Learn about GSTR 8 return I Learn about GSTR-8 return

#GSTR8 #GSTRETURN #GST8 #GSTDUEDATE

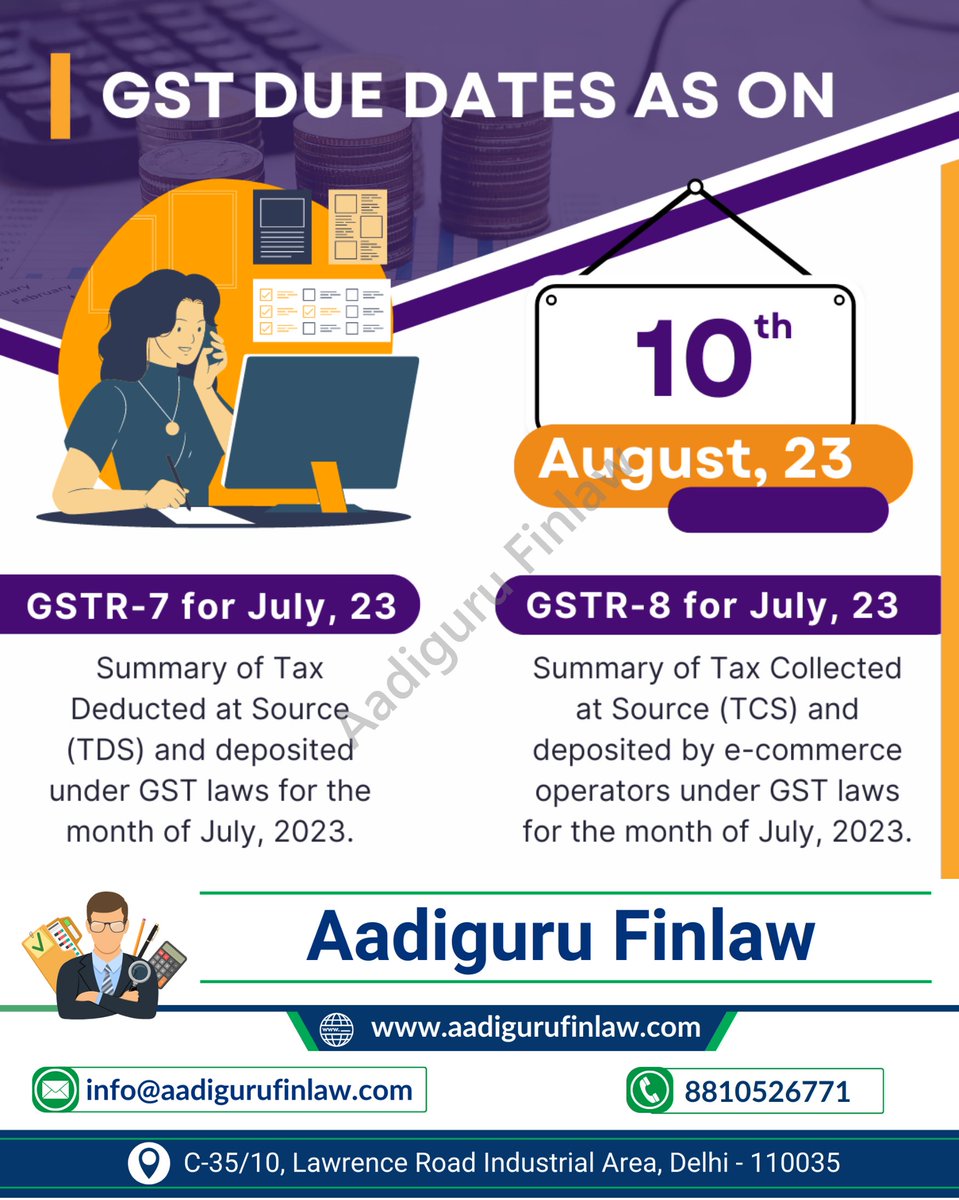

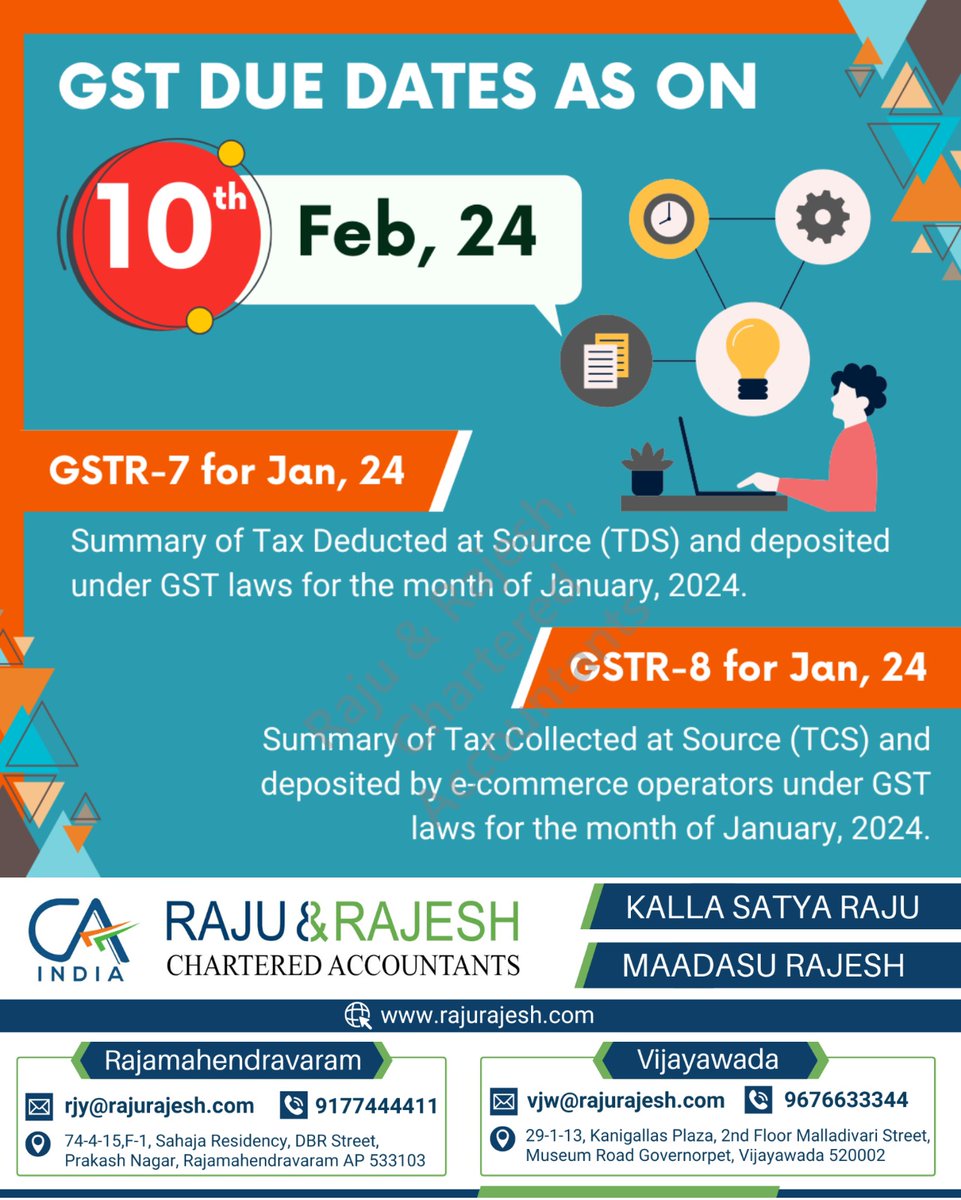

