Agenda Econômica Touro de Ouro com Pablo Spyer

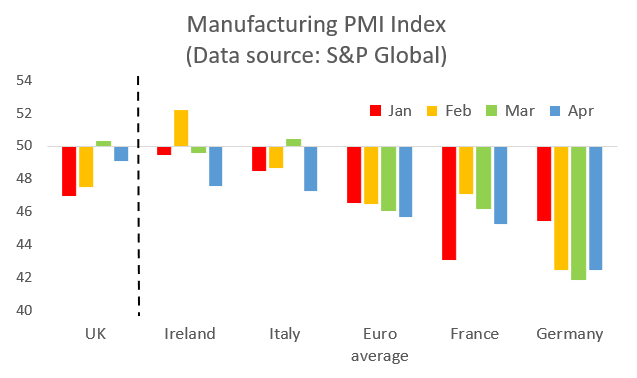

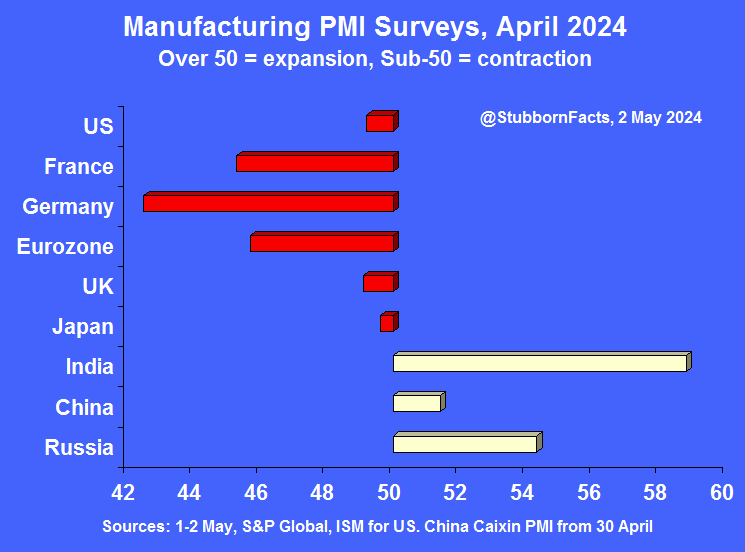

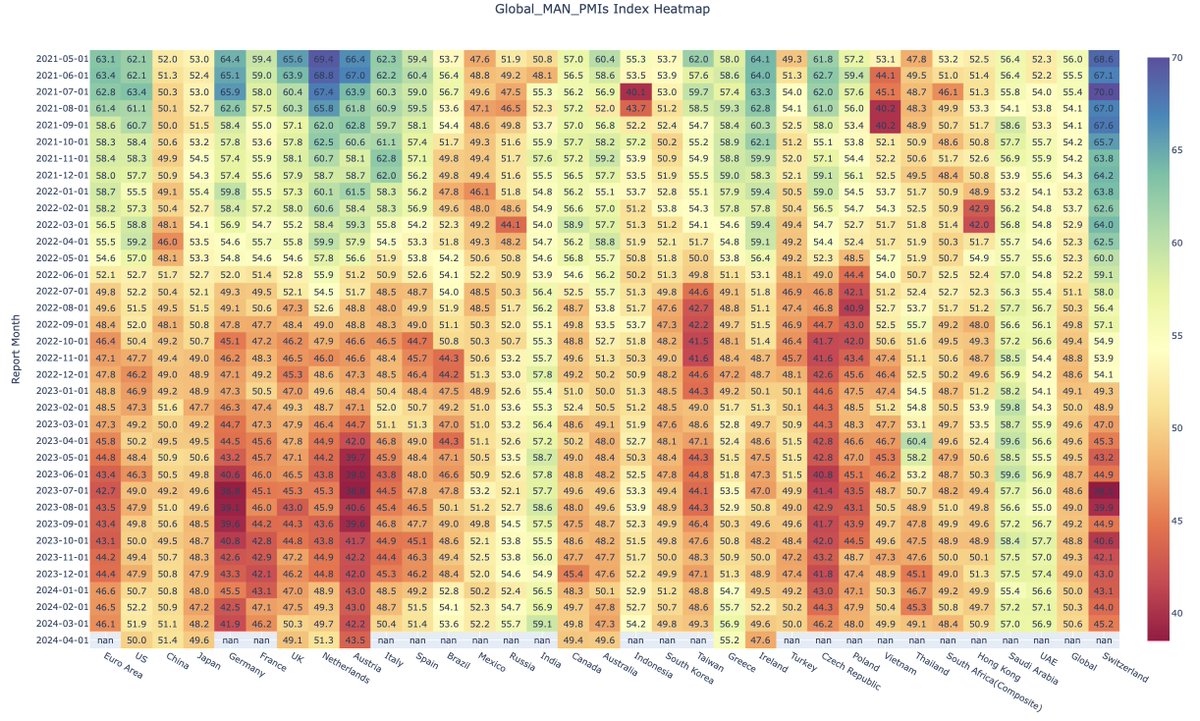

Decisão de juros e Powell, Payroll, PMIs, balanços e feriados

Saiba o que de mais importante vai movimentar a próxima semana no mercado financeiro

