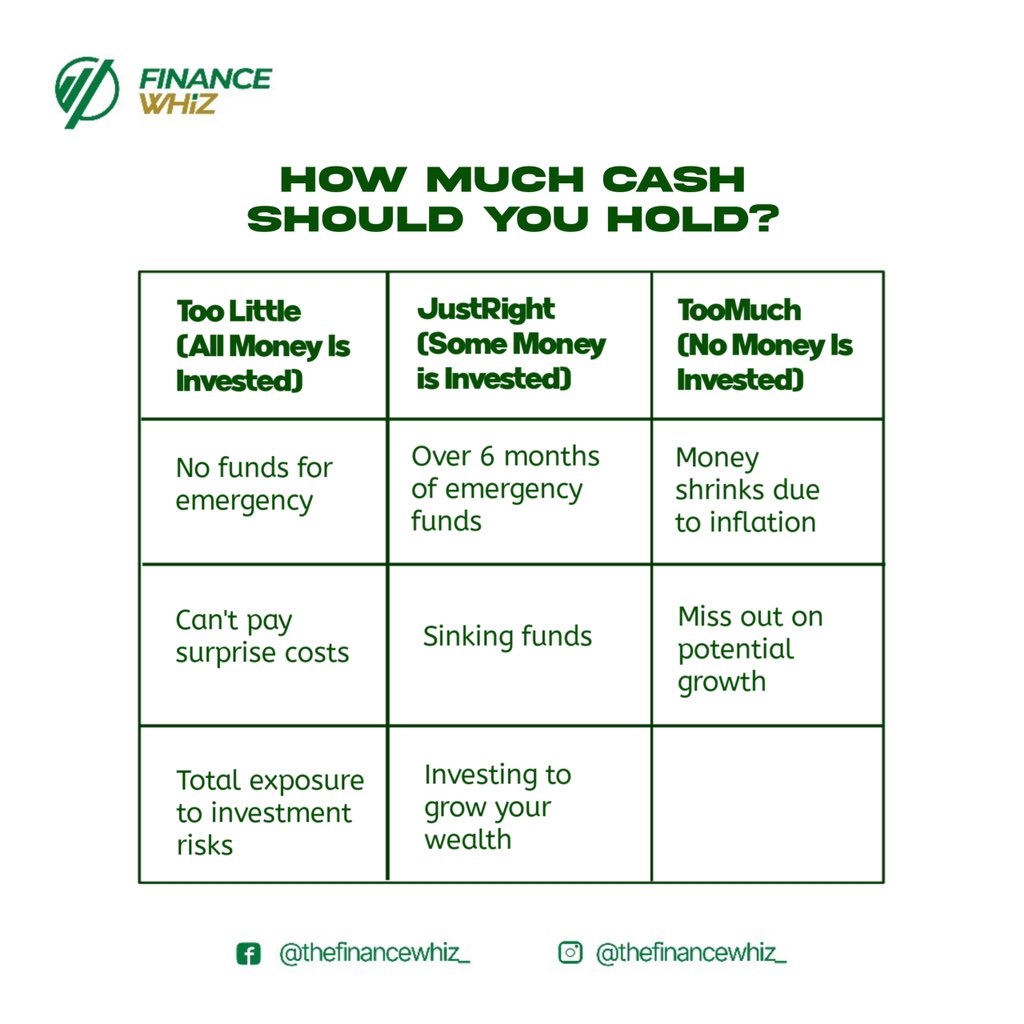

#FinanceWhiz

#AuditTrail

#AccountingLife

#NumbersNerd

#TaxSeason

#FinancialWizard

#AccountantLife

#IncomeTax

#AuditFirm

Is it just me or did professor Patrick Boyle 💎 trade his calculator for a movie script? He's killing it as Anton Zeleski in The Hummingbird Project! Can't wait to see his next Youtube video...or movie role.

#financewhiz #hummingbirdproject #patrickboylelookalike #quanttradinggeek

Bloomberg Wow, ChatGPT acing finance tests? Better invest in the ChatGPT-O-Matic! But wait, there's more! Have you seen squirrels water skiing? #financewhiz #squirrelantics #chatgptomatic

'Move over, Donald Trump, we've got a whip-smart, self-made Republican making stacks in finance and biotech! 💸🚀 It's like the American Dream had a turbo boost. 🌟♟️😄

Forbes

#SelfMadeSuccess #FinanceWhiz '