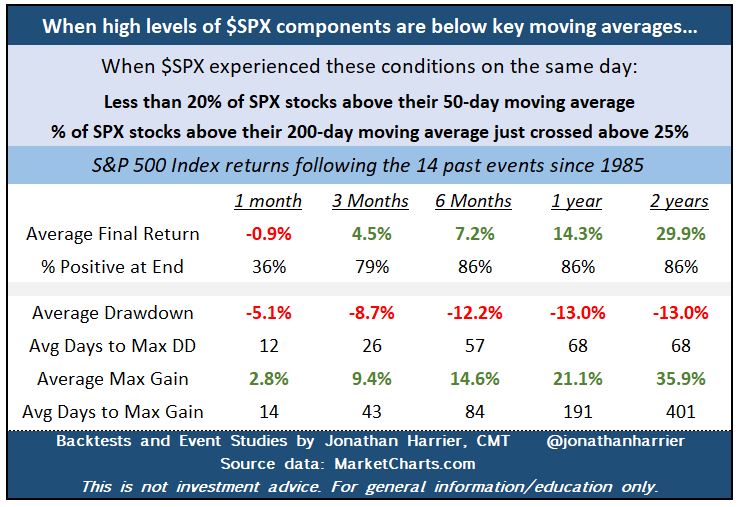

MarketCharts.com

@MarketCharts

Charts, backtesting, scanning and alerts, including breadth indicators for $SPX / $SPY, $MID / $MDY, $SML / $SLY, $NDX / $QQQ, $RUT / $IWM, ETFs and more.

ID:24247232

https://www.MarketCharts.com/ 13-03-2009 20:31:17

17,8K Tweets

5,4K Followers

314 Following

ICYMI: Weekly ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources

MarketCharts.com

Andrew Sarna

Topdown Charts

Kakashii

New Low Observer

The Idea Farm

Ramit Sethi

Sam Ro 📈

ICYMI: Weekly ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources

MarketCharts.com

Topdown Charts

Shane C. Murphy

The Chart Report

Michael A. Arouet

Ian Harnett

Andrew Sarna

ICYMI: Weekly ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources

Topdown Charts

MarketCharts.com

Liz Ann Sonders

Sam Ro 📈

Michael A. Arouet

Tom McClellan

Ian Harnett

@allocator_asset

Jason Goepfert

Meb Faber

Ryan Telford

ICYMI: Weekly ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources

Topdown Charts

MarketCharts.com

Gina Martin Adams

Daily Chartbook

Duncan Lamont

Bob Elliott

Meb Faber

Barchart

Julian Jessop FRSA

$HSI $KWEB

Near the end of January, over 50% of the 82 stocks in the Hang Seng Index (Hong Kong) hit a 52-week low.

N= 9 past 20 years

Avg 1-yr return later = 31%

Avg 1-yr drawdown = 15% (hit on day 24 on avg)

Brendan Ahern

Marcel Münch 🇨🇳📉📈

Brian Tycangco 鄭彥渊

ICYMI: Weekly ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources

Topdown Charts

MarketCharts.com

Maverick Equity Research

Daily Chartbook

Cameron Dawson

Dean Christians, CMT

Jesse Felder

Snippet Finance

Weekly S&P500 ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources:

MarketCharts.com

StockCharts.com

Daily Chartbook

Lance Roberts

Barchart

Ryan Detrick, CMT

Dario Perkins

Mike Zaccardi, CFA, CMT 🍖

Evan

Topdown Charts

ICYMI: Weekly S&P500 ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources

MarketCharts.com

Steven Strazza

Martin Pelletier

Austin Harrison, CFA, CMT

ISABELNET

Gunjan Banerji

Kris Sidial🇺🇸

Daily Chartbook

Otavio (Tavi) Costa

Topdown Charts

Here is where I see unique opportunity in the market, and here is where I see opportunity in developing ourselves as traders: traderfeed.blogspot.com/2023/12/where-… Quantifiable Edges Barchart MarketCharts.com StockCharts.com

ICYMI: Weekly S&P500 ChartStorm blog post chartstorm.info/p/weekly-s-and…

Thanks + follow reco to chart sources:

Topdown Charts

MarketCharts.com

Macro “KING LEEROY” Tactical 👑

The Market Ear

Market Sentiment

The Kobeissi Letter

Jeff Weniger

Absolute Strategy Research

chartr 📊

Jurrien Timmer

Jamie Catherwood