Gordon Berry

@wealthagent

Business Adviser. Chartered Certified Accountant and Chartered Tax Adviser. NLP Master Practitioner.

ID:301075537

https://armadillo-support.co.uk/ 18-05-2011 20:50:58

40,9K Tweets

1,6K Followers

1,2K Following

Follow People

LoanChargeHell It does, it warns people to stay well clear of funding those who say they 'specialise in contractor tax' despite having no prior involvement in contractor tax & who'd gaslight you, having increased your liability by failing to warn that TTP wasn't the only benefit of settlement.

Loan Charge Action Group [LCAG] John McNally MP Brendan O'Hara MP Chris Stephens MP Carol Monaghan MP 🏴 🇺🇦 Dave Doogan MP Jeremy Hunt Rachel Reeves David Linden MP Deidre Brock MP BBC Newsnight Arguing for agency rules means arguing you were under the direction, supervision & control of the agency, meaning you were subject to PAYE all along.

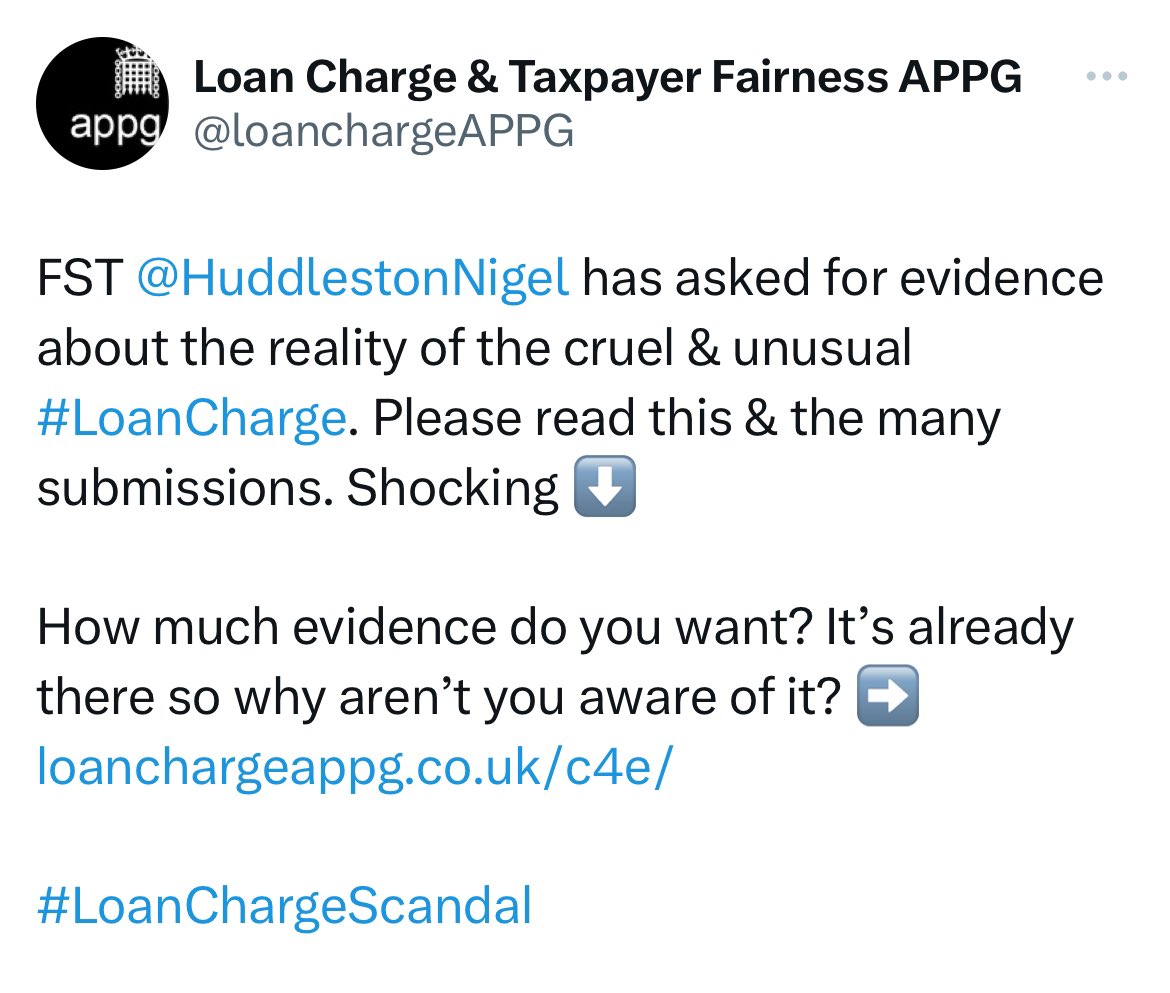

WTT just make up something else every time they're previous argument is blown-out & LCAG repeat it and sell it to the APPG🤷♂️

💰💰

LoanChargeHell Just as well.