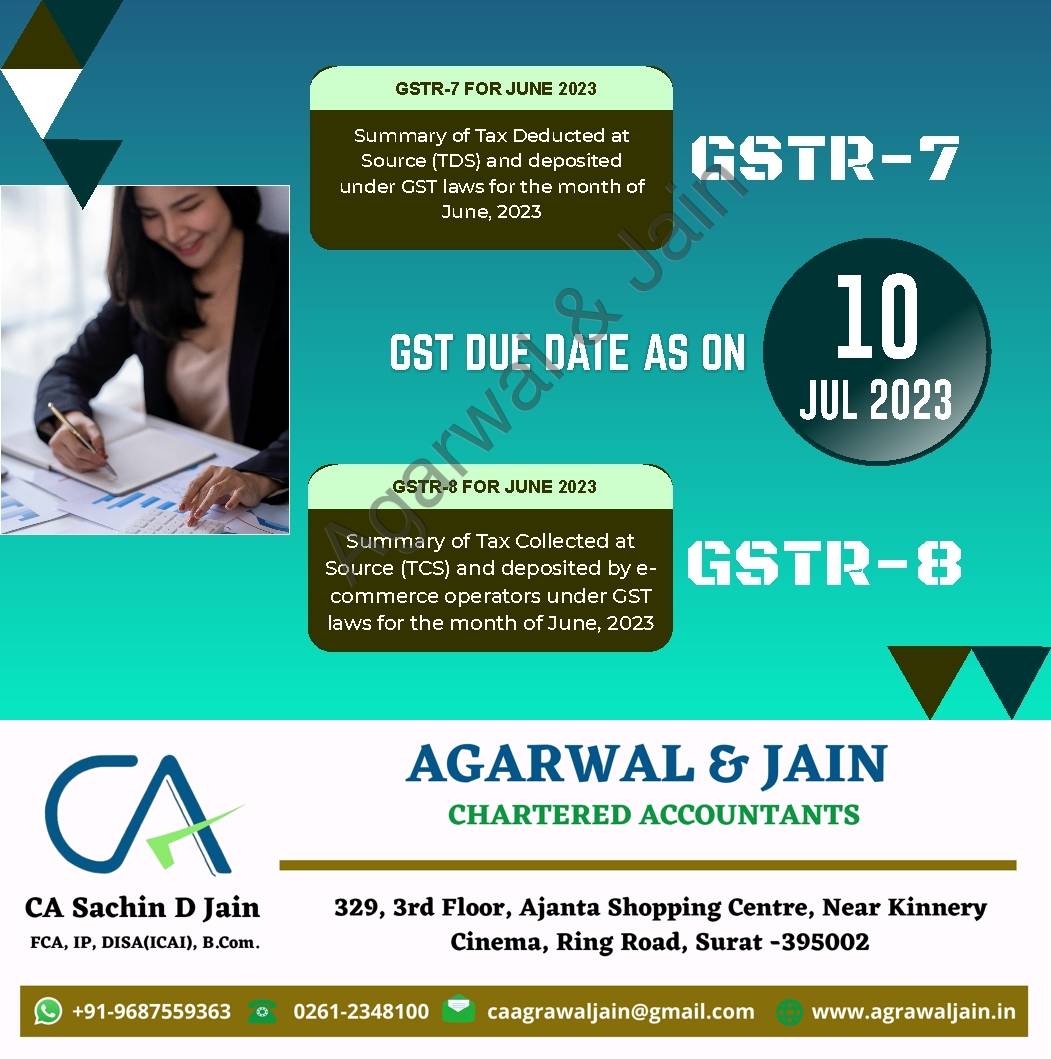

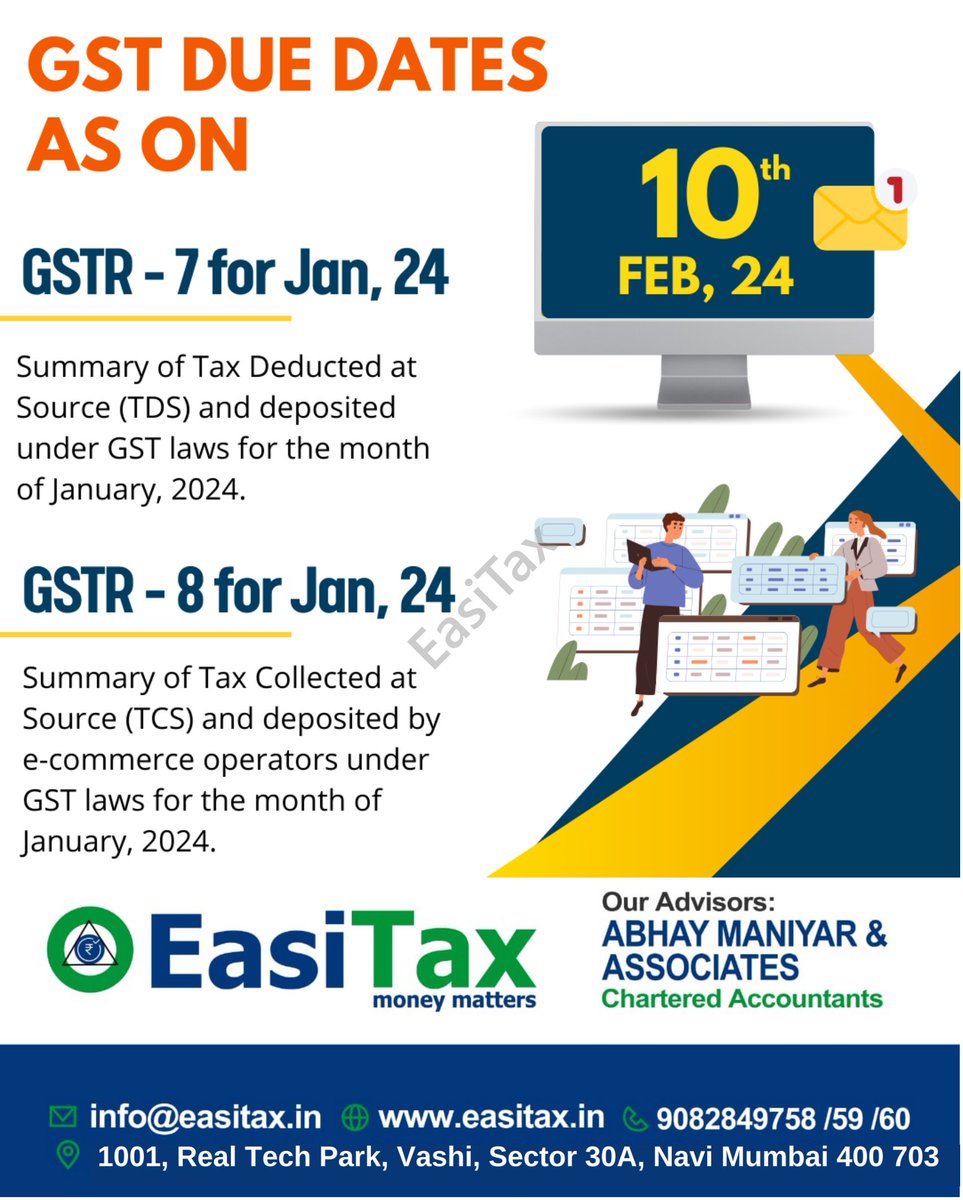

Due dates on GSTR-7 & GSTR-8 For April 2023 is 10th of May 2023.

