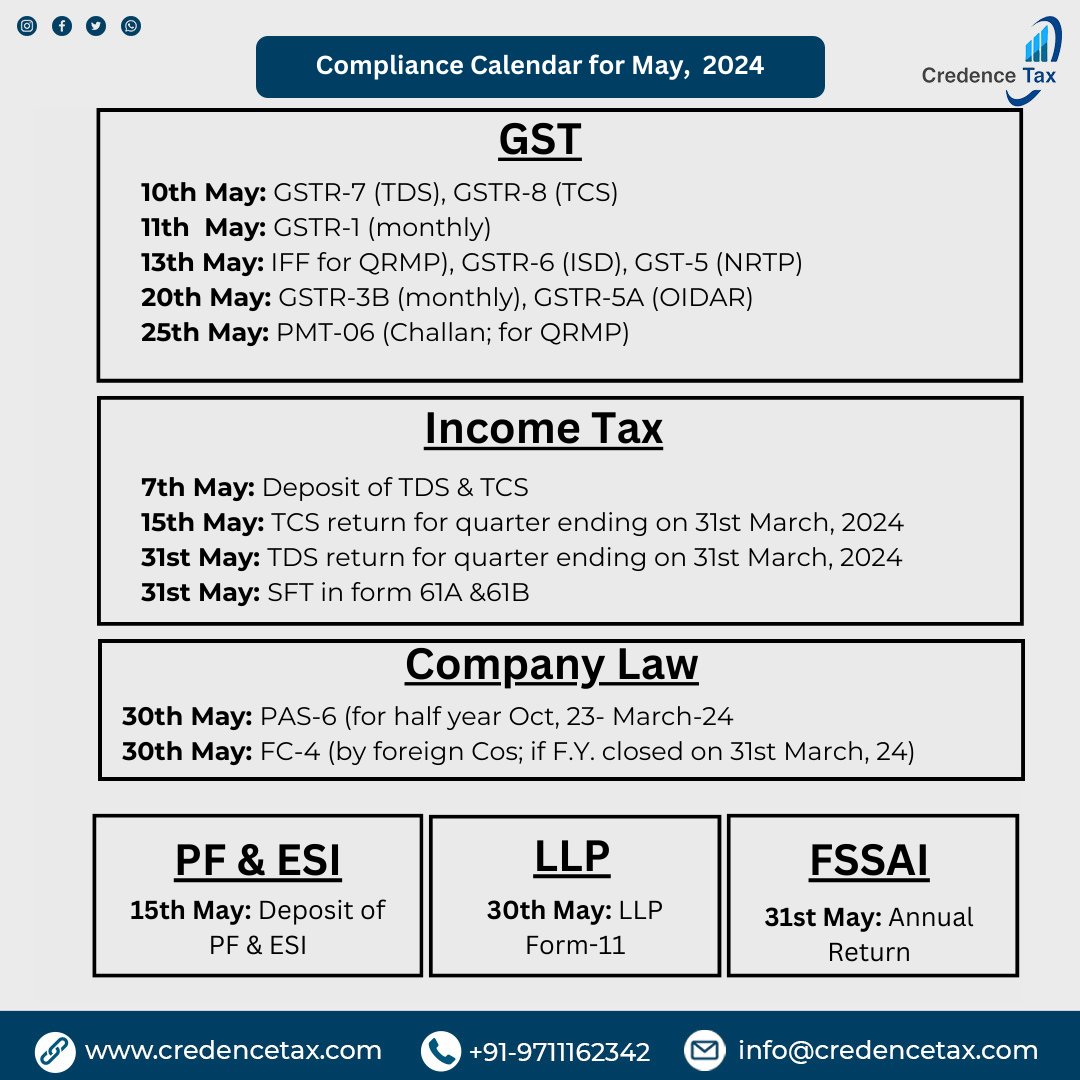

Don't miss the GSTR-1 deadline! Ensure timely submission by marking the last date for filing monthly returns for April 2024. 💼⏰ #GSTR1 #TaxFiling #DeadlineReminder

🌟GST Portal par Update Hua New Feature 🌟

Read the full post....

For more information download Law Legends App

#gst n #gst #gst portal #newfeature #gst r1 #trendingreels #summary #autopopulate #application #updation

🌟 Attention Monthly GSTR-1 Filers! 🌟

⏰ 11th is your deadline! File GSTR-1 on time to stay compliant and keep your sales details accurate.

💡 Timely filing = Don't let the date slip!

📞 Need help? We're here for you.

🔔 #GSTR1 #GSTCompliance #OnTimeFiling #LegalTerminus

Navigate Indian finance with ease! Discover Oracle NetSuite's essential reports for CFOs. From GSTR1 to TDS compliance, streamline operations and drive success.

Learn More - integscloud.com/blog/guide-to-…

#OracleNetSuite #FinancialReporting #IndianFinance #CFOs #CloudERPImplementation

📂Get your documents ready! The GSTR-1 deadline is May 11th🗓️

Connect with us! 📧[email protected] | 📞+91 9643203209 | 💻ebizfiling.com

Join our WhatsApp community: zurl.co/6MvE

#Compliance #taxation #gstreturns #deadline #taxfiling #gstr1 #Ebizfiling

Abhishek Raja Ram: Against High Pitch Notices..!! Dear Sir, Govt. Work contractor should show his payment received under B2B or B2C in GSTR1. Everyone gives confusing answers.hence question to you.Although they do not provide Bill's but I only have there GSTN. Thanks in advance

Piyush Sarawgi| CA|Investor Jrurat nahi aap original invoice ko cancel krke gstr1 me hta skte h

Aur document summary me cancelled mention kr skte h

Schedule a demo now and watch your business thrive! [email protected] | +91- 7499914484 | logitax.in | bit.ly/446GA0y #gstr1 #gstreturns #gstfiling #vendormanagement #accountpayable #accountpayable automation #vendoriisues #gstupdates

D.Muthukrishnan Please tell us the mechanism, that how within hours of ending the month of April the govt has GST figures?? I understand it must b true but how do they arrive at those figures even before public file gstr1??

Need to know since long