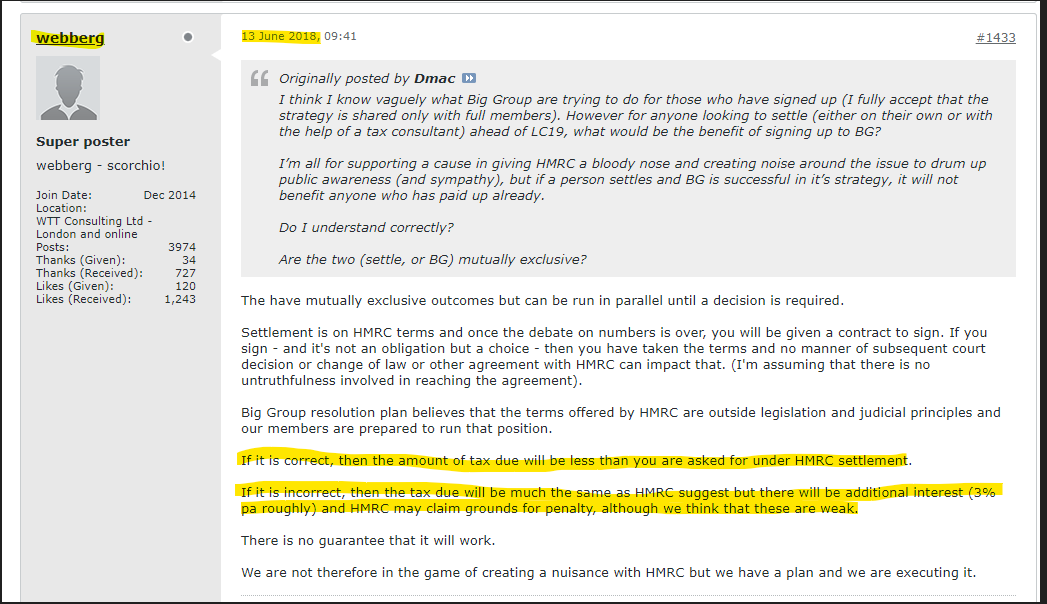

1. Let's form a Big Group so HMRC will offer better terms ❌

2. Let's write-off loans so #loancharge isn't due ❌

3. Let's not disclose loans fully on 2019 tax return as tax can't be any more than CLSO 2 ❌

4. Fees of £3,600 + £216 pa for 9 years is well spent ❌

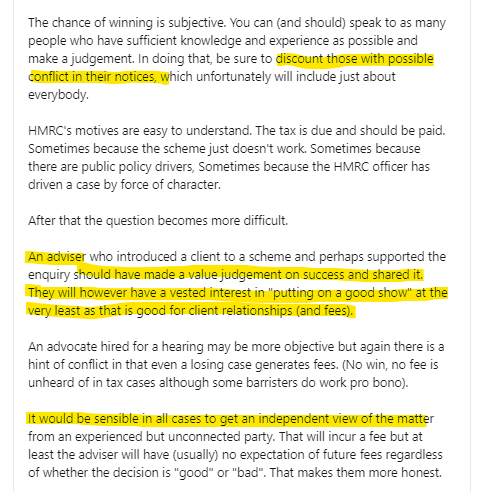

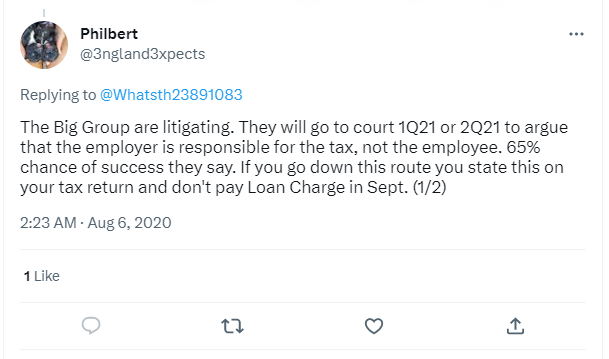

LoanChargeHell Not if they were being (mis)sold the idea that it was all the employers liability & that there was a 65% chance they'd have to pay nothing!

Were they warned that their liability would double under the 2020 #loancharge terms?

It appears not!

WTF

If HMRC halved the 2020 #loancharge settlement terms then that would bring us back to about the same as settlement under 2017 terms had one settled prior to 30/9/2020

I don’t think people understand the consequences of the LCAG & WTT advice, indeed it doesn’t seem they did!

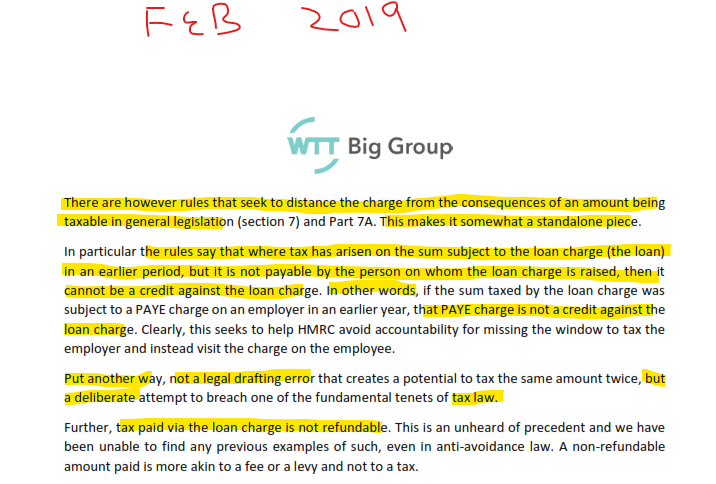

WTT have known since at least Feb 2019 that a change on 22nd November 2017 means a claim for PAYE credit (s684), even if successful, cannot be relieved against the #loancharge

No other adviser is arguing that in tax the general overrules the specific!🤦♂️

Warnings?