Minuto Touro de Ouro com Pablo Spyer

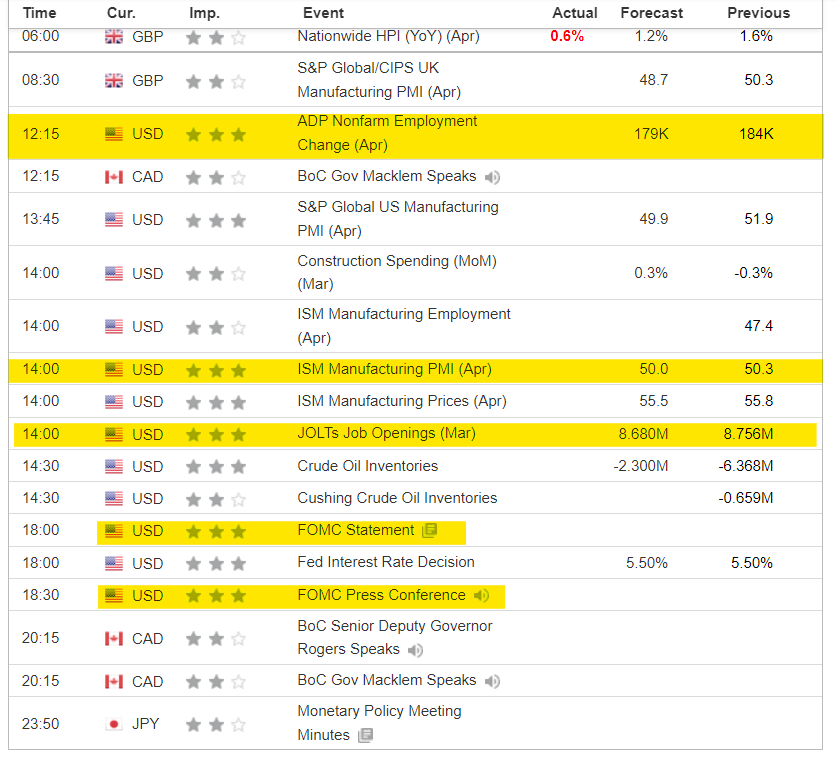

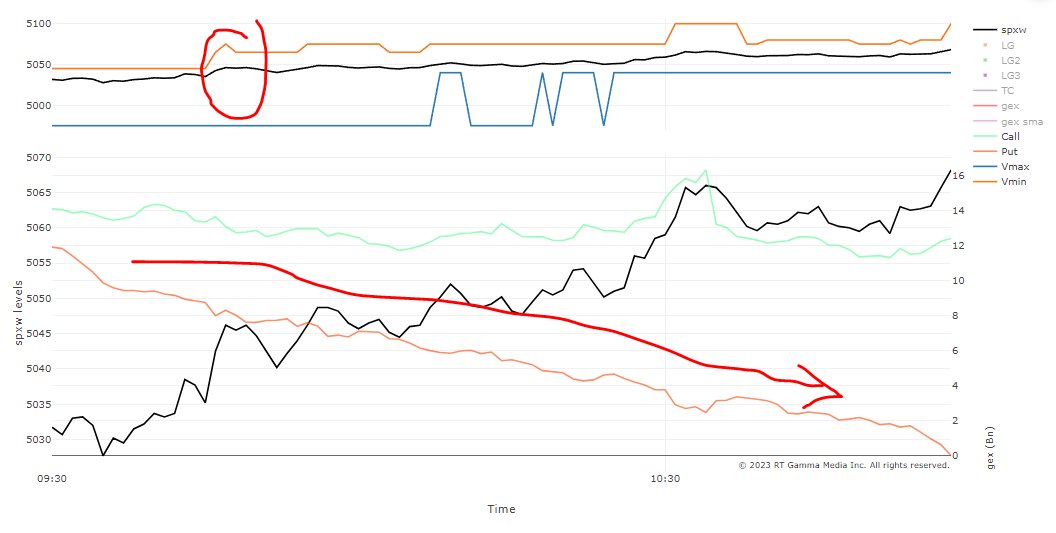

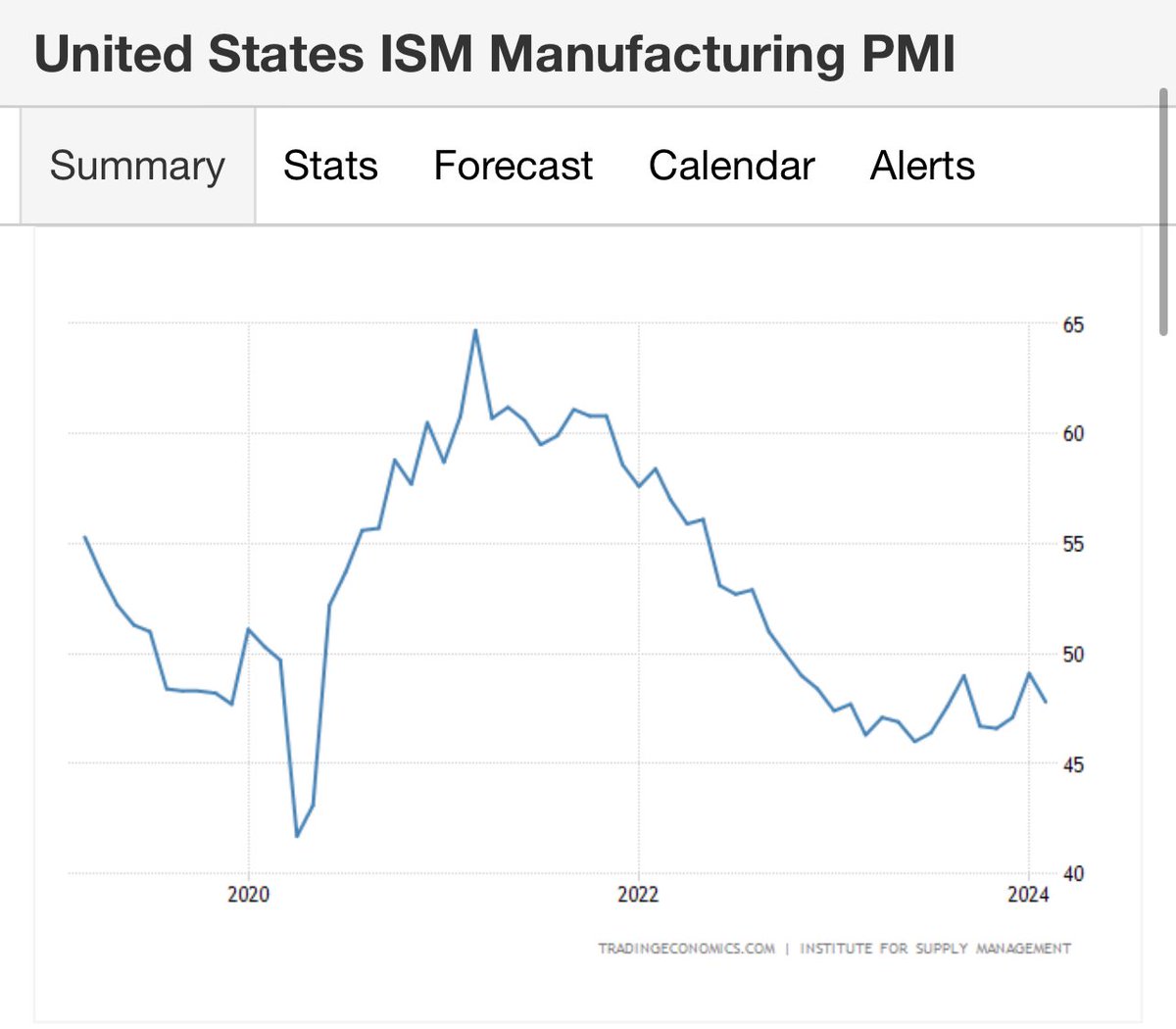

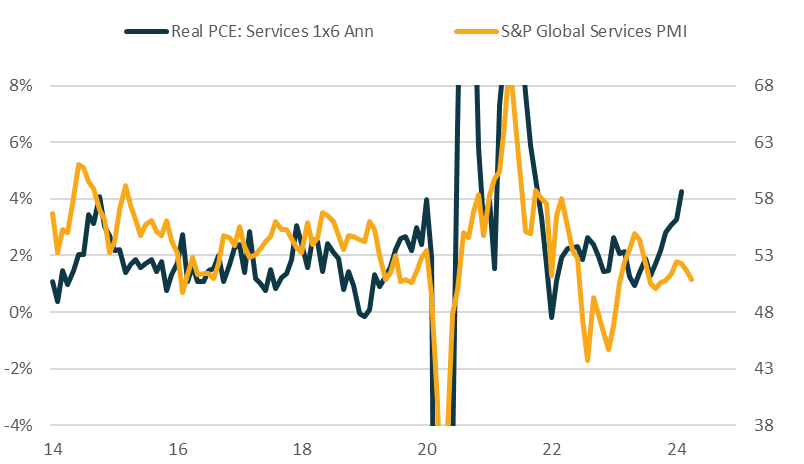

Em dia de ADP e PMIs, mercado aguarda Powell

🏆 Vencedor do prêmio iBest:

¤ Maior influenciador de Investimentos em 2023

▫️ Melhor Programa de Investimentos do Brasil 2022

🏆 Melhor Programa de Rádio do Brasil 2021