Xend Finance ($RWA)

@xendfinance

Backed by @binance and @google, Xend Finance is the first universal framework and blockchain for worldwide assets tokenization and on-chain management.

ID:1305119080656113664

https://linktr.ee/xendfinanceofficial 13-09-2020 12:20:35

1,6K Tweets

71,5K Followers

35 Following

Follow People

🎉Results are in! Winners are:

🥇Thee.Web3.Qing (⚔️) - $30 in $RWA tokens

🥈Gwen 💜🥷 - $25 in $RWA tokens

🥉N13ds0n - $20 in $RWA tokens

🏅Ryle K. - $15 in $RWA tokens

🏅Favourite crypto gee💎🚀 - $10 in $RWA tokens

🏆Winners, DM @XendFinance with your EVM wallet to claim your prizes.

What will 'RWA' cover in the Xend Finance ($RWA) OAE framework?

The term ‘RWA’ will cover all legally transactable asset types:

1⃣Tangible (physical) assets like artwork and real estate.

2⃣Intangible (digital, intellectual, legal) assets like carbon credits and IP rights.

Xend Finance ($RWA) is building a comprehensive ecosystem towards the financial inclusion and innovation of its users.

By optimizing returns for users via financial tools such as:

1⃣ Yield aggregation

2⃣ A fiat-to-crypto on/off ramp, and

3⃣ Multi-chain wallet functionality.

The On-chain Asset Environment (OAE) framework is integral to Xend Finance ($RWA)'s vision for tokenizing any asset and token right on-chain.

OAE is designed to facilitate the on-chain onboarding of any legally transactable asset types to manage the full lifecycle of assets.

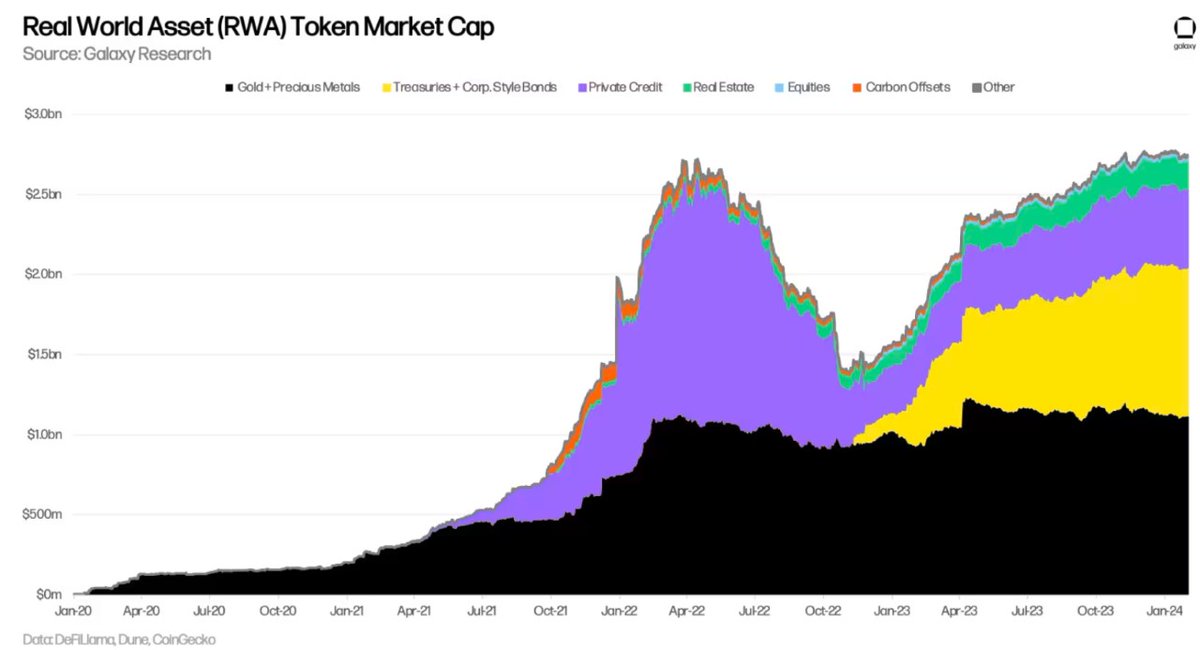

The global real estate market is worth $228T.

Moving these assets on-chain will increase global accessibility, liquidity, and business volume.

Tokenization is poised to expand the investment opportunities for the assets lying dormant.

Xend Finance ($RWA) is leading the transition.