#GSTR7

#GSTR7 _for_April_2023

#Tax_Compliance

#GST_due_dates

#GSTR_filling_Process

#GSTR8

#GSTR8 _for_April_2023

#EasiTax

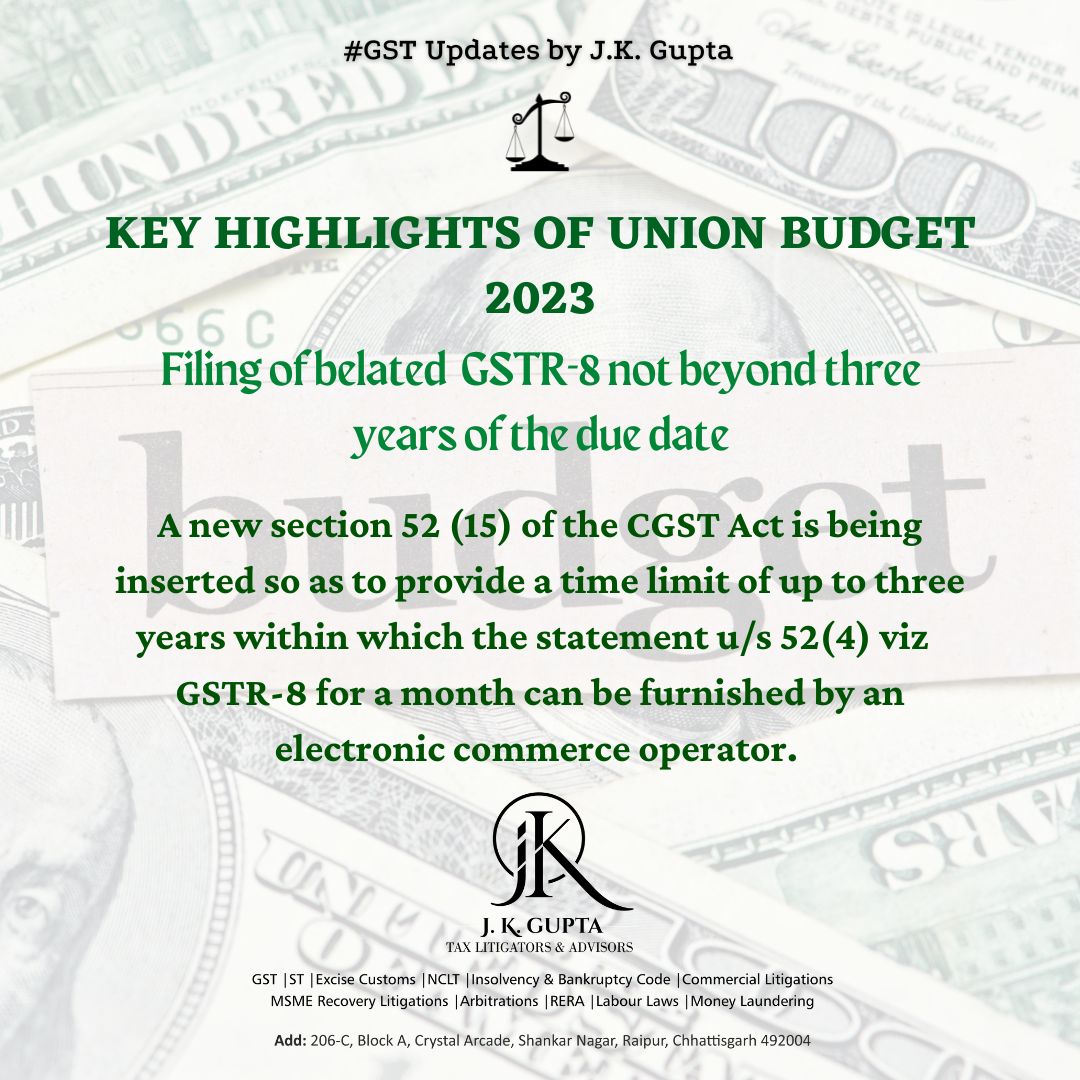

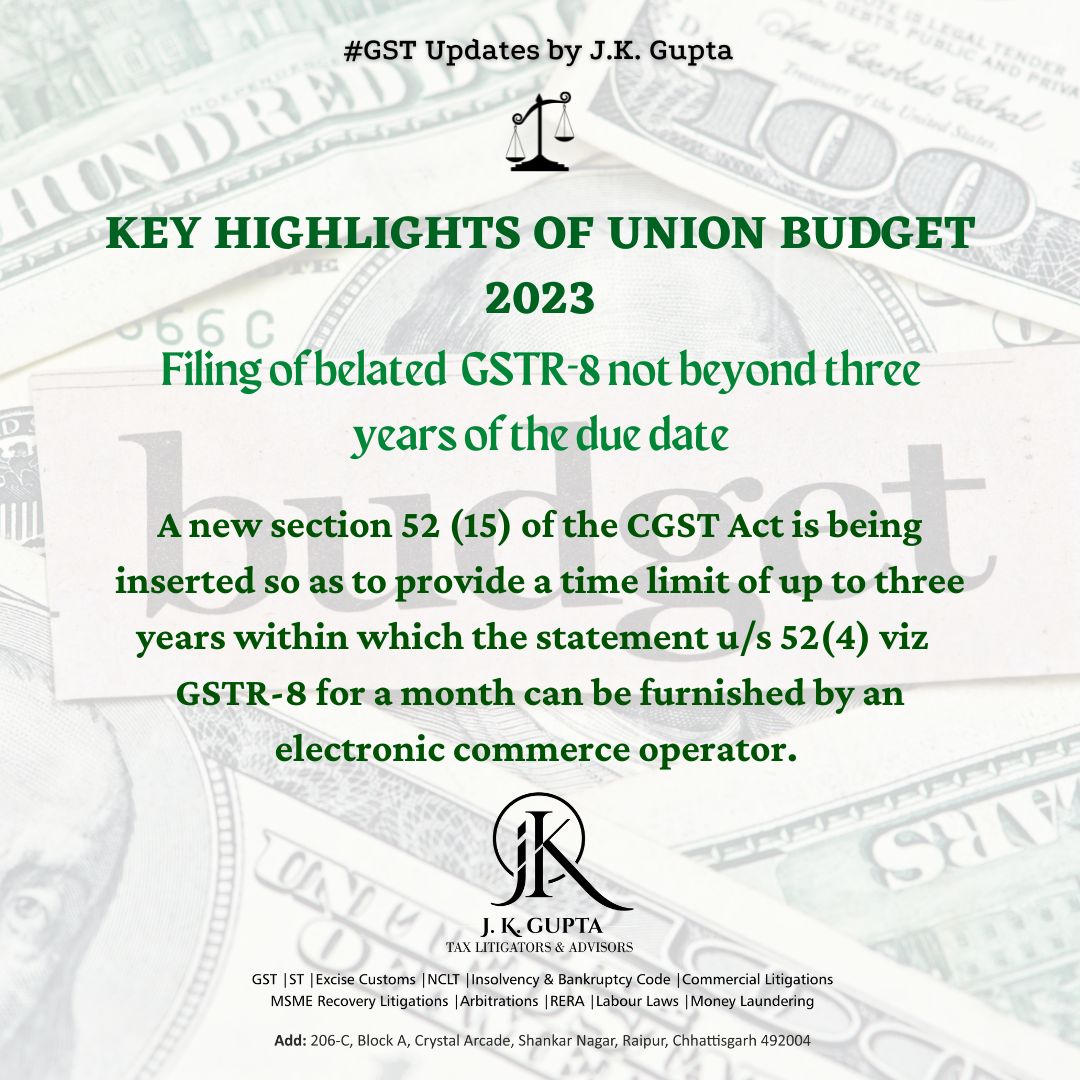

Filing of belated GSTR-8 not beyond three years of the due date

#gst #gst update #gst india #jkg #jkg upta #budgetupdate2023 #Budget2023 #UnionBudget2023

A new section 52 (15) of the CGST Act is being inserted to provide a time limit of up to three years within which the statement u/s 52(4) viz GSTR-8 for a month can be furnished by an electronic commerce operator.

