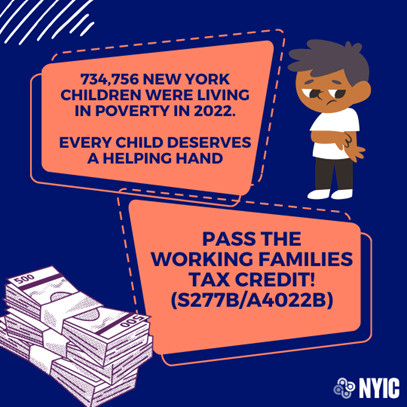

Governor Kathy Hochul, Carl E. Heastie, Sen. Stewart-Cousins: NY families like mine deserve a better, fairer tax credit. Pass the Working Families Tax Credit this year, and get families what they need! #GiveNYFamiliesCredit #NYWFTC New York Immigration Coalition (NYIC) Liza Schwartzwald

New York City Council passed Alexa Avilés 🌹 愛麗莎 reso supporting state passenger of the NYWFTC, which would address the federal govt’s failure to renew the successful expanded CTC, which lifted 2.9M children out of poverty & drove the national rate of child poverty to a record low in 2021.

New York families need relief. Meaningful, refundable tax credits for families can provide that relief, enabling families to meet immediate needs, like food, and deliver long-term benefits. #NYWFTC #GiveNYFamiliesCredit

via No Kid Hungry New York RT No Kid Hungry

Thanks to New York State Senate for including the Working Families Tax Credit in their budget proposal, which would give families up to $550 per child to every family!

#NYWFTC #GiveNYFamiliesCredit

Thanks to New York State Senate for including the Working Families Tax Credit in their budget proposal, which would give families up to $550 per child to every family!

#NYWFTC #GiveNYFamiliesCredit

New York families deserve a better, more fair tax credit! The NYS Budget must include the Working Families Tax Credit. #NYWFTC #GiveNYFamiliesCredit

Schuyler Center The Children's Agenda New York Immigration Coalition (NYIC) Andrew Hevesi Senator Andrew Gounardes