Kerching 💰💰💰

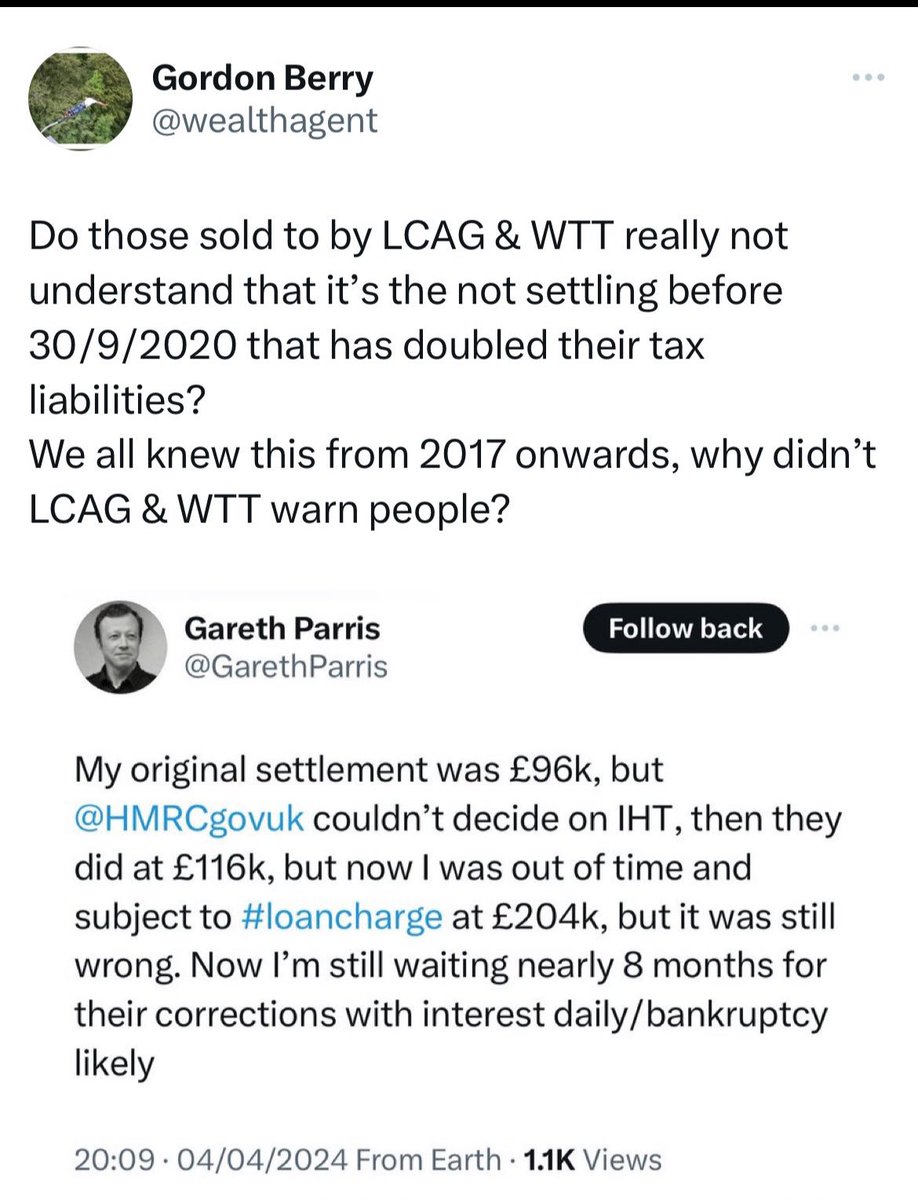

Kezabal Customer Outrage Daisy Cooper MP 🔶 Loan Charge & Taxpayer Fairness APPG Promoters put 85% in your hand.

Settlement sought to take back 20% tax (on that 85%), plus 6 years interest at circa 4%

Instead WTT & LCAG helped increase the tax to 40% (double) of 85% under the #loancharge , plus 4 years interest at circa 7%

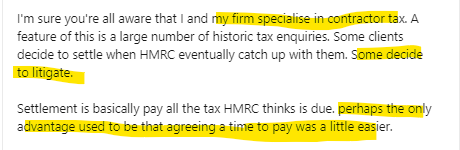

WTT charged you a £3,600 fee for it!

Remarkably that same firm is now charging ‘victims’ an additional FEE of £1,200 plus vat to add them to a JR for years not affected by the #loancharge without, it appears, making clear any risks or the fact that JR may not be relevant to them at all.

WTF 🤷♂️

Read this thread

👇