#gst #jkg #jkg upta #Budget2023 #budgetupdate #taxlitigators

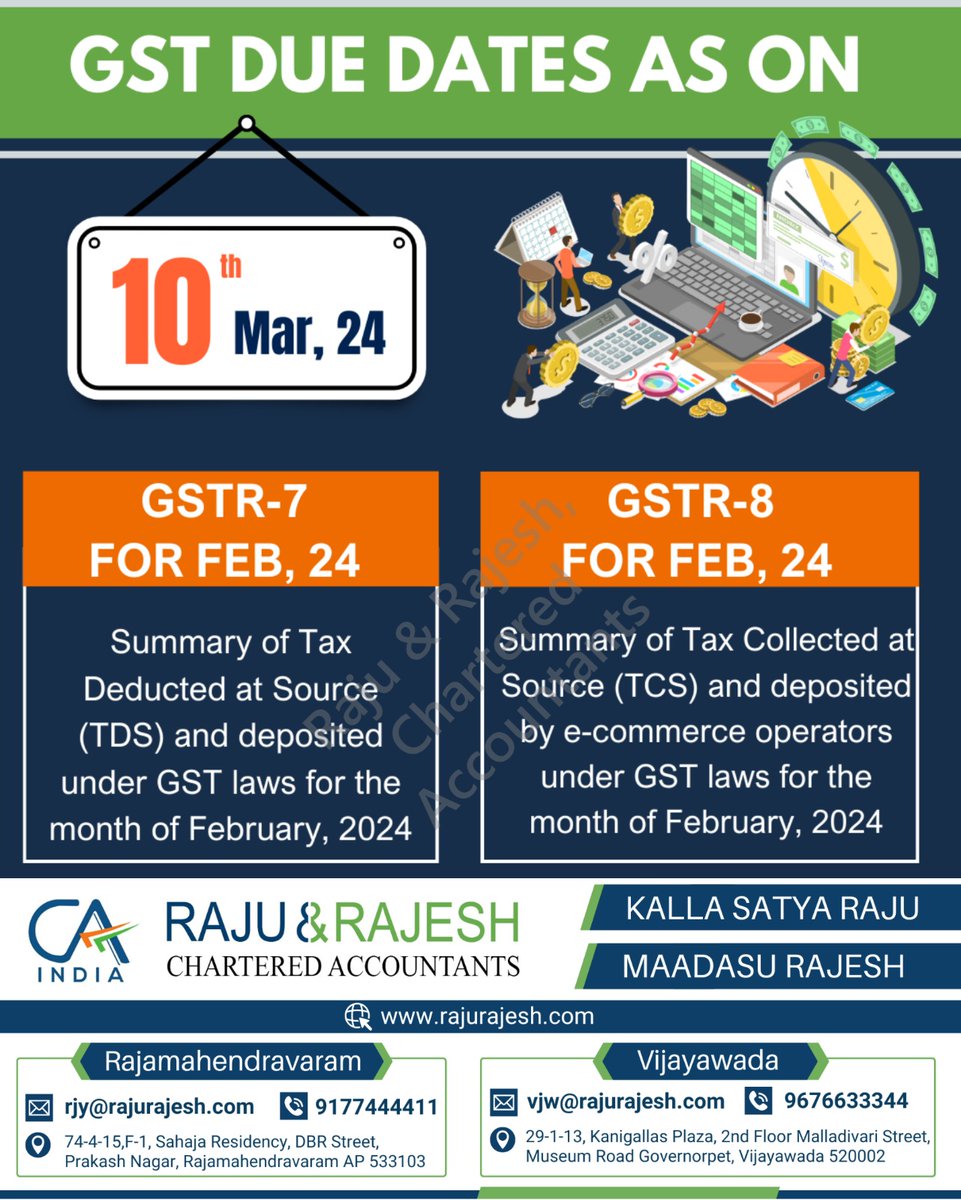

GSTR-7

GSTR-8

#GSTR7

#GSTR8

#GSTCompliance

#TaxDeduction

#TDS

#TCS

#GSTFiling

#GSTIndia

#TaxCompliance

#DigitalGST

#EconomyBoost

#vcjco #firozabad #agra #shikohabad #itr #incometaxreturn #refund #gst #gst r #gst registration #tax #tax ation